District of Columbia Triple Net Lease for Commercial Real Estate

Description

How to fill out Triple Net Lease For Commercial Real Estate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you will access thousands of forms for commercial and personal use, organized by categories, locations, or keywords. You can find the latest versions of forms like the District of Columbia Triple Net Lease for Commercial Real Estate in just a few minutes.

If you hold a subscription, Log In and download the District of Columbia Triple Net Lease for Commercial Real Estate from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab in your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make adjustments. Fill out, modify, and print and sign the saved District of Columbia Triple Net Lease for Commercial Real Estate. Each template you added to your account does not have an expiration date, meaning it is yours indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the District of Columbia Triple Net Lease for Commercial Real Estate with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

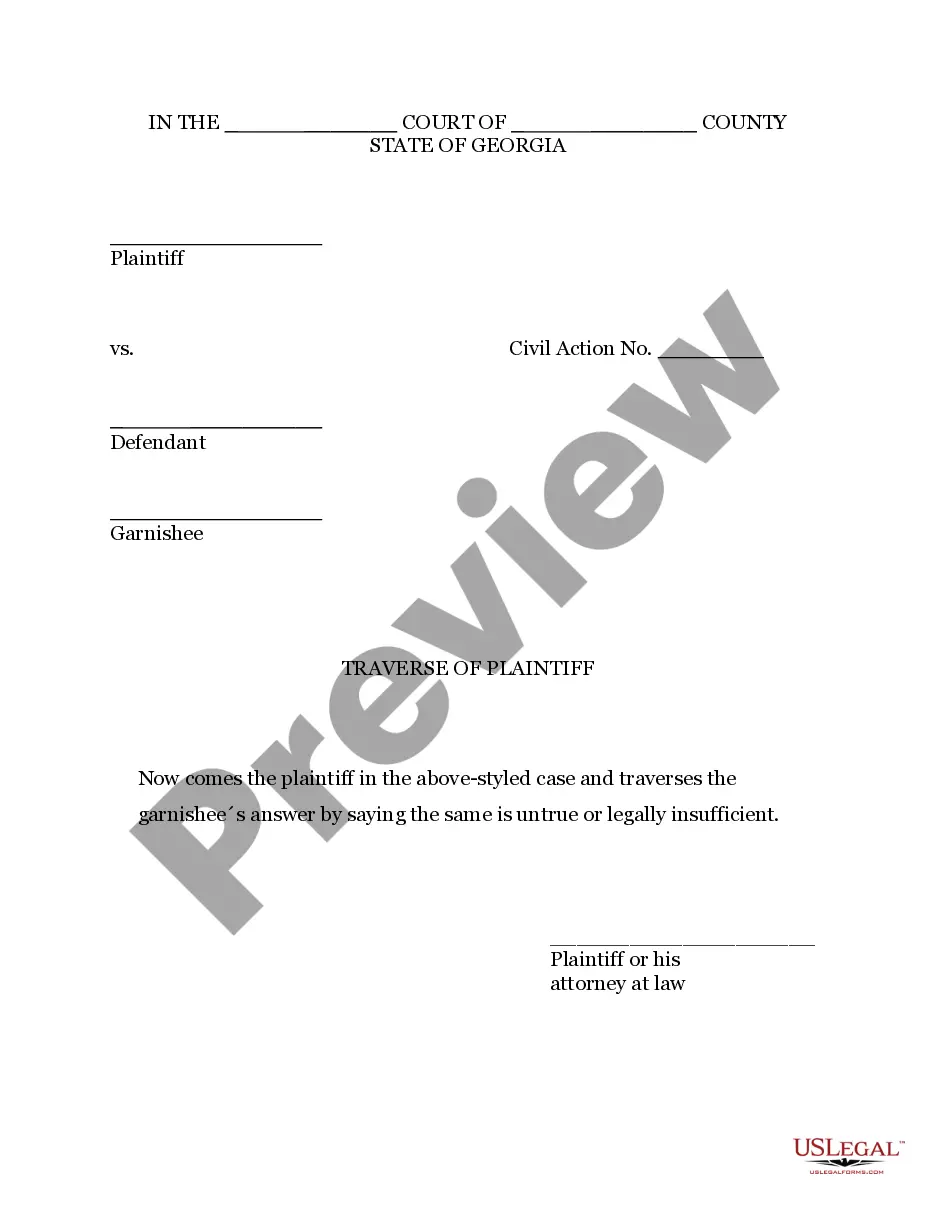

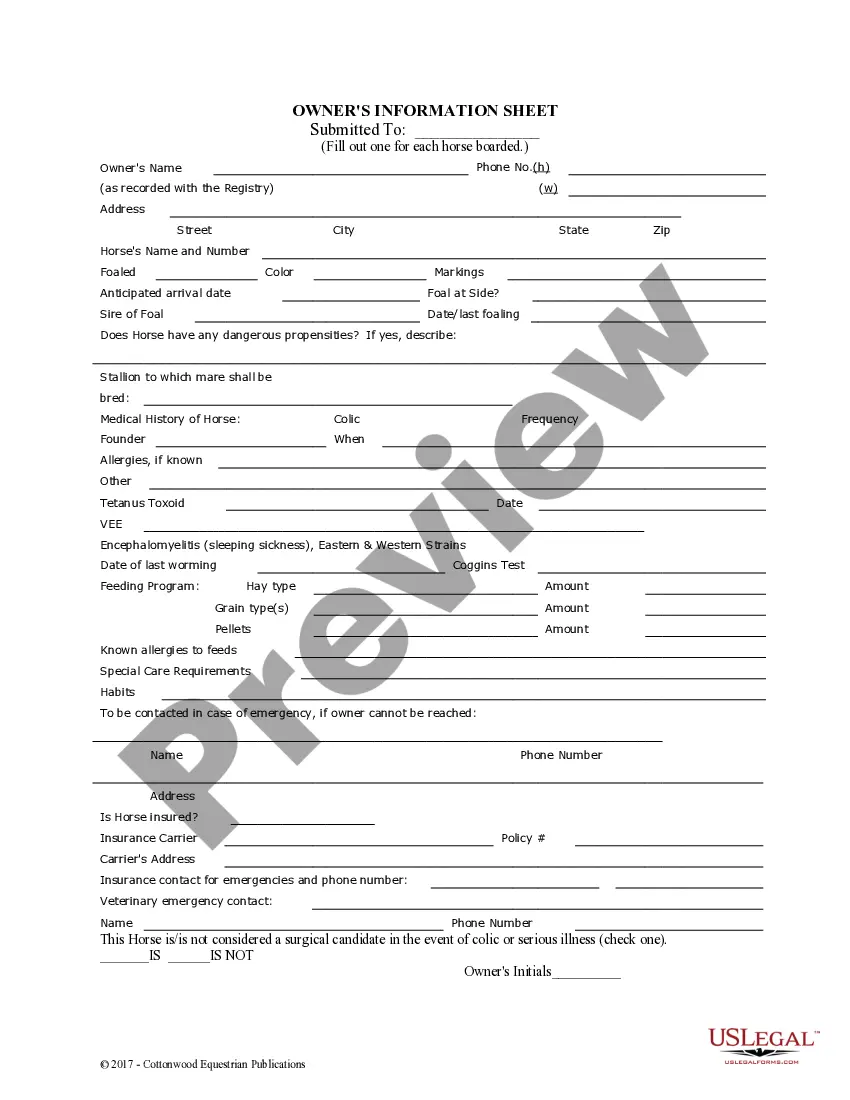

- Click the Review button to check the form’s details.

- Examine the form description to confirm that you have chosen the right one.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

To calculate commercial rent under a District of Columbia Triple Net Lease for Commercial Real Estate, you first need to determine the base rent per square foot. Then, you add the costs for property taxes, insurance, and maintenance, which are typically included in NNN leases. Multiply the total by the square footage of the leased space. This calculation provides a clear understanding of your financial commitments.

While not all commercial leases are triple net, the District of Columbia Triple Net Lease for Commercial Real Estate is increasingly common, especially in investment transactions. Many property owners favor this lease structure due to its predictability and reduced management obligations. If you're considering leasing a commercial property, it's wise to explore the benefits of triple net leases in your negotiations.

The most common types of commercial leases include gross leases and triple net leases, with the District of Columbia Triple Net Lease for Commercial Real Estate gaining popularity. This type of lease often appeals to investors and property owners looking for minimal management responsibilities. By understanding the different lease structures, you can make more informed decisions about your commercial space.

NNN stands for 'Triple Net,' which indicates that the tenant is responsible for three main expenses: property taxes, insurance, and maintenance costs. In a District of Columbia Triple Net Lease for Commercial Real Estate, this means tenants take on more financial responsibility, but typically enjoy lower base rent and increased control over the property. Understanding these terms helps you navigate leasing negotiations better.

To obtain a District of Columbia Triple Net Lease for Commercial Real Estate, start by identifying a suitable property. Engage with a real estate agent who understands the local market and can connect you with property owners offering triple net leases. Review the terms carefully, and ensure that the responsibilities for property taxes, insurance, and maintenance are clearly outlined in the lease agreement.

Per square foot NNN refers to costs calculated on a per-square-foot basis under a triple net lease, covering rent and other expenses. The tenant pays a specified amount for each square foot of leased space, which includes additional costs for property taxes, insurance, and maintenance. This information is vital for prospective tenants when evaluating rental properties. Hence, ensure you understand how these calculations apply to a District of Columbia Triple Net Lease for Commercial Real Estate.

Structuring a triple net lease involves defining the base rent, outlining the tenant's obligations, and detailing operating expenses. You start with establishing the base rent per square foot and clarify the scope of costs the tenant will cover, such as taxes and maintenance. It's crucial to draft an agreement that protects both parties and lays out responsibilities clearly. Utilizing a platform like USLegalForms can streamline this process, especially for those familiarizing themselves with a District of Columbia Triple Net Lease for Commercial Real Estate.

To calculate commercial rent under a triple net lease in the District of Columbia, you start by determining the base rent per square foot. Next, you add the costs for property taxes, insurance, and maintenance, as these are typically the tenant's responsibilities. Multiply the total square footage of the leased space by the combined rate to arrive at the total monthly rent. Understanding this formula can help you make informed financial decisions when considering a District of Columbia Triple Net Lease for Commercial Real Estate.

While a District of Columbia Triple Net Lease for Commercial Real Estate offers certain benefits, it also carries some downsides. The tenant assumes additional responsibilities for property expenses, making budgeting essential. Unexpected costs for repairs or increased property taxes may arise, so it's crucial to assess these factors before committing to a lease.

Many commercial leases are structured as triple net leases in the District of Columbia. This arrangement shifts the responsibility for property expenses, including taxes, insurance, and maintenance, to the tenant. Understanding this structure can help you make informed decisions, as it often results in lower base rent for the property.