District of Columbia Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

You can dedicate time on the internet trying to locate the legal document template that satisfies both state and federal requirements you have.

US Legal Forms offers a vast array of legal forms that are evaluated by experts.

You can easily download or print the District of Columbia Revocable Trust for Grandchildren from the service.

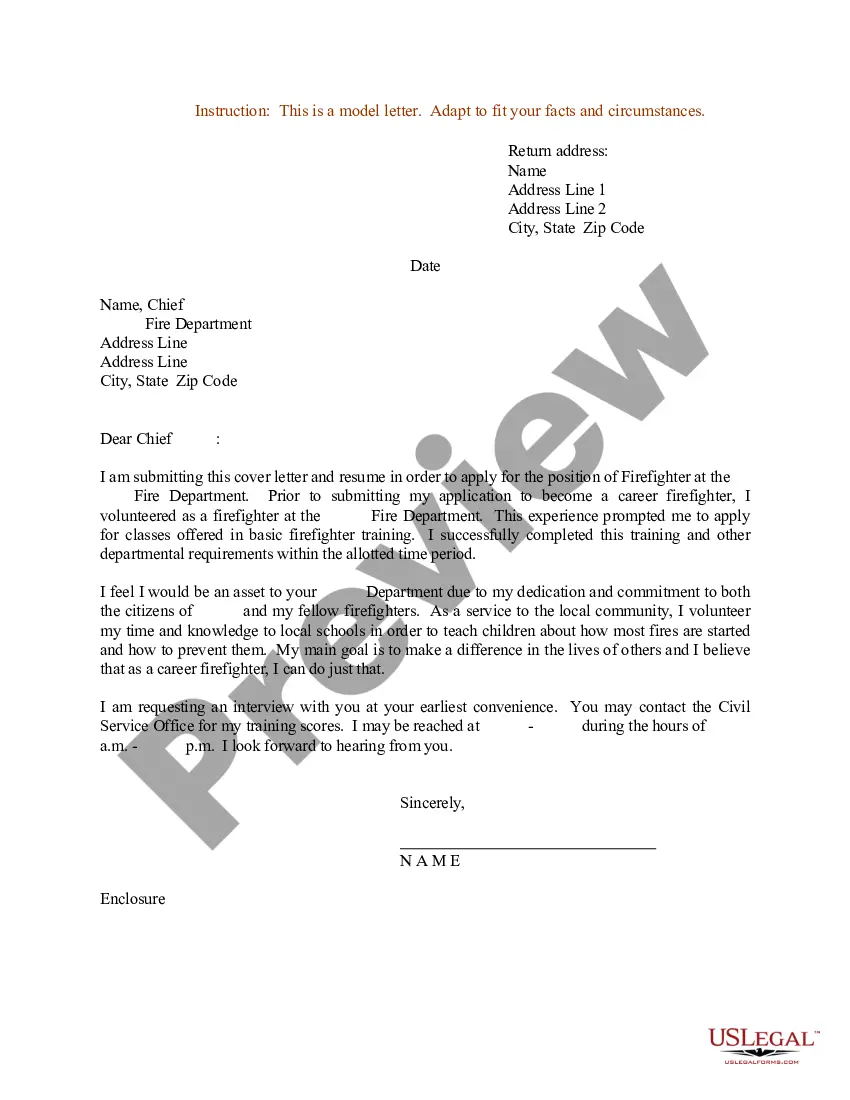

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the District of Columbia Revocable Trust for Grandchildren.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any acquired form, go to the My documents tab and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your preference.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

The best way to leave an inheritance to your grandchildren is by using a District of Columbia Revocable Trust for Grandchildren. This trust type allows you to create specific guidelines for how the inheritance is distributed, helping to manage your grandchildren’s financial responsibilities. By working with a professional and utilizing platforms like uslegalforms, you can streamline the process and ensure your wishes are honored.

Establishing a District of Columbia Revocable Trust for Grandchildren involves a few straightforward steps. First, consult with a legal expert who specializes in estate planning to ensure your trust aligns with your goals. After drafting the trust document, you will need to fund the trust by transferring assets into it, thereby ensuring they are properly managed according to your wishes.

When considering a trust for your children, a District of Columbia Revocable Trust is often ideal. It provides the ability to specify how and when your children access their inheritance, promoting responsible financial management. This structure supports your children’s needs while allowing you the flexibility to adjust the terms if necessary.

A District of Columbia Revocable Trust for Grandchildren is an excellent option, as it offers both flexibility and control. This trust enables you to manage your assets during your lifetime while ensuring that your grandchildren receive their inheritance smoothly. Additionally, it allows you to specify terms that reflect your intentions, making it an ideal choice for providing for future generations.

While many states offer favorable conditions for revocable living trusts, the District of Columbia provides strong protections and flexibility. Establishing a District of Columbia Revocable Trust for Grandchildren can provide you with specific advantages, including easy management of your estate and simplified distribution to your beneficiaries. Each state has its unique benefits, so it’s wise to assess your individual needs.

A District of Columbia Revocable Trust for Grandchildren can help you avoid probate, which may indirectly benefit your heirs by reducing the overall tax burden. However, to completely avoid inheritance tax, you may need to explore other types of irrevocable trusts. Consulting with a tax advisor or an estate planning professional can provide tailored strategies aligned with your goals.

The best trust for a grandchild is often a District of Columbia Revocable Trust for Grandchildren. This type of trust allows you to maintain control over your assets while providing for the financial security of your grandchildren. It can be easily modified during your lifetime and helps to ensure that your grandchildren receive their inheritance as intended.

A sample District of Columbia Revocable Trust for Grandchildren typically outlines the specific assets you wish to leave to your grandchildren, along with any instructions for their management. This type of trust may include provisions for education, healthcare, or other needs. You can find customizable templates on platforms such as US Legal Forms, making it easy to create a solid foundation for your grandchildren's future.

Filling out a District of Columbia Revocable Trust for Grandchildren involves several organized steps. First, gather essential information about your assets and beneficiaries. Then, you can use trusted online platforms like US Legal Forms to create and customize your trust documents. This ensures your revocable living trust adequately reflects your wishes and protects your grandchildren’s interests.

Setting up a District of Columbia Revocable Trust for Grandchildren involves a few key steps. First, consult with an estate planning lawyer to discuss your goals and the structure of your trust. Next, draft the trust document, and finally, fund the trust with your assets. Platforms like USLegalForms offer valuable resources to guide you through this process efficiently.