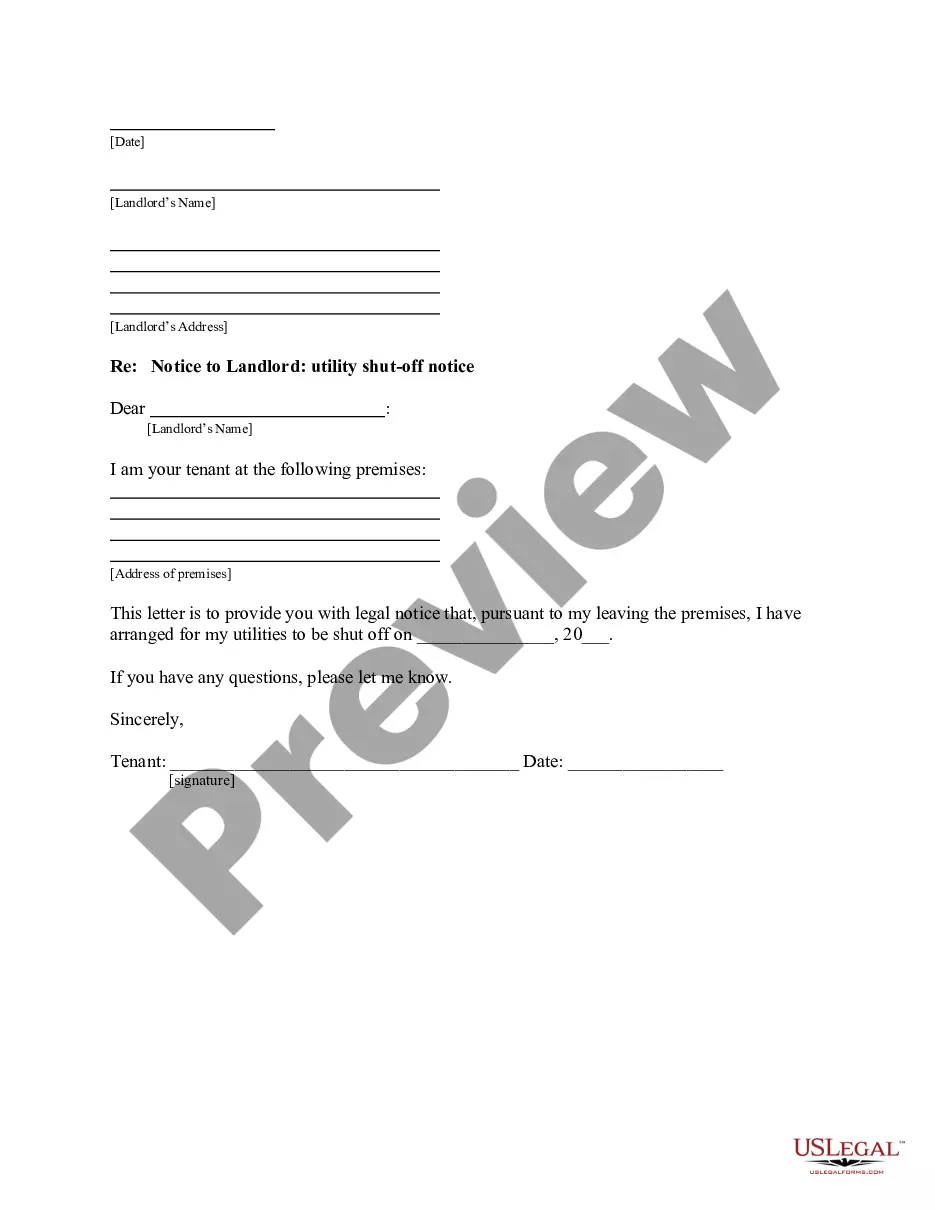

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the District of Columbia Agreement to Extend Debt Payment: Exploring Its Key Aspects and Types Introduction: The District of Columbia Agreement to Extend Debt Payment refers to a legally binding agreement between creditors and the District of Columbia government, allowing it to extend its debt payment timeline beyond the original maturity date. This agreement is crucial for managing the financial obligations of the District and ensuring its fiscal stability. In this article, we will delve into the key aspects and various types of the District of Columbia Agreement to Extend Debt Payment. Key Aspects of the District of Columbia Agreement to Extend Debt Payment: 1. Objective: The primary objective of the agreement is to provide the District with financial flexibility by granting it an extension to meet its debt payment obligations. This helps the government navigate financial challenges without defaulting on their loans. 2. Negotiations: Before finalizing the agreement, extensive negotiations take place between the District of Columbia government and its creditors. These negotiations involve discussions on the proposed extended repayment terms, including the extension duration, interest rates, and any potential modifications to the loan covenants. 3. Legal Documentation: The agreement is drafted in the form of a legally binding contract, incorporating all the terms and conditions agreed upon between the parties involved. It outlines the new repayment schedule, any revised interest rates, and any other modifications that may have been made to the original loan agreement. 4. Creditors' Approval: For the agreement to come into effect, it requires the approval of a significant majority of the creditors holding the outstanding debt. Typically, a certain percentage of creditor approval is necessary to proceed with the extension. Types of District of Columbia Agreement to Extend Debt Payment: 1. Short-term Debt Extension: This type of agreement allows the District of Columbia government to extend the payment deadline for a short duration. It aids in managing short-term financial constraints and offers temporary relief to ensure timely repayment. 2. Long-term Debt Extension: Under this type of agreement, the government secures an extended repayment timeline for a more substantial period. It allows for more comprehensive financial planning and the implementation of long-term fiscal strategies to alleviate debt burdens. 3. Restructuring Agreement: In certain cases, the District of Columbia may negotiate a restructuring agreement, which entails revising the debt's principal amount or interest rate. This type of agreement aims to provide a more sustainable debt repayment plan, addressing the specific financial challenges faced by the District. Conclusion: The District of Columbia Agreement to Extend Debt Payment plays a vital role in the fiscal management of the District, ensuring its ability to fulfill financial obligations. By allowing for extended repayment timelines and potential modifications to loan terms, this agreement allows for stability, flexibility, and the ability to navigate periods of financial strain. Understanding the key aspects and types of the District of Columbia Agreement to Extend Debt Payment is crucial for comprehending its significance in maintaining the District's financial health.