US Legal Forms - among the biggest libraries of legal forms in the United States - delivers an array of legal papers templates you can obtain or produce. Using the web site, you can find 1000s of forms for business and specific functions, sorted by groups, says, or keywords and phrases.You will discover the most recent types of forms such as the District of Columbia Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act within minutes.

If you have a membership, log in and obtain District of Columbia Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act through the US Legal Forms collection. The Download key can look on each kind you view. You gain access to all in the past acquired forms from the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, allow me to share straightforward directions to help you get began:

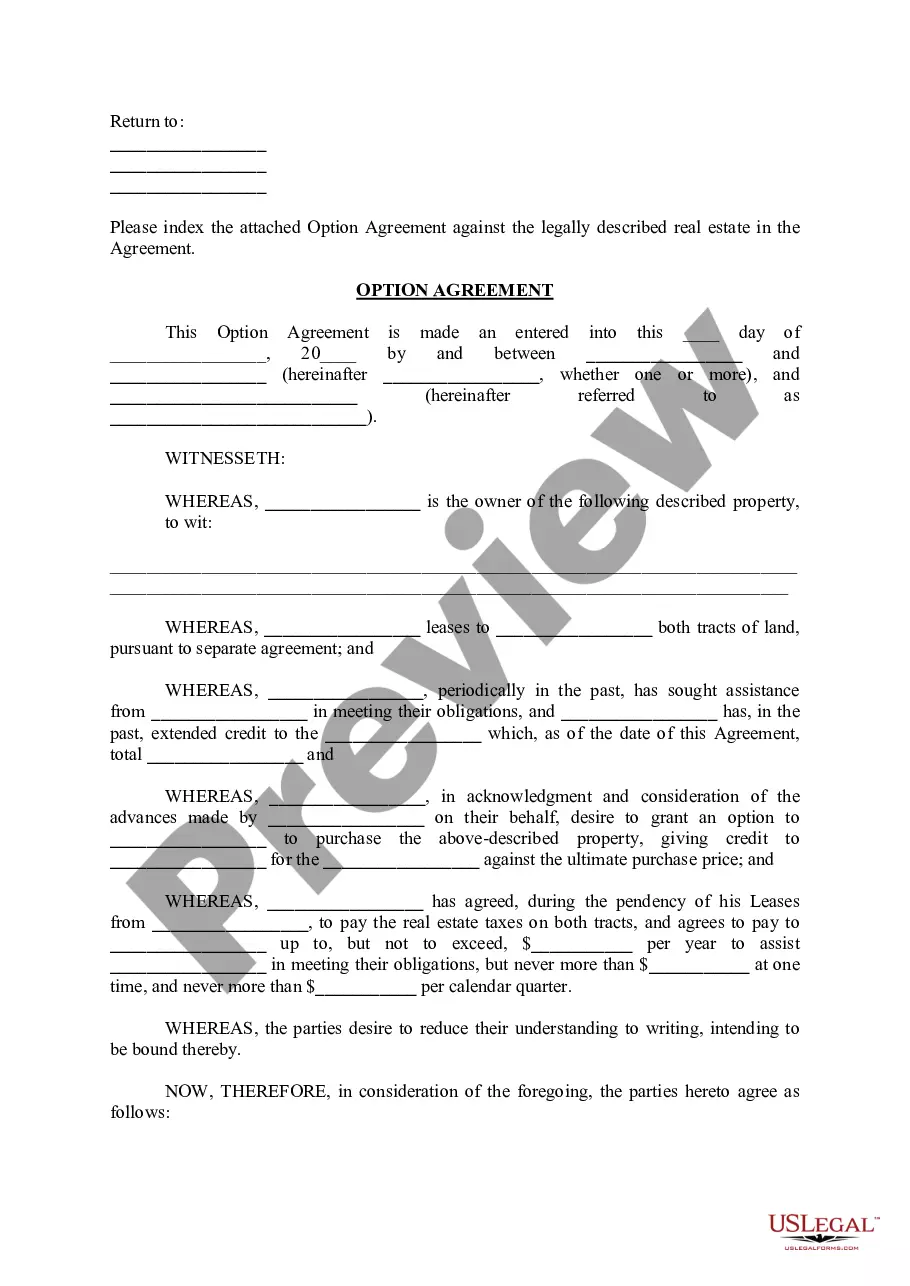

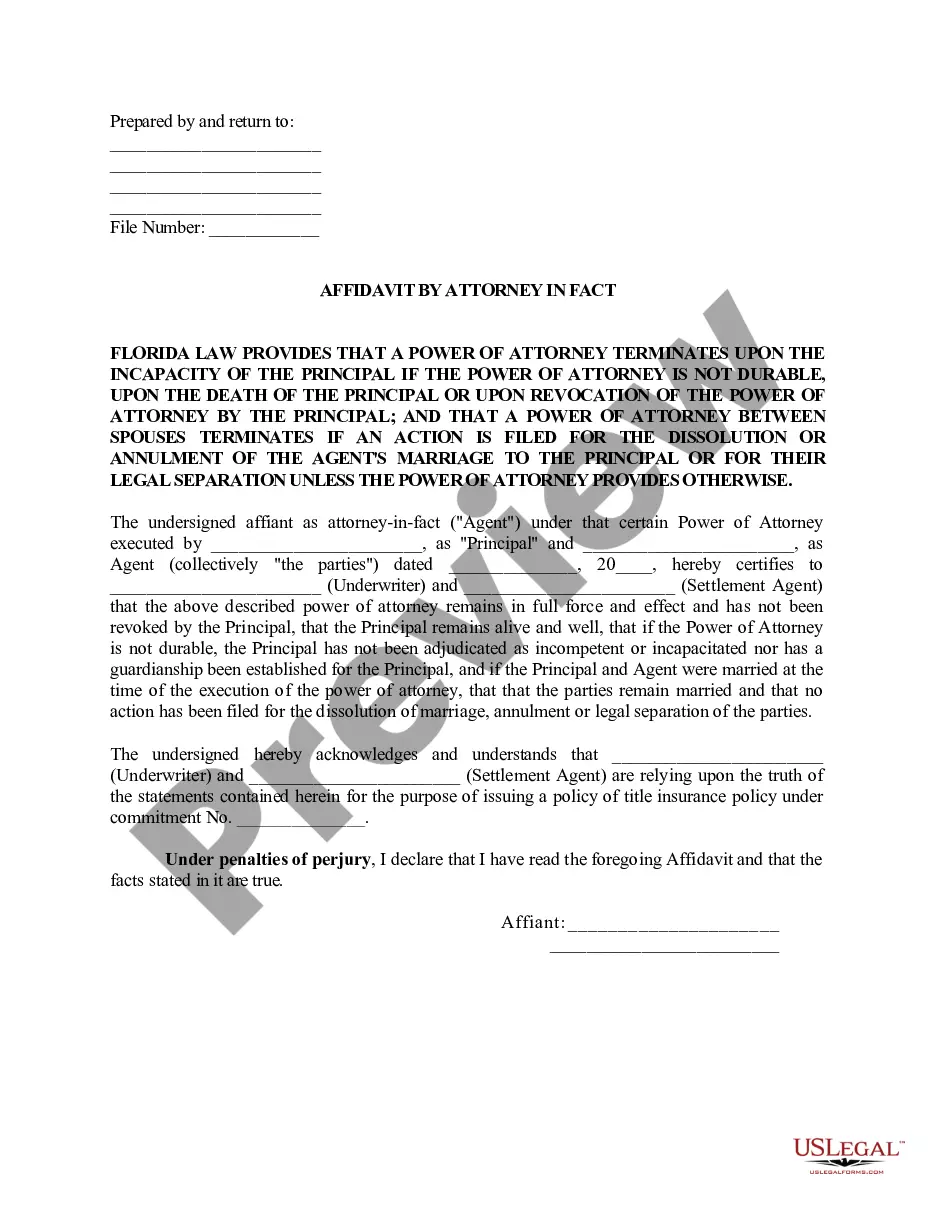

- Be sure to have picked out the best kind to your city/county. Select the Preview key to examine the form`s articles. Look at the kind outline to ensure that you have selected the proper kind.

- In the event the kind doesn`t suit your requirements, take advantage of the Search area near the top of the display to obtain the one which does.

- If you are content with the form, confirm your decision by simply clicking the Buy now key. Then, select the pricing prepare you like and provide your accreditations to register for an profile.

- Procedure the deal. Utilize your charge card or PayPal profile to perform the deal.

- Choose the file format and obtain the form on your own device.

- Make modifications. Load, change and produce and sign the acquired District of Columbia Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Each template you included with your bank account does not have an expiry time and is also the one you have eternally. So, if you wish to obtain or produce one more version, just check out the My Forms portion and click about the kind you require.

Gain access to the District of Columbia Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms, by far the most substantial collection of legal papers templates. Use 1000s of specialist and status-particular templates that fulfill your organization or specific demands and requirements.