A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

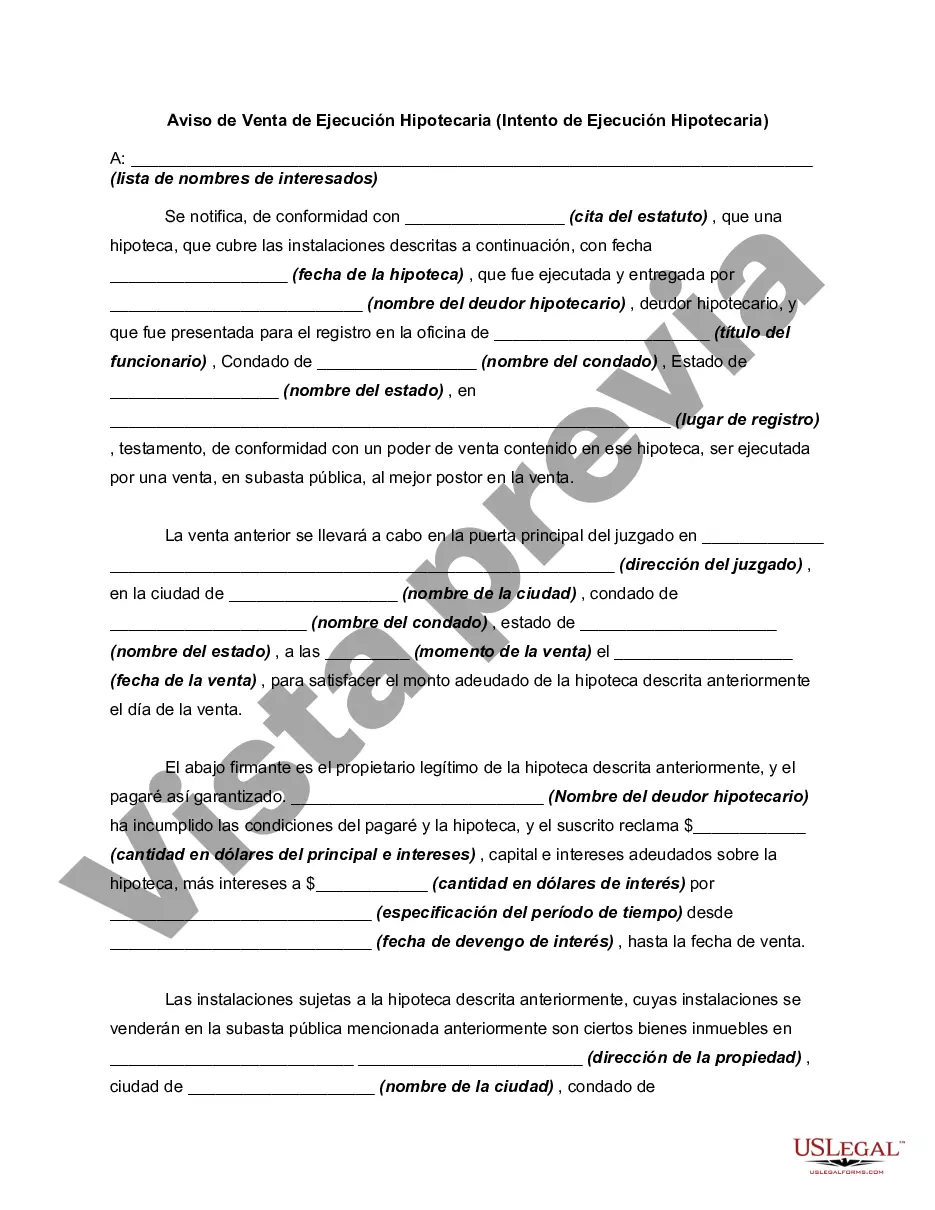

Title: Understanding the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose Keywords: District of Columbia, Notice of Foreclosure Sale, Intent to Foreclose, foreclosure process, types, property foreclosure, foreclosure laws Description: The District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is a crucial legal document that plays a significant role in the foreclosure process in the District of Columbia. It serves as a formal notification to the homeowner, alerting them that their property is at risk of being sold due to mortgage default or delinquency. There are several types of District of Columbia Notice of Foreclosure Sale — Intent to Foreclose, each serving a specific purpose within the foreclosure process. 1. Judicial Foreclosure: This type of foreclosure occurs when the lender files a lawsuit against the borrower to obtain a court order allowing them to foreclose on the property. Once the court grants the order, the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is typically issued to inform the homeowner about the impending sale. 2. Non-Judicial Foreclosure: In certain situations, the lender may opt for a non-judicial foreclosure. This process involves using a power of sale clause present in the deed of trust or mortgage. The District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is crucial in such cases as it outlines the date, time, and location of the foreclosure sale. 3. Notice Requirements: The District of Columbia foreclosure laws outline specific notice requirements that must be met before initiating a foreclosure sale. This includes mailing the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose to the homeowner's last known address, publishing the notice in a newspaper, and posting it on the property itself. 4. Redemption Period: The District of Columbia offers homeowners a redemption period after receiving the Notice of Foreclosure Sale — Intent to Foreclose. This period allows the homeowner to reclaim their property by paying off the outstanding debt and associated costs before the foreclosure sale takes place. 5. Effects of Foreclosure: Understanding the implications of foreclosure is essential. In addition to losing their property, homeowners may face adverse consequences such as damage to their credit score, difficulty in securing future loans, and potential deficiency judgments. In conclusion, the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is a critical document that marks the initial stage of the foreclosure process. Whether it follows a judicial or non-judicial path, homeowners must acknowledge this notice and take appropriate action to protect their property rights. Understanding the foreclosure laws, notice requirements, and redemption period associated with this notice can greatly assist homeowners facing possible foreclosure.Title: Understanding the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose Keywords: District of Columbia, Notice of Foreclosure Sale, Intent to Foreclose, foreclosure process, types, property foreclosure, foreclosure laws Description: The District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is a crucial legal document that plays a significant role in the foreclosure process in the District of Columbia. It serves as a formal notification to the homeowner, alerting them that their property is at risk of being sold due to mortgage default or delinquency. There are several types of District of Columbia Notice of Foreclosure Sale — Intent to Foreclose, each serving a specific purpose within the foreclosure process. 1. Judicial Foreclosure: This type of foreclosure occurs when the lender files a lawsuit against the borrower to obtain a court order allowing them to foreclose on the property. Once the court grants the order, the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is typically issued to inform the homeowner about the impending sale. 2. Non-Judicial Foreclosure: In certain situations, the lender may opt for a non-judicial foreclosure. This process involves using a power of sale clause present in the deed of trust or mortgage. The District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is crucial in such cases as it outlines the date, time, and location of the foreclosure sale. 3. Notice Requirements: The District of Columbia foreclosure laws outline specific notice requirements that must be met before initiating a foreclosure sale. This includes mailing the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose to the homeowner's last known address, publishing the notice in a newspaper, and posting it on the property itself. 4. Redemption Period: The District of Columbia offers homeowners a redemption period after receiving the Notice of Foreclosure Sale — Intent to Foreclose. This period allows the homeowner to reclaim their property by paying off the outstanding debt and associated costs before the foreclosure sale takes place. 5. Effects of Foreclosure: Understanding the implications of foreclosure is essential. In addition to losing their property, homeowners may face adverse consequences such as damage to their credit score, difficulty in securing future loans, and potential deficiency judgments. In conclusion, the District of Columbia Notice of Foreclosure Sale — Intent to Foreclose is a critical document that marks the initial stage of the foreclosure process. Whether it follows a judicial or non-judicial path, homeowners must acknowledge this notice and take appropriate action to protect their property rights. Understanding the foreclosure laws, notice requirements, and redemption period associated with this notice can greatly assist homeowners facing possible foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.