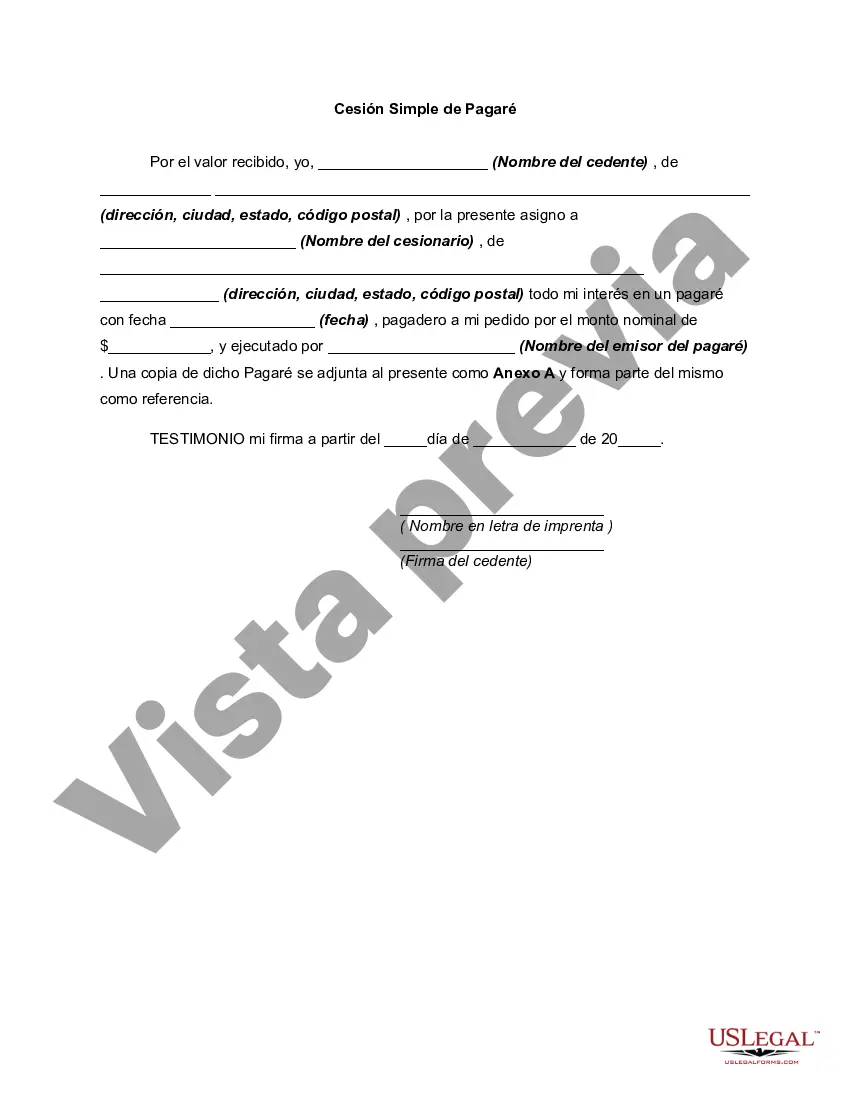

A District of Columbia Simple Promissory Note for Family Loan is a legally binding contract that outlines the terms and conditions of a loan agreement between family members in the District of Columbia. This document provides a clear understanding of the loan amount, repayment terms, interest rate, and any other pertinent details. In the District of Columbia, there are several types of Simple Promissory Notes for Family Loans, including: 1. Lump Sum Repayment: This type of promissory note requires the borrower to repay the full loan amount in one lump sum by a specified date. It is suitable for loans with a short repayment period or when the borrower has the means to repay the loan in one go. 2. Installment Payments: With this type of note, the loan amount is divided into equal installments over a specific period. The borrower must make regular payments, including principal and interest, until the loan is fully paid off. This option is appropriate for larger loans that require longer repayment schedules. 3. Interest-Free Loan: A promissory note may also include clauses that allow for loans without any interest. It is ideal for family members who wish to help each other financially without the burden of accruing interest charges. Regardless of the specific type, a District of Columbia Simple Promissory Note for Family Loan should include essential elements such as: — Identification of the parties involved: Clearly state the names, addresses, and contact details of both the lender and borrower. — Loan amount: Specify the exact amount agreed upon for the loan. — Repayment terms: Outline the repayment schedule, including any due dates or installment amounts, as applicable. — Interest rate (if applicable): If interest is charged on the loan, clearly state the agreed-upon rate in the note. — Late payment penalties: Determine any penalties or fees for late or missed payments. — Collateral (if applicable): If the loan is secured by collateral, provide a detailed description of the pledged assets. — Governing law: Mention that the promissory note is governed by the laws of the District of Columbia. — Signatures: Require both parties to sign the promissory note to signify their acceptance and agreement to the terms. It is crucial to consult with a legal professional when drafting or finalizing a District of Columbia Simple Promissory Note for Family Loan to ensure that the document complies with all relevant laws and regulations in the District of Columbia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out District Of Columbia Pagaré Simple Para Préstamo Familiar?

US Legal Forms - among the largest libraries of lawful kinds in America - offers a wide array of lawful file themes you can down load or print. While using website, you may get a huge number of kinds for organization and individual reasons, sorted by classes, states, or key phrases.You can find the most up-to-date models of kinds like the District of Columbia Simple Promissory Note for Family Loan within minutes.

If you have a monthly subscription, log in and down load District of Columbia Simple Promissory Note for Family Loan from the US Legal Forms catalogue. The Download option can look on every type you view. You get access to all previously delivered electronically kinds within the My Forms tab of your own profile.

In order to use US Legal Forms initially, listed here are basic directions to help you get started out:

- Be sure to have picked out the proper type for your city/state. Select the Preview option to review the form`s content material. Look at the type explanation to actually have chosen the correct type.

- If the type does not match your requirements, use the Look for discipline on top of the display screen to get the one that does.

- In case you are satisfied with the form, affirm your selection by visiting the Get now option. Then, choose the rates plan you like and offer your qualifications to sign up for an profile.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the structure and down load the form on the device.

- Make changes. Complete, edit and print and sign the delivered electronically District of Columbia Simple Promissory Note for Family Loan.

Each and every template you put into your money lacks an expiration time which is the one you have permanently. So, if you would like down load or print yet another backup, just go to the My Forms area and click about the type you want.

Get access to the District of Columbia Simple Promissory Note for Family Loan with US Legal Forms, the most considerable catalogue of lawful file themes. Use a huge number of professional and condition-specific themes that meet your organization or individual requirements and requirements.