A District of Columbia Simple Promissory Note for Tuition Fee is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the District of Columbia specifically for the purpose of covering tuition fees. This note serves as a written record of the borrower's promise to repay the loan amount, and it helps protect the rights and interests of both parties involved. The District of Columbia offers various types of Simple Promissory Notes for Tuition Fees to cater to different situations and requirements. Some common types include: 1. Traditional Promissory Note: This is the most basic type of promissory note, encompassing the primary elements of the loan agreement, such as the loan amount, interest rate, repayment schedule, and consequences of default. 2. Interest-free Promissory Note: This type of promissory note is specifically tailored for borrowers who are not required to pay any interest on the loan amount. It outlines the terms and conditions for repayment without any additional interest charges, making it an ideal choice for individuals seeking financial assistance without incurring interest-related costs. 3. Graduated Repayment Promissory Note: A Graduated Repayment Promissory Note is designed to accommodate borrowers who anticipate an increase in their income over time. This note allows for a flexible repayment structure, starting with lower monthly payments that progressively increase throughout the loan term to align with the borrower's expected income growth. 4. Extended Repayment Promissory Note: An Extended Repayment Promissory Note enables borrowers to extend the repayment period beyond the standard term to make the loan more manageable. This type of note can be particularly beneficial for borrowers facing financial constraints or those who require more time to repay the loan. Regardless of the type of District of Columbia Simple Promissory Note for Tuition Fee chosen, it is essential to carefully review and understand the terms before signing the agreement. Both the borrower and the lender should seek legal advice to ensure compliance with applicable laws and to protect their respective interests.

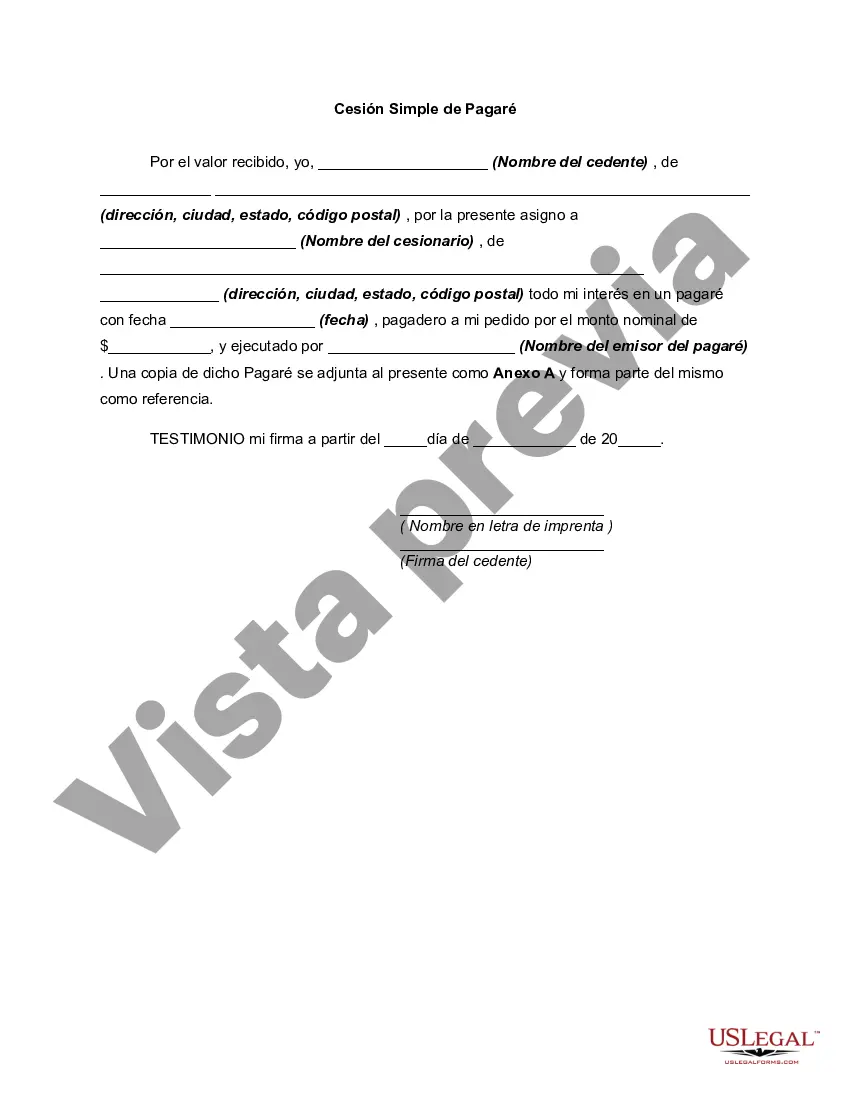

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out District Of Columbia Pagaré Simple De Matrícula?

Are you within a place in which you need to have paperwork for both company or individual uses virtually every working day? There are tons of lawful papers web templates available on the net, but finding kinds you can depend on isn`t easy. US Legal Forms delivers 1000s of type web templates, much like the District of Columbia Simple Promissory Note for Tutition Fee, that happen to be written to fulfill federal and state requirements.

In case you are already acquainted with US Legal Forms internet site and get an account, basically log in. Afterward, you are able to acquire the District of Columbia Simple Promissory Note for Tutition Fee web template.

Should you not have an bank account and want to begin using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for that appropriate area/region.

- Utilize the Review switch to analyze the form.

- Read the description to actually have chosen the right type.

- In case the type isn`t what you`re seeking, utilize the Look for field to find the type that meets your requirements and requirements.

- Once you discover the appropriate type, just click Purchase now.

- Opt for the costs plan you need, fill out the specified info to produce your money, and pay money for the order using your PayPal or credit card.

- Choose a handy document formatting and acquire your version.

Get every one of the papers web templates you may have bought in the My Forms menu. You can get a further version of District of Columbia Simple Promissory Note for Tutition Fee whenever, if necessary. Just go through the needed type to acquire or print out the papers web template.

Use US Legal Forms, one of the most extensive variety of lawful types, in order to save time as well as avoid blunders. The services delivers skillfully produced lawful papers web templates which can be used for a range of uses. Produce an account on US Legal Forms and begin creating your lifestyle easier.