District of Columbia Promissory Note in Connection with Sale of Motor Vehicle

Description

A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

How to fill out Promissory Note In Connection With Sale Of Motor Vehicle?

You might spend numerous hours online attempting to discover the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a wide array of legal forms that are evaluated by professionals.

You can easily download or print the District of Columbia Promissory Note in Connection with Sale of Motor Vehicle from our platform.

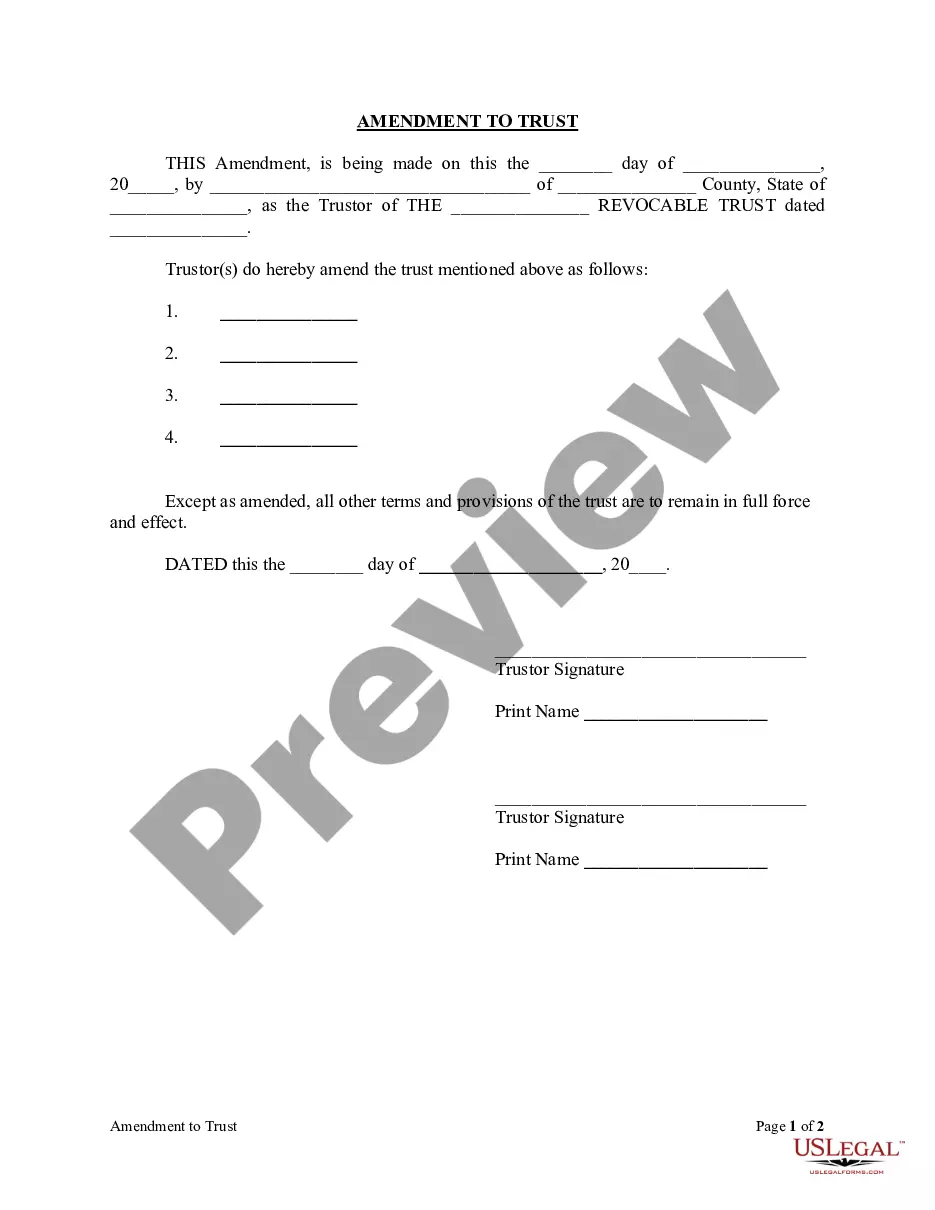

If available, use the Review button to verify the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Acquire button.

- Then, you can complete, edit, print, or sign the District of Columbia Promissory Note in Connection with Sale of Motor Vehicle.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for the jurisdiction that you choose.

- Review the form summary to verify you have selected the correct form.

Form popularity

FAQ

Many dealerships offer promissory notes as part of their financing options when selling vehicles. A District of Columbia Promissory Note in Connection with Sale of Motor Vehicle can provide a structured payment plan that suits both the dealership and the buyer. By using a promissory note, dealers can facilitate smoother transactions and maintain a clear record of the payment terms. It's essential to review the note to ensure it aligns with your financial plans and obligations.

In the District of Columbia, a bill of sale is not explicitly required for the transfer of a motor vehicle. However, it is highly recommended, as it serves as a critical record of the transaction and can simplify the process of registering the vehicle. This document can help protect both the buyer and the seller by providing proof of the sale. When you create a District of Columbia Promissory Note in Connection with Sale of Motor Vehicle, including a bill of sale can enhance clarity and ensure a smoother transaction.

Writing a contract agreement for payment requires clarity and thoroughness. Start with the introduction of parties involved, define the consideration, and specify payment terms, including amounts and schedules. Incorporating a District of Columbia Promissory Note in Connection with Sale of Motor Vehicle adds a level of security for both buyer and seller.

To sell a car with a promissory note, draft a detailed agreement that includes the specifics of the vehicle and the payment terms. The District of Columbia Promissory Note in Connection with Sale of Motor Vehicle should outline the agreed-upon payment amount, due dates, and any applicable interest. This formal document secures your interest in the vehicle until the buyer fulfills their payment obligations.

To write a contract for selling a car with payments, start by detailing the vehicle’s information, including make, model, and VIN. Clearly outline the payment terms, which should include the total amount, down payment, and installment schedule. Make sure to mention the application of a District of Columbia Promissory Note in Connection with Sale of Motor Vehicle to formalize the agreement and protect both parties.

Yes, promissory notes typically hold up in court if they are clear, properly executed, and compliant with local laws. In the District of Columbia, a valid promissory note provides legal grounds for collection, should the buyer fail to meet their payment obligations. It is essential to ensure that this document is accurately completed to reinforce its enforceability. For added assurance, consider using a platform like US Legal Forms to generate your promissory note, ensuring it meets all necessary legal standards.

Selling a VehicleRemove your license tags from the vehicle and return them to DC DMV either in person or by mail.Surrender Tags.Provide the new owner with the properly signed title.More items...

Writing a bill of sale for a carThe date of the sale.A description of the car, including its: Year, make and model.The selling price of the car. If the car is a gift or partial gift, you should still create a bill of sale.Warranty information.The full names, addresses and signatures of the buyer and seller.

Bills of sale in Virginia, which can be drafted by hand if necessary, do not need to be notarized. However, each document should feature the following information in order to serve its purpose: The names, contact information, and signatures of the buyer and seller. A full description of the vehicle.

When you buy or sell a vehicle in Washington D.C., you should complete a Bill of Sale for your safety. This serves as a legal receipt from the buyer to the seller documenting both the change in ownership and the purchase price.