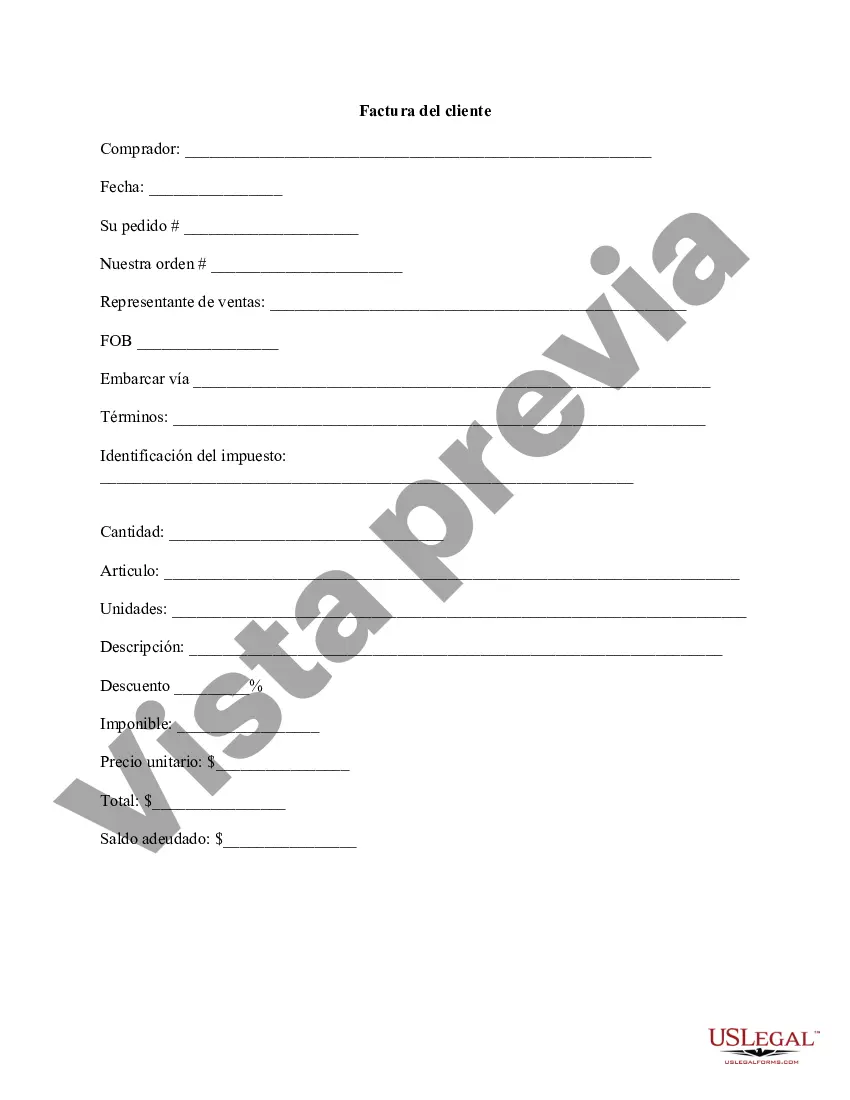

A District of Columbia Customer Invoice is a legal document that provides a detailed record of a financial transaction between a business in the District of Columbia and its customers. This invoice is used to request payment for goods or services rendered and serves as proof of the transaction. The primary purpose of the District of Columbia Customer Invoice is to outline and present all relevant information related to the sale, including the itemized list of products or services provided, their quantities, unit prices, total amounts, and any applicable taxes or discounts. It also includes the invoice number, issue date, payment due date, and the customer's contact and billing information. Different types of District of Columbia Customer Invoices may exist based on the nature of the business and the specific requirements of the transaction. Some possible variations include: 1. Standard District of Columbia Customer Invoice: This type of invoice includes basic details such as the business name, address, and contact information, along with information about the purchased items or services, quantities, rates, taxes, and the total amount due. 2. Recurring District of Columbia Customer Invoice: In cases where businesses provide ongoing services or products that require regular payments, recurring invoices are utilized. These invoices are generated at specified intervals, such as monthly or annually, and outline the recurring charges and payment terms. 3. Proforma District of Columbia Customer Invoice: A proforma invoice is issued prior to the completion of a transaction. It provides a tentative breakdown of the products or services and their associated costs to serve as an estimate or a pre-payment request. 4. Credit Memo District of Columbia Customer Invoice: This type of invoice is issued when a customer is owed a credit or refund due to returns, discounts, or overpayments. It outlines the amount to be credited or refunded and can be used to offset future purchases or processed as a cash refund. 5. Past Due District of Columbia Customer Invoice: This kind of invoice is issued as a reminder to customers who have unpaid balances beyond the payment due dates. It typically includes a prominent "Past Due" notice and may include additional fees or interest charges for late payments. District of Columbia Customer Invoices play a crucial role in maintaining transparent and organized financial records for businesses operating in the District of Columbia. These invoices facilitate smooth financial management and enable businesses to track revenue, manage cash flow, and maintain accurate accounts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Factura del cliente - Customer Invoice

Description

How to fill out District Of Columbia Factura Del Cliente?

You are able to spend hours online searching for the authorized file format that fits the federal and state specifications you want. US Legal Forms offers 1000s of authorized varieties which are reviewed by experts. It is possible to download or print out the District of Columbia Customer Invoice from my service.

If you already have a US Legal Forms accounts, you can log in and then click the Obtain key. Following that, you can full, modify, print out, or indication the District of Columbia Customer Invoice. Each authorized file format you get is yours forever. To obtain another duplicate of any purchased develop, go to the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms website the very first time, keep to the straightforward directions under:

- Initially, make certain you have selected the right file format for that area/area of your choosing. Browse the develop information to ensure you have picked out the correct develop. If offered, make use of the Review key to search throughout the file format too.

- If you wish to locate another model of your develop, make use of the Search discipline to get the format that fits your needs and specifications.

- Upon having discovered the format you desire, simply click Buy now to move forward.

- Find the rates program you desire, type your references, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal accounts to purchase the authorized develop.

- Find the formatting of your file and download it to the product.

- Make alterations to the file if required. You are able to full, modify and indication and print out District of Columbia Customer Invoice.

Obtain and print out 1000s of file web templates utilizing the US Legal Forms website, which offers the most important selection of authorized varieties. Use specialist and state-specific web templates to tackle your business or person requirements.