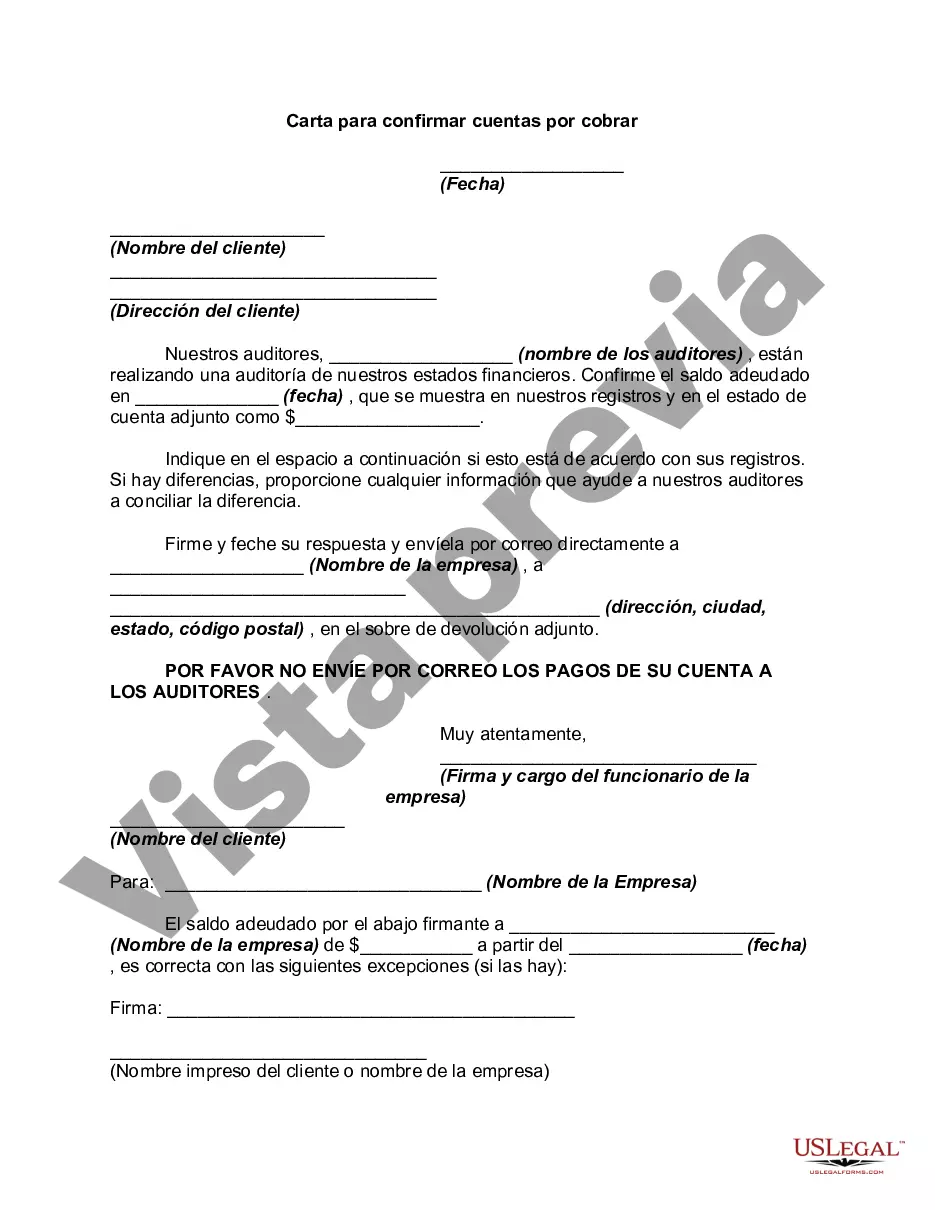

District of Columbia Letter to Confirm Accounts Receivable is a legal document used in the District of Columbia to verify and confirm the amount of money owed by a customer to a business for goods or services rendered. It acts as official confirmation of the outstanding accounts receivable and provides a formal record to help businesses maintain accurate financial records and ensure that they receive payments in a timely manner. The District of Columbia Letter to Confirm Accounts Receivable is an essential tool for businesses operating in the District of Columbia. It helps streamline and strengthen financial transactions by ensuring that all parties involved are aware of their financial obligations and commitments. This letter serves as a written record for both the business and the customer, outlining the agreed-upon terms and the outstanding amount due. There are several types of District of Columbia Letters to Confirm Accounts Receivable, each serving a specific purpose within various business contexts. These include: 1. Standard District of Columbia Letter to Confirm Accounts Receivable: This is a generic template used by businesses in the District of Columbia to formally request customers to confirm their outstanding debts. It includes essential details such as the customer's name, account number, outstanding balance, payment terms, and a deadline for response. 2. District of Columbia Letter to Confirm Accounts Receivable for Legal Proceedings: This specific type of letter is used when a business is preparing for or considering legal action against a customer for non-payment or default on their accounts. It emphasizes the seriousness of the situation and may include additional legal language to demonstrate the potential consequences of failing to settle the debt promptly. 3. District of Columbia Letter to Confirm Accounts Receivable with a Payment Plan: In situations where a customer is unable to pay the entire outstanding amount at once, this type of letter outlines a defined payment plan to clear the debt over a specified period. The letter includes the agreed-upon installment amounts, payment schedule, and consequences for non-compliance. 4. District of Columbia Letter to Confirm Accounts Receivable with Disputed Items: When there is a disagreement or dispute between the business and customer regarding specific items on the accounts, this letter is used to address and resolve the disputed items. It often requests the customer's cooperation in providing additional information or documentation to reach a resolution. In summary, the District of Columbia Letter to Confirm Accounts Receivable plays a crucial role in financial management for businesses operating in the District of Columbia. It helps maintain accurate records, prompt payment collection, and acts as a formal communication channel between businesses and customers. Different types of letters cater to unique circumstances, such as legal proceedings, payment plans, and dispute resolutions, ensuring comprehensive debt management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Carta para confirmar cuentas por cobrar - Letter to Confirm Accounts Receivable

Description

How to fill out District Of Columbia Carta Para Confirmar Cuentas Por Cobrar?

Discovering the right legitimate file format can be quite a have a problem. Naturally, there are a variety of templates available on the Internet, but how can you find the legitimate kind you require? Make use of the US Legal Forms site. The support delivers a huge number of templates, including the District of Columbia Letter to Confirm Accounts Receivable, which you can use for enterprise and private demands. All the varieties are checked out by specialists and fulfill state and federal specifications.

When you are previously signed up, log in to the bank account and click the Obtain switch to find the District of Columbia Letter to Confirm Accounts Receivable. Utilize your bank account to look from the legitimate varieties you might have purchased formerly. Go to the My Forms tab of the bank account and obtain another copy of your file you require.

When you are a whole new consumer of US Legal Forms, allow me to share basic directions that you can adhere to:

- Very first, make certain you have selected the appropriate kind for your personal city/county. You are able to look over the form utilizing the Preview switch and browse the form information to guarantee this is basically the best for you.

- If the kind will not fulfill your needs, take advantage of the Seach industry to obtain the proper kind.

- Once you are certain the form is suitable, select the Buy now switch to find the kind.

- Opt for the rates strategy you want and enter in the necessary information. Make your bank account and purchase your order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the file format and acquire the legitimate file format to the product.

- Comprehensive, change and print out and indicator the attained District of Columbia Letter to Confirm Accounts Receivable.

US Legal Forms is the largest collection of legitimate varieties that you can find various file templates. Make use of the company to acquire professionally-made files that adhere to express specifications.