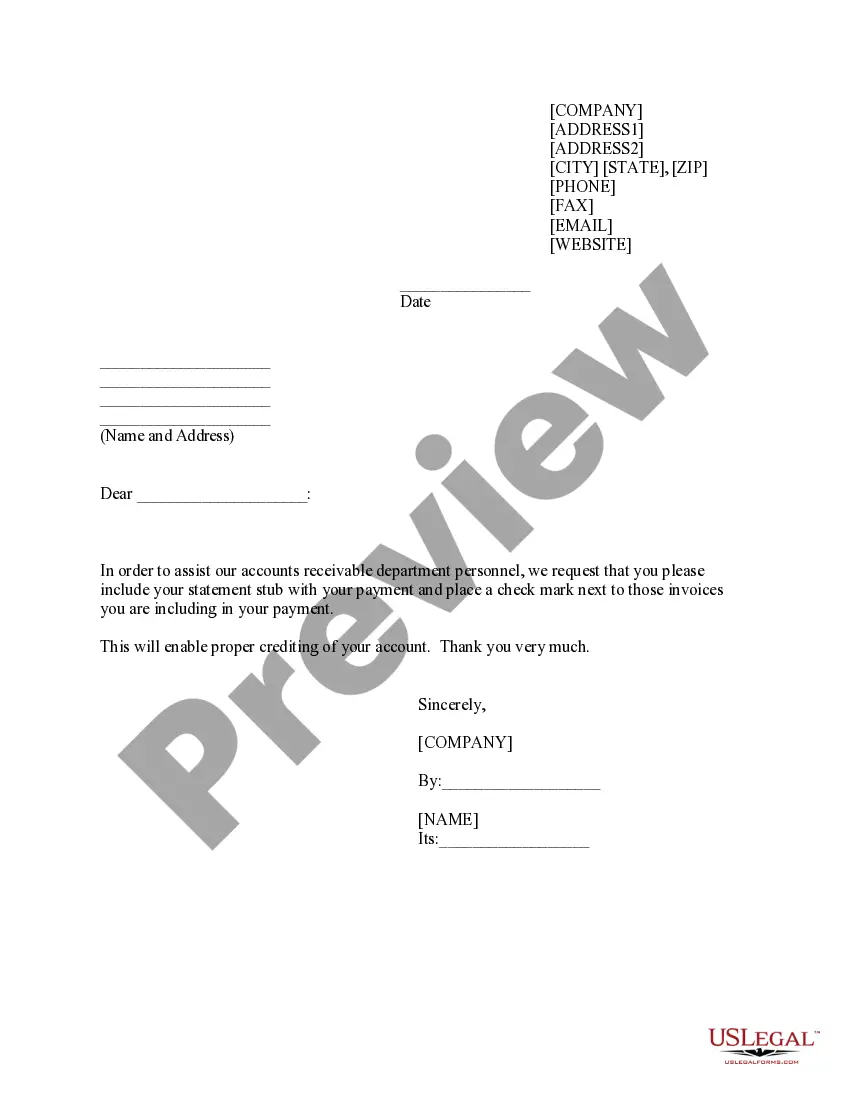

District of Columbia Sample Letter for Request for Clarification in Applying Payment

Description

How to fill out Sample Letter For Request For Clarification In Applying Payment?

You can spend time online looking for the valid document template that fulfills the state and federal criteria you need.

US Legal Forms provides a vast array of valid forms that are reviewed by experts.

You can actually download or print the District of Columbia Sample Letter for Request for Clarification in Applying Payment from our service.

If available, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can fill out, modify, print, or sign the District of Columbia Sample Letter for Request for Clarification in Applying Payment.

- Each valid document template you purchase is yours indefinitely.

- To get another copy of a purchased template, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/area of your choice.

- Read the document description to ensure you have chosen the appropriate template.

Form popularity

FAQ

The form to file an amended return in Washington, DC, is Form D-40. This allows you to make necessary corrections to your original tax filing. If you are unsure how to complete this form or what changes are necessary, the District of Columbia Sample Letter for Request for Clarification in Applying Payment can provide clarity. Using this letter can help you in reaching out for specific guidance on your amended return.

In Washington, DC, the person who records the deed pays the recordation tax. This usually involves the seller or the buyer during property transactions. If you have questions about how this tax applies to your specific situation, the District of Columbia Sample Letter for Request for Clarification in Applying Payment can serve as a helpful guide. By using this letter, you can seek further clarification on any tax liabilities involved.

Generally, a DC tax refund takes about 8 to 12 weeks to process. However, some factors like the accuracy of your filing can affect this timeline. If you're facing delays or require more specifics about your refund, you might find the District of Columbia Sample Letter for Request for Clarification in Applying Payment useful. This letter can assist in inquiring about your refund status directly.

Both residents and non-residents who earn income in Washington, DC, must file a DC tax return. If you meet the income thresholds set by the District of Columbia, you will need to file. It is crucial to understand your obligations, and if you're unsure, utilizing the District of Columbia Sample Letter for Request for Clarification in Applying Payment can help simplify your understanding. This letter can assist in clarifying any confusion regarding your filing requirements.

The DC tax credit reduces the amount of income tax you owe to the District of Columbia. It is designed to provide relief to eligible residents and taxpayers. If you have specific questions about how this applies to your situation, consider using the District of Columbia Sample Letter for Request for Clarification in Applying Payment for guidance. This resource can help clarify how you may benefit from the tax credit.

Yes, Washington DC does offer a standard deduction for individual filers and couples. This deduction reduces your taxable income, which can lower your tax bill. The amount may vary based on your filing status. For precise calculations or clarifications, using a District of Columbia Sample Letter for Request for Clarification in Applying Payment may guide you through any questions you have.

The 183 day rule in DC pertains to residency status for tax purposes. If you spend more than 183 days in the city during a tax year, you are generally considered a resident. This status can impact your tax liability. To clarify your residency status or related tax issues, a District of Columbia Sample Letter for Request for Clarification in Applying Payment can be beneficial.

The DC refund form is used to request a tax refund from the District of Columbia. It is essential to complete this form accurately to ensure timely processing. You can obtain the form from the DC Office of Tax and Revenue website. If you have questions, consider using a District of Columbia Sample Letter for Request for Clarification in Applying Payment for guidance.

Filling out a form in Washington DC typically requires clear information. Ensure you provide your personal details, including name, address, and social security number. Review each section carefully before submitting. For more detailed situations, use a District of Columbia Sample Letter for Request for Clarification in Applying Payment to ask for assistance.

To fill out a W-4 form online, start by visiting the IRS website. You can find an interactive guide that walks you through each step. Once you complete the form, ensure you review your withholding allowances. If you need additional clarification, a District of Columbia Sample Letter for Request for Clarification in Applying Payment might assist in your understanding.