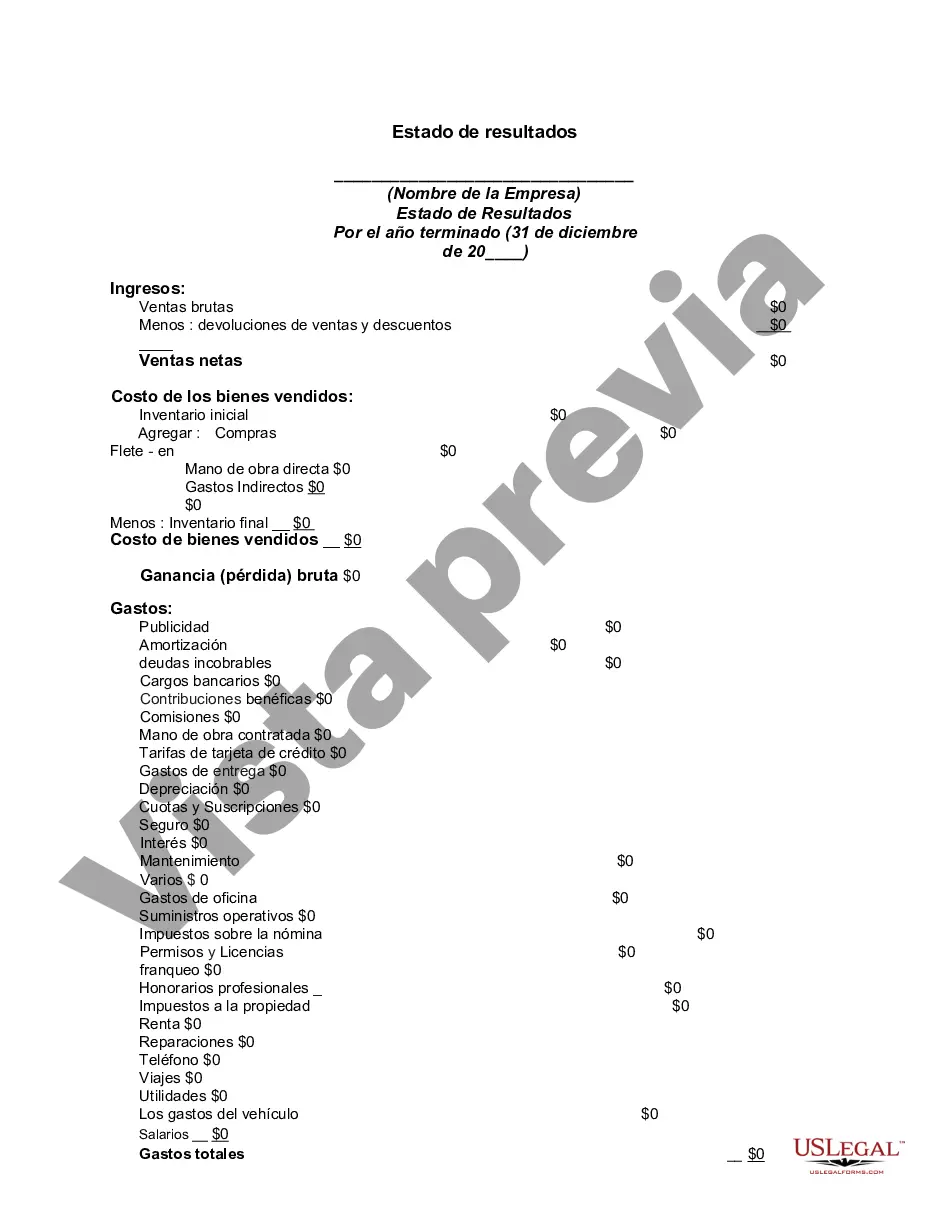

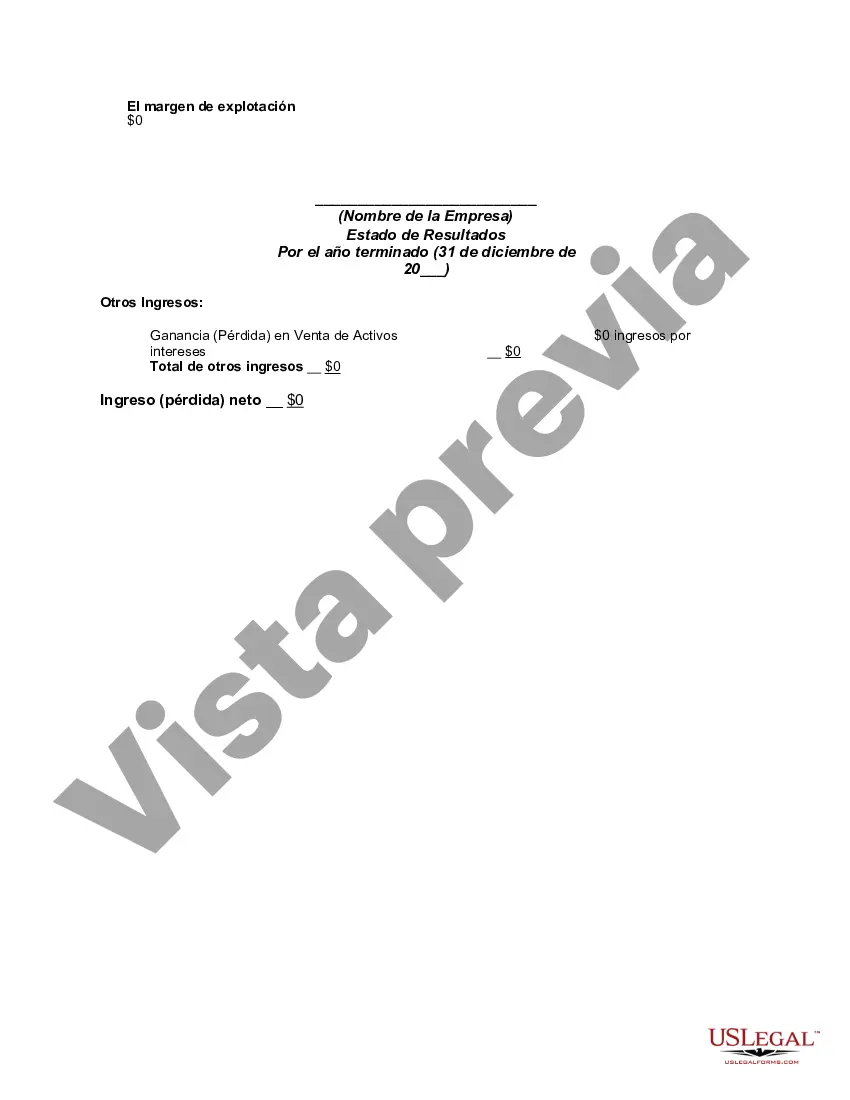

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The District of Columbia Income Statement is a financial document that provides a detailed summary of the revenue, expenses, and profit generated by a business or individual residing in the District of Columbia. It is used to assess the financial performance of an entity over a specific period, such as a year, month, or quarter. Keywords: District of Columbia, income statement, financial document, revenue, expenses, profit, financial performance, period. There are generally two main types of income statements used in the District of Columbia: 1. Single-Step Income Statement: This type of income statement presents all revenues and gains on one side and all expenses and losses on the other side, resulting in a single-step calculation to determine the net income or loss. It provides a straightforward overview of the financial performance without complexities. 2. Multi-Step Income Statement: This type of income statement provides a more detailed analysis of revenues, expenses, and gains/losses by separating them into various categories. It includes multiple steps such as gross profit calculation, operating income determination, and net income/loss calculation. This allows for a more comprehensive understanding of the financial picture and aids in identifying specific areas affecting profitability. Both types of income statements provide crucial insights into a business's financial health and can assist in decision-making, budgeting, and assessing growth opportunities in the District of Columbia. Keywords: Single-Step Income Statement, Multi-Step Income Statement, revenue, gains, expenses, losses, net income, gross profit, operating income, financial health, decision-making, budgeting, growth opportunities.The District of Columbia Income Statement is a financial document that provides a detailed summary of the revenue, expenses, and profit generated by a business or individual residing in the District of Columbia. It is used to assess the financial performance of an entity over a specific period, such as a year, month, or quarter. Keywords: District of Columbia, income statement, financial document, revenue, expenses, profit, financial performance, period. There are generally two main types of income statements used in the District of Columbia: 1. Single-Step Income Statement: This type of income statement presents all revenues and gains on one side and all expenses and losses on the other side, resulting in a single-step calculation to determine the net income or loss. It provides a straightforward overview of the financial performance without complexities. 2. Multi-Step Income Statement: This type of income statement provides a more detailed analysis of revenues, expenses, and gains/losses by separating them into various categories. It includes multiple steps such as gross profit calculation, operating income determination, and net income/loss calculation. This allows for a more comprehensive understanding of the financial picture and aids in identifying specific areas affecting profitability. Both types of income statements provide crucial insights into a business's financial health and can assist in decision-making, budgeting, and assessing growth opportunities in the District of Columbia. Keywords: Single-Step Income Statement, Multi-Step Income Statement, revenue, gains, expenses, losses, net income, gross profit, operating income, financial health, decision-making, budgeting, growth opportunities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.