Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

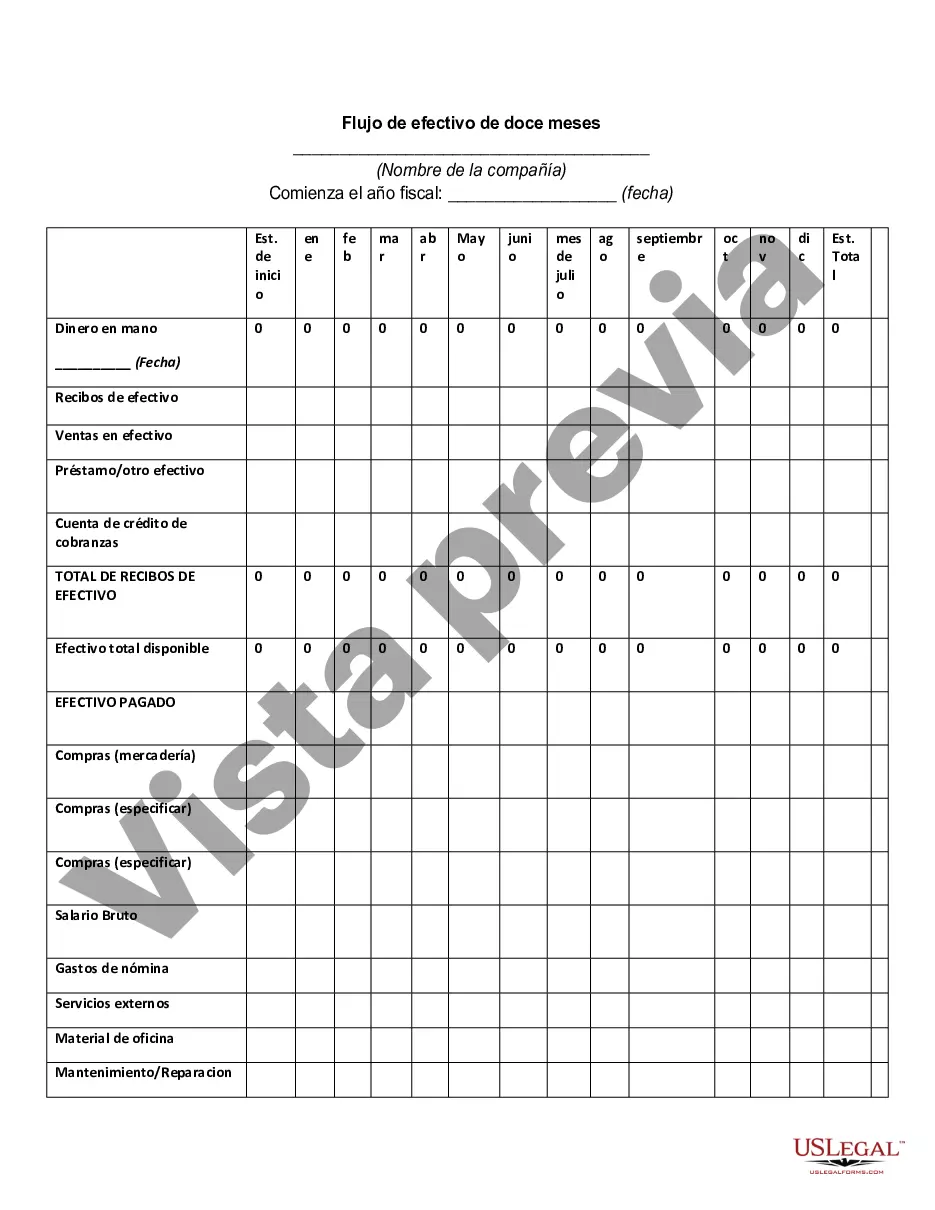

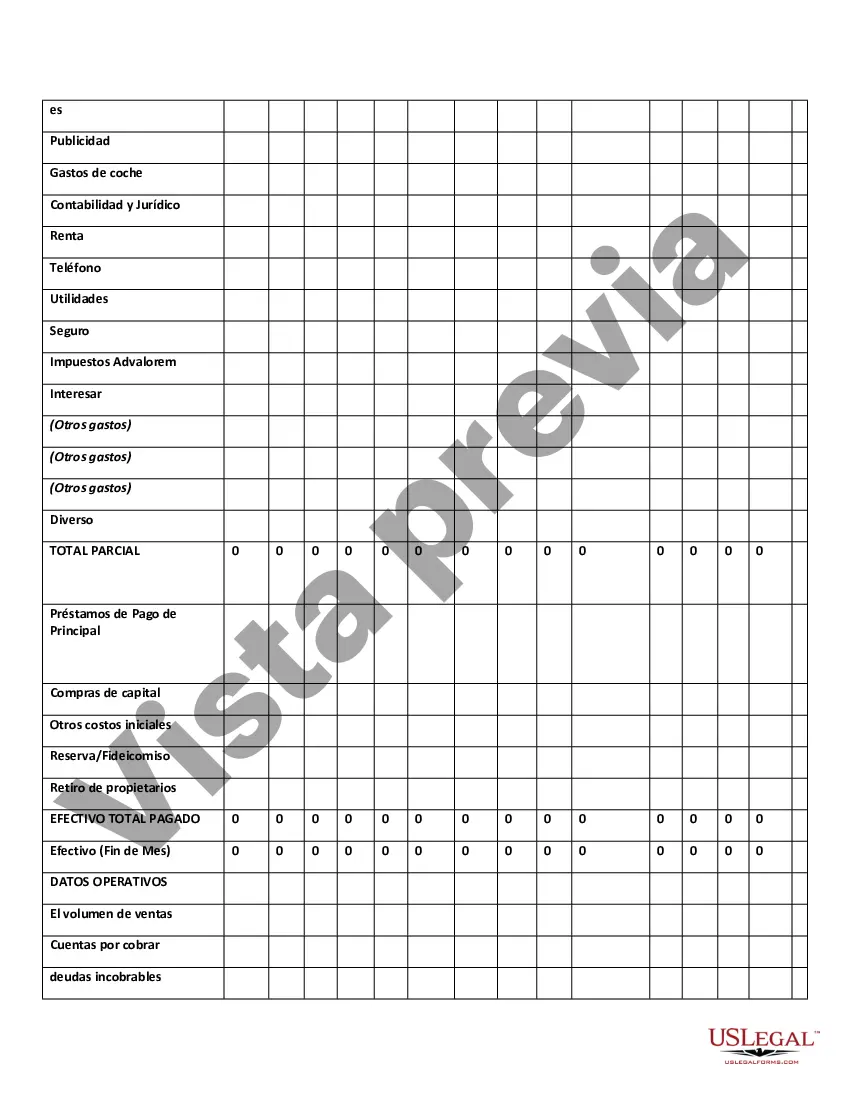

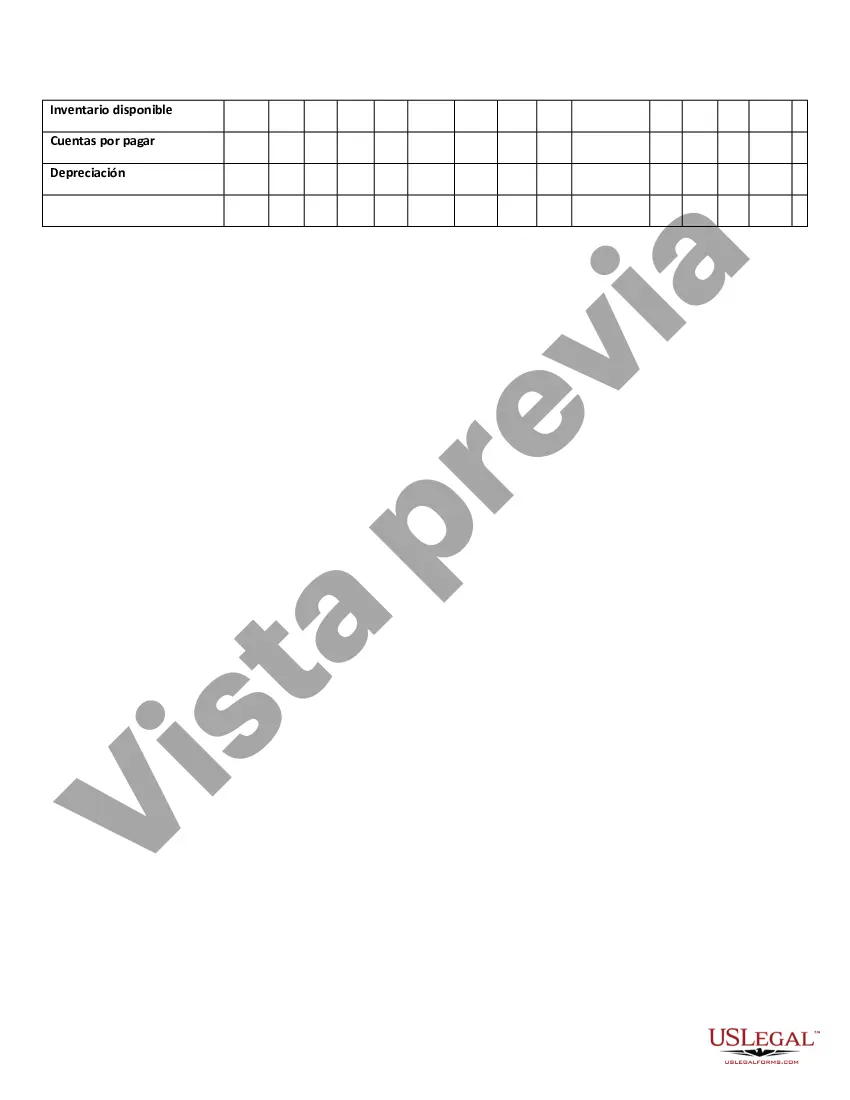

The District of Columbia Twelve-Month Cash Flow refers to a detailed financial statement that summarizes the inflows and outflows of cash for the government of Washington, D.C. over a twelve-month period. This crucial document provides insights into the city's financial health, liquidity, and ability to manage its day-to-day operations. Keywords: District of Columbia, Twelve-Month Cash Flow, financial statement, inflows, outflows, cash, government, Washington, D.C., financial health, liquidity. Different types of District of Columbia Twelve-Month Cash Flow may include: 1. Operating Cash Flow: This type of cash flow represents the funds generated or used by the District of Columbia through its core operations such as taxes, fees, fines, grants, and other revenue sources. It showcases the primary source of cash for running the city and covers expenses like salaries, infrastructure maintenance, utilities, and services. 2. Financing Cash Flow: The financing cash flow category in the District of Columbia Twelve-Month Cash Flow captures the government's activities related to borrowing and repayment of debts. This could include issuing bonds, taking loans, or making loan repayments. It reveals the city's financial leverage and its ability to acquire necessary funds for major projects or debt obligations. 3. Investing Cash Flow: The investing cash flow section details the District of Columbia's cash flows related to investments in capital assets. It encompasses purchases and sales of property, equipment, infrastructure projects, and investments in public enterprises or agencies. This portion showcases the city's long-term investment strategy and highlights its commitment to improving public services and infrastructure. By analyzing the District of Columbia Twelve-Month Cash Flow, policymakers, financial analysts, and citizens can assess the city's financial performance, evaluate its ability to meet obligations, and identify any areas of concern or potential opportunities for improvement. It serves as a valuable tool for budgeting, strategic planning, and ensuring transparent fiscal management. Overall, the District of Columbia Twelve-Month Cash Flow plays a crucial role in understanding the financial dynamics of the city, aiding in decision-making processes, and promoting accountability in the management of public funds.The District of Columbia Twelve-Month Cash Flow refers to a detailed financial statement that summarizes the inflows and outflows of cash for the government of Washington, D.C. over a twelve-month period. This crucial document provides insights into the city's financial health, liquidity, and ability to manage its day-to-day operations. Keywords: District of Columbia, Twelve-Month Cash Flow, financial statement, inflows, outflows, cash, government, Washington, D.C., financial health, liquidity. Different types of District of Columbia Twelve-Month Cash Flow may include: 1. Operating Cash Flow: This type of cash flow represents the funds generated or used by the District of Columbia through its core operations such as taxes, fees, fines, grants, and other revenue sources. It showcases the primary source of cash for running the city and covers expenses like salaries, infrastructure maintenance, utilities, and services. 2. Financing Cash Flow: The financing cash flow category in the District of Columbia Twelve-Month Cash Flow captures the government's activities related to borrowing and repayment of debts. This could include issuing bonds, taking loans, or making loan repayments. It reveals the city's financial leverage and its ability to acquire necessary funds for major projects or debt obligations. 3. Investing Cash Flow: The investing cash flow section details the District of Columbia's cash flows related to investments in capital assets. It encompasses purchases and sales of property, equipment, infrastructure projects, and investments in public enterprises or agencies. This portion showcases the city's long-term investment strategy and highlights its commitment to improving public services and infrastructure. By analyzing the District of Columbia Twelve-Month Cash Flow, policymakers, financial analysts, and citizens can assess the city's financial performance, evaluate its ability to meet obligations, and identify any areas of concern or potential opportunities for improvement. It serves as a valuable tool for budgeting, strategic planning, and ensuring transparent fiscal management. Overall, the District of Columbia Twelve-Month Cash Flow plays a crucial role in understanding the financial dynamics of the city, aiding in decision-making processes, and promoting accountability in the management of public funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.