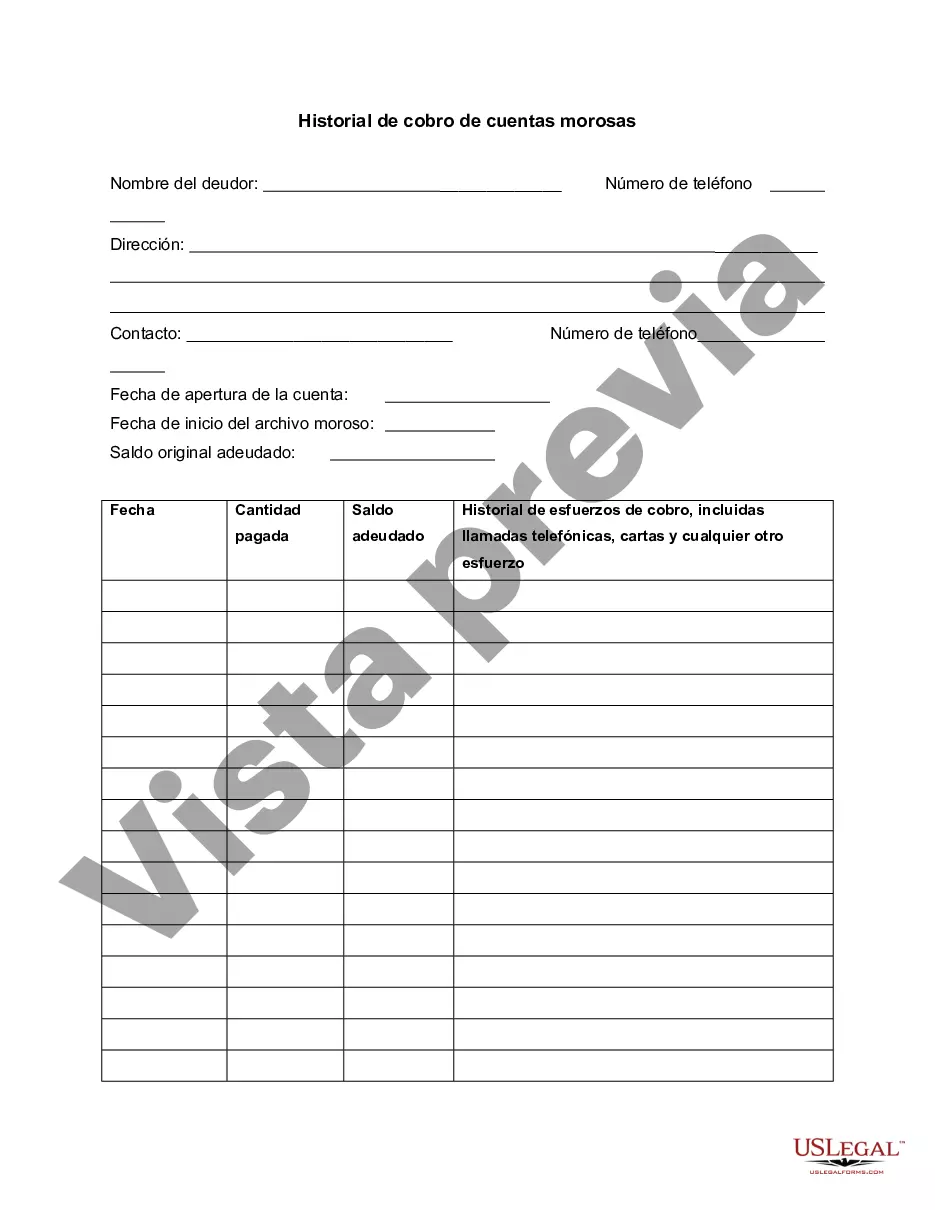

This is a form to track progress on a delinquent customer account and to record collection efforts.

District of Columbia Delinquent Account Collection History refers to the record of outstanding debts owed to the government in the District of Columbia that have remained unpaid for a specific period of time. It involves the efforts made by the District of Columbia to collect these delinquent accounts and recoup the owed funds. The District of Columbia has implemented various initiatives and programs to recover outstanding debts. One notable program is the Delinquent Debt Collection Program, which aims to identify and pursue delinquent accounts through a systematic approach. This program covers a wide range of debt types, including but not limited to unpaid taxes, fines, fees, and penalties. The District of Columbia categorizes its Delinquent Account Collection History into different types based on the nature of the debt or the department responsible for its collection. Some common types include: 1. Tax Delinquencies: This category encompasses delinquent accounts related to income taxes, property taxes, sales taxes, and other forms of taxes owed to the District of Columbia. 2. Traffic and Parking Fines: This type of delinquent account collection history covers unpaid fines issued for traffic violations, parking violations, and other infractions within the District of Columbia. 3. Utilities and Service Fees: Delinquent accounts associated with unpaid utility bills such as water, electricity, and gas, as well as outstanding charges for services provided by the District of Columbia, fall under this category. 4. License and Permit Fees: This type includes delinquent payments owed for various licenses and permits required to conduct business or engage in certain activities within the District of Columbia. 5. Court-Related Debts: This category comprises unpaid fines, court fees, restitution payments, and other legal obligations resulting from court proceedings in the District of Columbia. The District of Columbia utilizes various methods to collect on delinquent accounts. These may include sending notifications, issuing demands for payment, implementing wage garnishments, placing liens on property, or pursuing legal action. The goal is to ensure that the owed funds are collected efficiently and that individuals and businesses fulfill their financial obligations to the District of Columbia. In summary, District of Columbia Delinquent Account Collection History refers to the comprehensive record and actions taken by the District of Columbia to recover outstanding debts owed to the government. This includes various types of delinquent accounts such as tax delinquencies, traffic fines, utility bills, license fees, and court-related debts. Through dedicated programs and initiatives, the District of Columbia aims to collect these outstanding funds and maintain financial accountability within the region.District of Columbia Delinquent Account Collection History refers to the record of outstanding debts owed to the government in the District of Columbia that have remained unpaid for a specific period of time. It involves the efforts made by the District of Columbia to collect these delinquent accounts and recoup the owed funds. The District of Columbia has implemented various initiatives and programs to recover outstanding debts. One notable program is the Delinquent Debt Collection Program, which aims to identify and pursue delinquent accounts through a systematic approach. This program covers a wide range of debt types, including but not limited to unpaid taxes, fines, fees, and penalties. The District of Columbia categorizes its Delinquent Account Collection History into different types based on the nature of the debt or the department responsible for its collection. Some common types include: 1. Tax Delinquencies: This category encompasses delinquent accounts related to income taxes, property taxes, sales taxes, and other forms of taxes owed to the District of Columbia. 2. Traffic and Parking Fines: This type of delinquent account collection history covers unpaid fines issued for traffic violations, parking violations, and other infractions within the District of Columbia. 3. Utilities and Service Fees: Delinquent accounts associated with unpaid utility bills such as water, electricity, and gas, as well as outstanding charges for services provided by the District of Columbia, fall under this category. 4. License and Permit Fees: This type includes delinquent payments owed for various licenses and permits required to conduct business or engage in certain activities within the District of Columbia. 5. Court-Related Debts: This category comprises unpaid fines, court fees, restitution payments, and other legal obligations resulting from court proceedings in the District of Columbia. The District of Columbia utilizes various methods to collect on delinquent accounts. These may include sending notifications, issuing demands for payment, implementing wage garnishments, placing liens on property, or pursuing legal action. The goal is to ensure that the owed funds are collected efficiently and that individuals and businesses fulfill their financial obligations to the District of Columbia. In summary, District of Columbia Delinquent Account Collection History refers to the comprehensive record and actions taken by the District of Columbia to recover outstanding debts owed to the government. This includes various types of delinquent accounts such as tax delinquencies, traffic fines, utility bills, license fees, and court-related debts. Through dedicated programs and initiatives, the District of Columbia aims to collect these outstanding funds and maintain financial accountability within the region.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.