District of Columbia Checklist — Sale of a Business The District of Columbia (D.C.) has specific requirements when it comes to selling a business. To ensure a smooth and legally compliant process, it's essential to follow the District of Columbia Checklist for the sale of a business. This checklist outlines the necessary steps and considerations that a business owner must take when selling their enterprise in the D.C. area. 1. Business Valuation: Prior to listing a business for sale, owners should determine its fair market value using industry-standard valuation methods. This will help set an appropriate asking price and attract potential buyers. 2. Tax Obligations: Business owners need to understand their tax obligations during the sale process. This includes ensuring compliance with District of Columbia sales and use tax, business income tax, and any applicable federal taxes. 3. Contract Preparation: Engaging a qualified attorney is essential to draft a comprehensive and legally binding sales agreement. The contract should include all relevant terms, such as purchase price, payment terms, assets included in the sale, non-compete clauses, and any contingencies. 4. Due Diligence: Buyers will conduct thorough due diligence to assess the business's financial and legal aspects. Sellers should be prepared to provide accurate financial statements, tax records, lease agreements, licensing and permits, employee contracts, and any outstanding liens or legal issues. 5. Licenses and Permits: Both the buyer and seller must comply with the District of Columbia's licensing and permit requirements. Sellers should transfer any necessary licenses to the buyer and cancel their own licenses once the sale is complete. 6. Lease Agreements: If the business operates from leased premises, the landlord's consent may be required for the transfer of lease. Sellers should review their lease agreement to identify any provisions related to sale or assignment of the lease. 7. Employee Considerations: Sellers must ensure compliance with employment laws during the sale process, such as providing required notices to employees and complying with wage and hour regulations. Buyers may choose to retain existing employees, and sellers should consider issuing non-disclosure agreements to protect sensitive business information. 8. Succession Planning: It's crucial for business owners to plan for succession and inform key employees or business partners of their intentions to sell. This helps maintain stability and ensures a smooth transition for the buyer. Different types of District of Columbia Checklist — Sale of a Business may include: 1. Restaurant Sale Checklist: This checklist would include additional considerations related to the specific regulations and requirements for selling a restaurant in the District of Columbia. It may cover topics like health inspections, food permits, liquor licenses, and compliance with food safety regulations. 2. Retail Business Sale Checklist: This checklist would focus on the unique aspects of selling a retail business in the District of Columbia. It may include considerations related to inventory management, point-of-sale systems, product warranties, and transfer of customer contracts. 3. Professional Service Business Sale Checklist: This checklist would address the particularities of selling a professional service business, such as law firms, accounting practices, or consulting companies. It may cover topics like client confidentiality, transfer of client files, and non-compete agreements for key personnel. By following the District of Columbia Checklist for the sale of a business and considering any specialized checklists specific to a particular industry, sellers in D.C. can navigate the sale process more efficiently and ensure compliance with all relevant legal and regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Lista de Verificación - Venta de un Negocio - Checklist - Sale of a Business

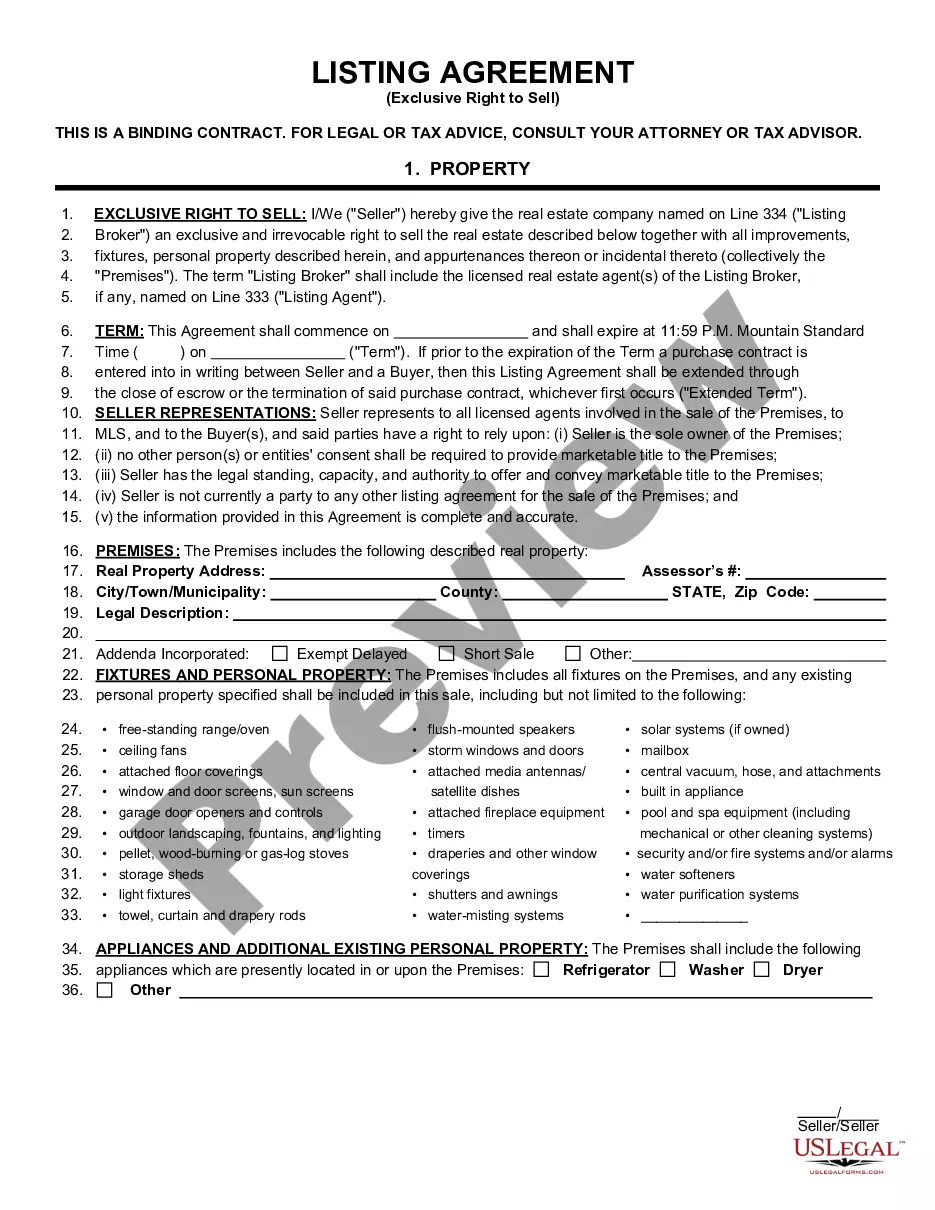

Description

How to fill out District Of Columbia Lista De Verificación - Venta De Un Negocio?

If you wish to complete, download, or print authorized document themes, use US Legal Forms, the largest assortment of authorized kinds, which can be found on the web. Utilize the site`s simple and practical research to find the papers you require. Various themes for organization and personal functions are categorized by classes and states, or key phrases. Use US Legal Forms to find the District of Columbia Checklist - Sale of a Business in a handful of click throughs.

When you are presently a US Legal Forms buyer, log in to the accounts and click on the Down load option to have the District of Columbia Checklist - Sale of a Business. You can also access kinds you earlier downloaded inside the My Forms tab of your own accounts.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the form for that correct town/region.

- Step 2. Take advantage of the Preview solution to examine the form`s content material. Never forget about to see the description.

- Step 3. When you are unsatisfied using the form, make use of the Look for industry on top of the display to locate other models of the authorized form design.

- Step 4. When you have located the form you require, click on the Acquire now option. Opt for the pricing plan you choose and put your accreditations to sign up for an accounts.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Pick the file format of the authorized form and download it on your system.

- Step 7. Total, modify and print or indication the District of Columbia Checklist - Sale of a Business.

Every authorized document design you acquire is your own property for a long time. You may have acces to each form you downloaded with your acccount. Click the My Forms section and select a form to print or download once more.

Be competitive and download, and print the District of Columbia Checklist - Sale of a Business with US Legal Forms. There are millions of skilled and condition-particular kinds you can use for the organization or personal demands.