A District of Columbia lease agreement between two nonprofit church corporations is a legally binding document that outlines the terms and conditions of the rental agreement between two nonprofit organizations that are operating as church corporations in the District of Columbia. This lease agreement is specific to the District of Columbia and is tailored to accommodate the unique needs and requirements of nonprofit church corporations in the region. The lease agreement typically includes the following key elements: 1. Parties involved: The agreement will clearly identify the two nonprofit church corporations entering into the lease agreement, including their legal names, addresses, and other relevant contact details. 2. Term of the lease: The lease agreement will specify the duration of the lease, including the start and end dates. This ensures that both parties are aware of the timeframe for which the property is being leased. 3. Property description: The agreement will provide a detailed description of the property being leased, including the full address, size, and any specific areas or utilities that are included in the lease. 4. Lease terms and conditions: This section outlines the specific terms and conditions of the lease, including rental payments, security deposits, utility responsibilities, allowable uses of the property, restrictions, and any maintenance obligations. 5. Rent and payment structure: The lease agreement will lay out the agreed-upon rental amount, payment frequency (monthly, quarterly, etc.), and the preferred method of payment (check, electronic transfer, etc.). It may also mention any allowable rental increases and the consequences for late payments. 6. Maintenance and repairs: This section defines the responsibilities of both parties regarding property maintenance and repairs. It may specify whether the landlord or the tenant is responsible for different aspects, such as routine maintenance, structural repairs, or utility repairs. 7. Insurance and liability: The lease will typically outline the insurance requirements for both parties, including general liability insurance coverage. It may also establish indemnification clauses, holding both parties liable for their actions or negligence. 8. Termination clauses: The lease agreement outlines the conditions under which either party can terminate the lease, including default, non-compliance with terms, or mutual agreement. It may specify notice periods required to initiate termination and any potential penalties. 9. Subleasing and assignment: This part addresses whether the tenant is allowed to sublease the property or assign the lease to another party and the process to obtain consent from the landlord, if applicable. 10. Governing law: The lease agreement will state that it is governed by the laws of the District of Columbia, ensuring that any legal disputes will be resolved according to the jurisdiction's laws. Different types of District of Columbia Lease Agreements Between Two Nonprofit Church Corporations may include variations based on the specific needs and preferences of the parties. These variations could include additional provisions such as parking restrictions, quiet hours, property modifications, or specific permitted uses for religious activities. The specific terms and conditions can be customized through negotiation between the parties to suit their unique circumstances and requirements.

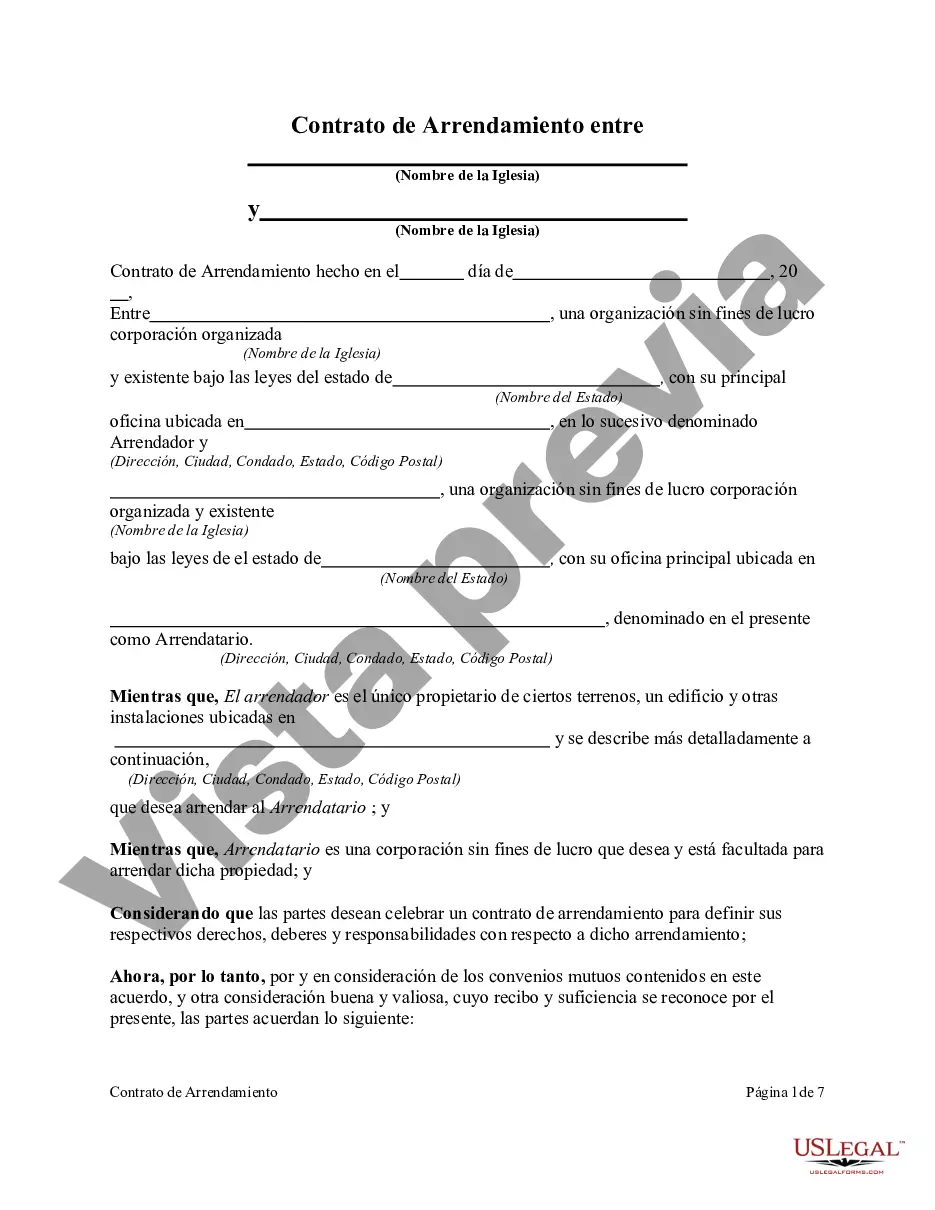

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out District Of Columbia Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

US Legal Forms - one of the most significant libraries of legitimate kinds in America - provides an array of legitimate papers web templates you may down load or print out. Utilizing the site, you can find a huge number of kinds for business and person uses, sorted by groups, claims, or search phrases.You can find the most recent variations of kinds much like the District of Columbia Lease Agreement Between Two Nonprofit Church Corporations within minutes.

If you currently have a subscription, log in and down load District of Columbia Lease Agreement Between Two Nonprofit Church Corporations from your US Legal Forms collection. The Download switch will show up on each and every form you view. You gain access to all in the past downloaded kinds from the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, allow me to share straightforward recommendations to help you started out:

- Be sure to have picked out the best form for your town/county. Go through the Review switch to analyze the form`s information. Read the form information to actually have chosen the right form.

- In case the form does not match your requirements, take advantage of the Look for area towards the top of the display screen to discover the one who does.

- Should you be pleased with the form, affirm your option by simply clicking the Purchase now switch. Then, select the costs program you want and provide your credentials to sign up for an bank account.

- Procedure the financial transaction. Make use of your credit card or PayPal bank account to accomplish the financial transaction.

- Pick the format and down load the form on your system.

- Make alterations. Fill up, revise and print out and sign the downloaded District of Columbia Lease Agreement Between Two Nonprofit Church Corporations.

Each and every format you included in your money lacks an expiry particular date and is yours eternally. So, if you want to down load or print out another copy, just proceed to the My Forms area and click on on the form you need.

Gain access to the District of Columbia Lease Agreement Between Two Nonprofit Church Corporations with US Legal Forms, the most substantial collection of legitimate papers web templates. Use a huge number of professional and express-particular web templates that satisfy your small business or person demands and requirements.