The District of Columbia Debt Adjustment Agreement with Creditor is a legal arrangement that aims to help individuals or businesses residing in the District of Columbia manage their debts effectively. This agreement is designed to provide debtors with an opportunity to negotiate new terms with their creditors, in order to make their debt repayments more manageable and avoid bankruptcy. One type of District of Columbia Debt Adjustment Agreement with a Creditor is known as a Debt Management Plan (DMP). This plan involves working with a certified credit counseling agency, which will negotiate with creditors on your behalf. They will help create a revised payment plan that takes into account your financial situation and allows you to make affordable monthly payments towards your debts. The DMP also involves stopping additional interest charges on your debts and potentially negotiating for reduced interest rates. Another type of Debt Adjustment Agreement specific to the District of Columbia is a Debt Settlement Agreement (DSA). In this arrangement, negotiations are made directly with the creditors to settle the debts for less than the total owed amount. Debt settlement can be a viable option for debtors facing financial hardship, as it allows for potentially significant reductions in the overall debt amount. However, it is important to note that debt settlement can have a negative impact on your credit score and may have tax implications. To initiate a District of Columbia Debt Adjustment Agreement with a Creditor, debtors must generally contact a reputable credit counseling agency or debt settlement company. Upon enrolling in a program, the agency will assess your financial situation, create a budget, and negotiate with your creditors to establish revised payment terms. The arrangement is usually aimed at unsecured debts, such as credit cards, personal loans, and medical bills. It is crucial to carefully review and understand the terms of the Debt Adjustment Agreement before committing to it. Debtors should ensure that they can realistically meet the revised payment obligations and should be aware of any potential fees or costs associated with the program. Additionally, it is essential to choose a reputable credit counseling agency or debt settlement company that is licensed and accredited to ensure proper guidance throughout the process. In conclusion, a District of Columbia Debt Adjustment Agreement with a Creditor provides individuals and businesses with a structured approach to managing their debts. Whether through a Debt Management Plan or a Debt Settlement Agreement, debtors can strive to achieve more manageable and sustainable repayment terms, helping them regain control of their financial situation.

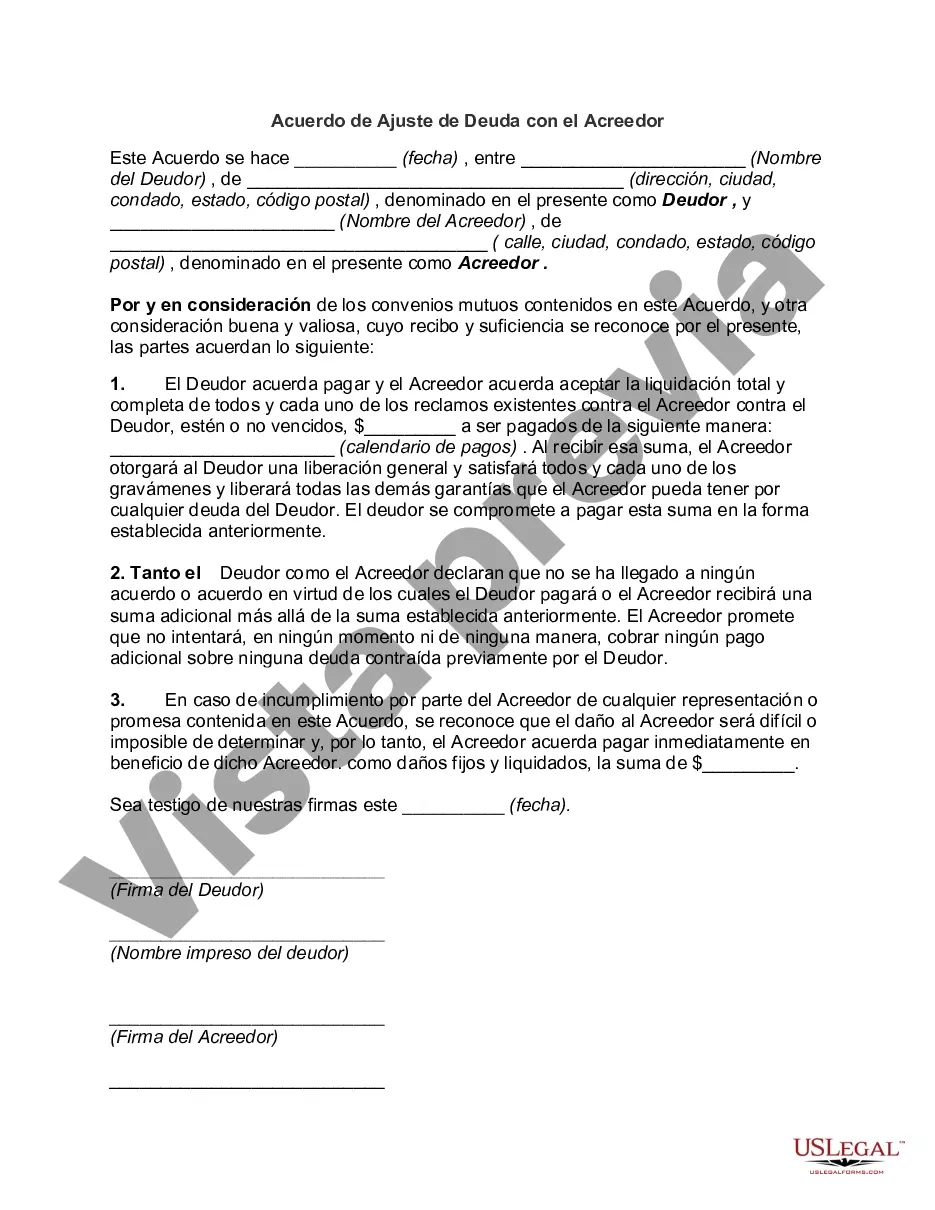

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out District Of Columbia Acuerdo De Ajuste De Deuda Con El Acreedor?

If you wish to total, down load, or produce legal papers layouts, use US Legal Forms, the largest assortment of legal forms, that can be found on the web. Use the site`s simple and practical research to obtain the paperwork you will need. Various layouts for company and individual reasons are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the District of Columbia Debt Adjustment Agreement with Creditor within a couple of click throughs.

If you are already a US Legal Forms buyer, log in for your accounts and click the Download key to find the District of Columbia Debt Adjustment Agreement with Creditor. You can even entry forms you formerly delivered electronically in the My Forms tab of your own accounts.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for the correct metropolis/country.

- Step 2. Make use of the Preview option to check out the form`s information. Don`t neglect to learn the explanation.

- Step 3. If you are not satisfied with the develop, utilize the Search area towards the top of the screen to locate other models from the legal develop web template.

- Step 4. After you have discovered the shape you will need, go through the Buy now key. Select the pricing plan you like and add your references to register for an accounts.

- Step 5. Method the transaction. You can use your charge card or PayPal accounts to perform the transaction.

- Step 6. Pick the format from the legal develop and down load it on the device.

- Step 7. Complete, revise and produce or indication the District of Columbia Debt Adjustment Agreement with Creditor.

Every single legal papers web template you get is the one you have eternally. You have acces to each develop you delivered electronically in your acccount. Click the My Forms area and choose a develop to produce or down load once more.

Compete and down load, and produce the District of Columbia Debt Adjustment Agreement with Creditor with US Legal Forms. There are many skilled and status-specific forms you can utilize to your company or individual needs.