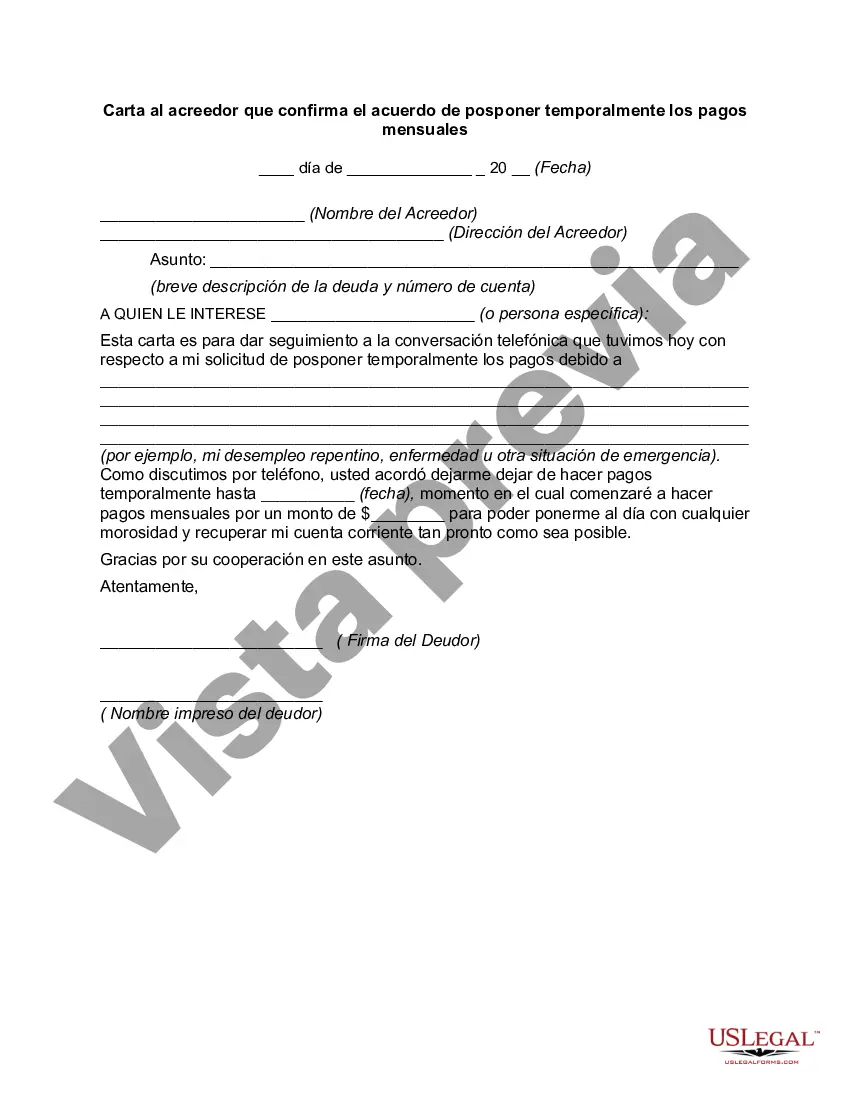

Title: District of Columbia Letter to Creditor Confirming Agreement for Temporary Postponement of Monthly Payments Keywords: District of Columbia, Letter to Creditor, Confirming Agreement, Monthly Payments, Temporarily Postponed Introduction: In the District of Columbia, individuals and businesses dealing with adverse financial situations may find themselves unable to meet their monthly financial obligations. In such cases, a formal communication with the creditor is required to notify them of the situation and seek a temporary postponement of monthly payments. This article aims to provide a detailed description of a District of Columbia Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Types of District of Columbia Letters to Creditors Confirming Postponement Agreements: 1. Personal Letter to Creditor: The personal letter is employed by individuals facing financial difficulties where they explicitly request their creditor for a temporary relief from making monthly payments. Such letters usually provide relevant details about the financial hardship faced, along with supporting documentation if needed. 2. Business Letter to Creditor: Businesses facing financial challenges or economic downturns may utilize a specific letter template to notify their creditors about the need for a temporary suspension of monthly payment obligations. These letters should outline the impact on the business, including financial statements if available, to support the request. 3. District of Columbia Legal Requirement Template: The District of Columbia may enforce specific templates or formats for letters to creditors seeking temporary postponement of monthly payments. These templates ensure compliance with local legislation and provide a standardized approach for communication between debtors and creditors. Key Elements to Include in a District of Columbia Letter to Creditor Confirming Agreement: 1. Date: The letter should begin with the date of writing to document the correspondence. 2. Recipient Information: Include the name, title, company, and address of the creditor to whom the letter is addressed. 3. Subject Line: Clearly state the purpose of the letter with a concise subject line that highlights the request for a temporary suspension of monthly payments. 4. Debtor Information: Provide your personal or business details, including name, contact information, and any relevant account or reference numbers. 5. Reason for Financial Hardship: Offer a detailed explanation of the financial challenges currently faced, including any unexpected circumstances such as job loss, medical emergencies, or natural disasters. Attach supporting documents, such as termination letters, medical bills, or insurance claim reports, if applicable. 6. Request for Temporary Postpone of Payments: Clearly express the request to suspend monthly payments temporarily due to the financial difficulties described. Specify the period for which the suspension is sought, such as three months or until the situation improves, demonstrating a commitment to fulfill the outstanding debt. 7. Commitment to Communication: Assure the creditor that you will maintain open lines of communication during the agreed-upon postponement period, providing updates if necessary and outlining plans for future payment arrangements. 8. Gratitude and Closing: Conclude the letter by expressing gratitude for their understanding and support during this challenging time. Sign the letter with your name and title (if applicable). Conclusion: Addressing financial difficulties responsibly requires open communication between debtors and creditors. A District of Columbia Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed enables individuals and businesses to seek temporary respite. By following a well-structured letter format and adhering to legal requirements, debtors can strengthen their case for a successful outcome.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out District Of Columbia Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

It is possible to commit hrs on-line trying to find the lawful file design that suits the state and federal demands you need. US Legal Forms supplies a large number of lawful kinds which are evaluated by professionals. You can actually download or print the District of Columbia Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed from your services.

If you already possess a US Legal Forms accounts, you can log in and then click the Obtain button. Following that, you can total, edit, print, or signal the District of Columbia Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Each lawful file design you buy is your own property for a long time. To obtain an additional copy of any bought develop, proceed to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site the first time, keep to the easy recommendations beneath:

- First, make sure that you have chosen the proper file design to the region/city of your choosing. Look at the develop description to make sure you have chosen the appropriate develop. If readily available, take advantage of the Preview button to appear from the file design as well.

- If you wish to locate an additional version in the develop, take advantage of the Research discipline to obtain the design that fits your needs and demands.

- After you have discovered the design you desire, just click Acquire now to move forward.

- Pick the rates strategy you desire, type in your credentials, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can use your charge card or PayPal accounts to purchase the lawful develop.

- Pick the structure in the file and download it to your system.

- Make adjustments to your file if required. It is possible to total, edit and signal and print District of Columbia Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Obtain and print a large number of file templates making use of the US Legal Forms web site, which provides the largest variety of lawful kinds. Use professional and status-particular templates to tackle your business or individual needs.