Subject: Request for Lower Interest Rate for a Certain Period of Time — District of Columbia Dear [Credit Card Company's Name], I hope this letter finds you well. I am writing to request a reduction in the interest rate on my credit card account for a specific period of time. As a resident of the District of Columbia, I am aware of my rights as a consumer and believe that I am eligible for a lower interest rate based on my financial circumstances and creditworthiness. First and foremost, I want to emphasize my commitment to fulfilling my financial obligations and maintaining a responsible credit history. Unfortunately, due to unexpected circumstances such as [briefly explain the reasons behind your request, e.g., sudden medical expenses or temporary reduction in income], I find it difficult to manage my current card balances under the current interest rate. As you may be aware, the District of Columbia has certain provisions in place to protect consumers like myself. These regulations aim to ensure that credit card companies are fair and transparent when dealing with cardholders. In light of these provisions, I kindly request your assistance in reducing the interest rate on my credit card account. By granting a lower interest rate, even for a specific period, you would enable me to make consistent payments and significantly contribute to clearing my outstanding balance. This gesture would greatly alleviate my financial situation and reduce the stress associated with managing my credit card debt. I understand that every request must be evaluated based on individual circumstances and risk assessment. To support my request, I would like to provide some information that showcases my commitment to responsible credit usage and my ability to fulfill my obligations promptly: 1. Current Financial Stability: — Provide an overview of your current financial situation (e.g., stable employment, consistent income, and other relevant sources of income). — Mention any savings, investments, or other financial assets that contribute to your overall stability. 2. Responsible Credit History: — Mention your history of timely payment or any improvements made in managing your credit obligations. — Highlight any positive credit-related activities, such as a good credit score or other successful credit relationships. 3. Comparative Market Research: — Share any research you have conducted to compare your current interest rate with that of other credit card companies or the prevailing interest rates in the market. This will emphasize the importance of a rate reduction to remain competitive. I kindly request that you review my account and consider adjusting the interest rate to [state the desired, feasible rate] for a period of [specify the preferred length, e.g., six months]. I believe this change will allow me to make substantial progress towards paying off my balance and demonstrate my ability to responsibly manage my credit card account. Furthermore, I appreciate your time and attention to this matter. Should you require any additional documentation or information to substantiate my request, please let me know, and I will be happy to provide it promptly. I genuinely hope we can come to a mutually beneficial agreement that will help me improve my financial situation while maintaining a positive relationship with your esteemed company. Thank you for considering my request, and I look forward to a favorable response. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Alternative names for similar letters could include: 1. Letter from a District of Columbia Resident Requesting a Temporary Reduction in Credit Card Interest Rate 2. Request for Adjustment of Credit Card Interest Rate — District of Columbia Consumer Letter 3. District of Columbia Consumer's Appeal for Lower Credit Card Interest Rate.

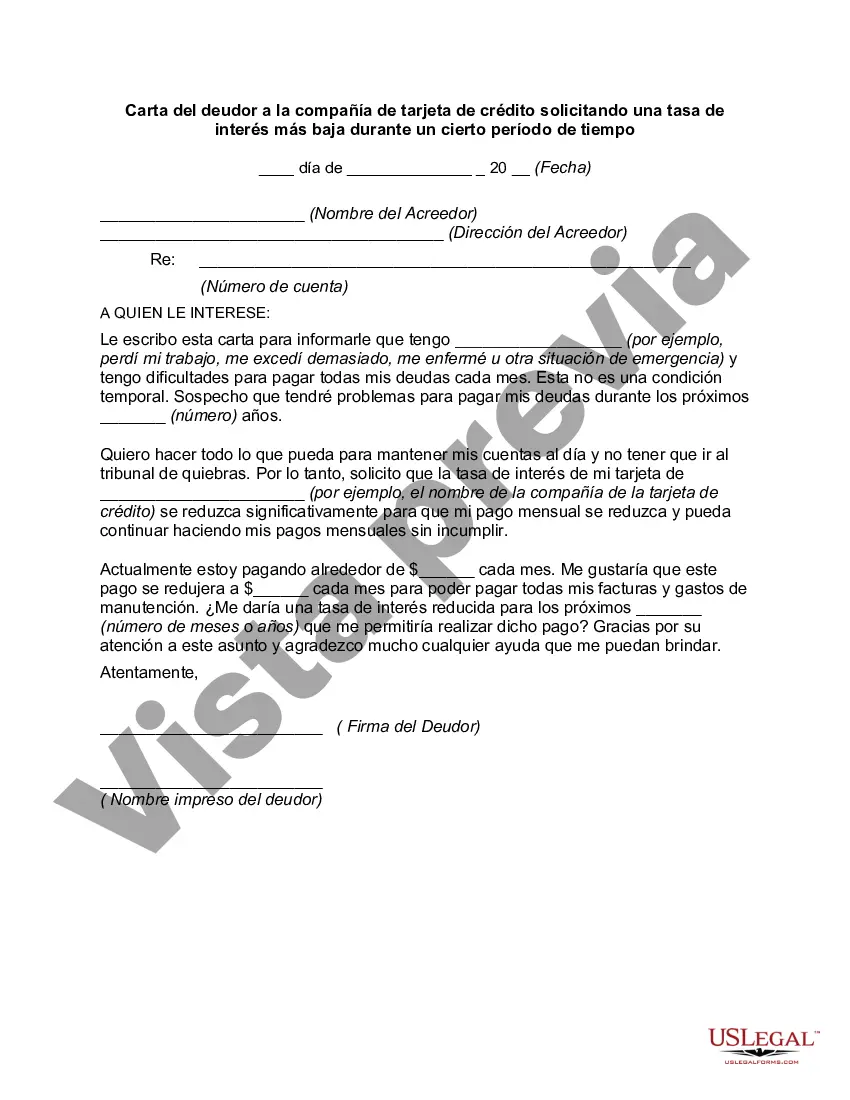

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out District Of Columbia Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

You are able to spend time online trying to find the lawful document template that fits the federal and state needs you require. US Legal Forms gives a huge number of lawful varieties which are evaluated by experts. You can actually obtain or print the District of Columbia Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time from our services.

If you already possess a US Legal Forms account, you can log in and click the Download option. Next, you can comprehensive, edit, print, or sign the District of Columbia Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Every lawful document template you get is yours eternally. To acquire another backup of any obtained develop, visit the My Forms tab and click the corresponding option.

If you use the US Legal Forms internet site for the first time, follow the easy instructions under:

- Initial, make certain you have chosen the proper document template for that region/city that you pick. See the develop information to ensure you have picked out the correct develop. If offered, use the Preview option to appear from the document template at the same time.

- If you want to find another version from the develop, use the Look for area to discover the template that suits you and needs.

- When you have found the template you need, click Acquire now to move forward.

- Select the costs plan you need, key in your qualifications, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal account to fund the lawful develop.

- Select the structure from the document and obtain it to your device.

- Make alterations to your document if needed. You are able to comprehensive, edit and sign and print District of Columbia Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

Download and print a huge number of document web templates making use of the US Legal Forms website, which offers the largest assortment of lawful varieties. Use skilled and condition-certain web templates to take on your organization or specific demands.