The District of Columbia Promissory Note for Commercial Loan Secured by Real Property is a legally binding document that outlines the terms and conditions of a commercial loan secured by real property in the District of Columbia. This note serves as evidence of the borrower's promise to repay the loan amount and any interest accrued according to the terms agreed upon by both parties. Keywords: District of Columbia, promissory note, commercial loan, secured, real property. In the District of Columbia, there are different types of promissory notes for commercial loans secured by real property: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the loan duration. The borrower agrees to repay the loan amount and interest at a consistent rate, ensuring stability and predictability in their repayment schedule. 2. Adjustable-Rate Promissory Note: Unlike fixed-rate notes, an adjustable-rate promissory note allows for changes in the interest rate over time. The interest rate may be linked to an index, and the borrower's repayment amount may fluctuate accordingly, based on changes in the index or other agreed-upon terms. 3. Balloon Promissory Note: A balloon promissory note consists of scheduled payments that are relatively smaller in the initial phase of the loan term, with a large "balloon" payment due at the end. This type of note allows borrowers to have lower monthly payments initially and a lump sum payment at the maturity of the loan. 4. Interest-Only Promissory Note: With an interest-only promissory note, the borrower only pays the interest amount for a specific period, typically at the beginning of the loan term. After this period, the borrower starts repaying both the principal and interest, typically resulting in higher monthly payments. These different types of promissory notes provide borrowers and lenders in the District of Columbia with flexibility in structuring their commercial loans. It is essential for both parties to carefully review and understand the terms of the note before signing, ensuring compliance with applicable laws and regulations in the District of Columbia.

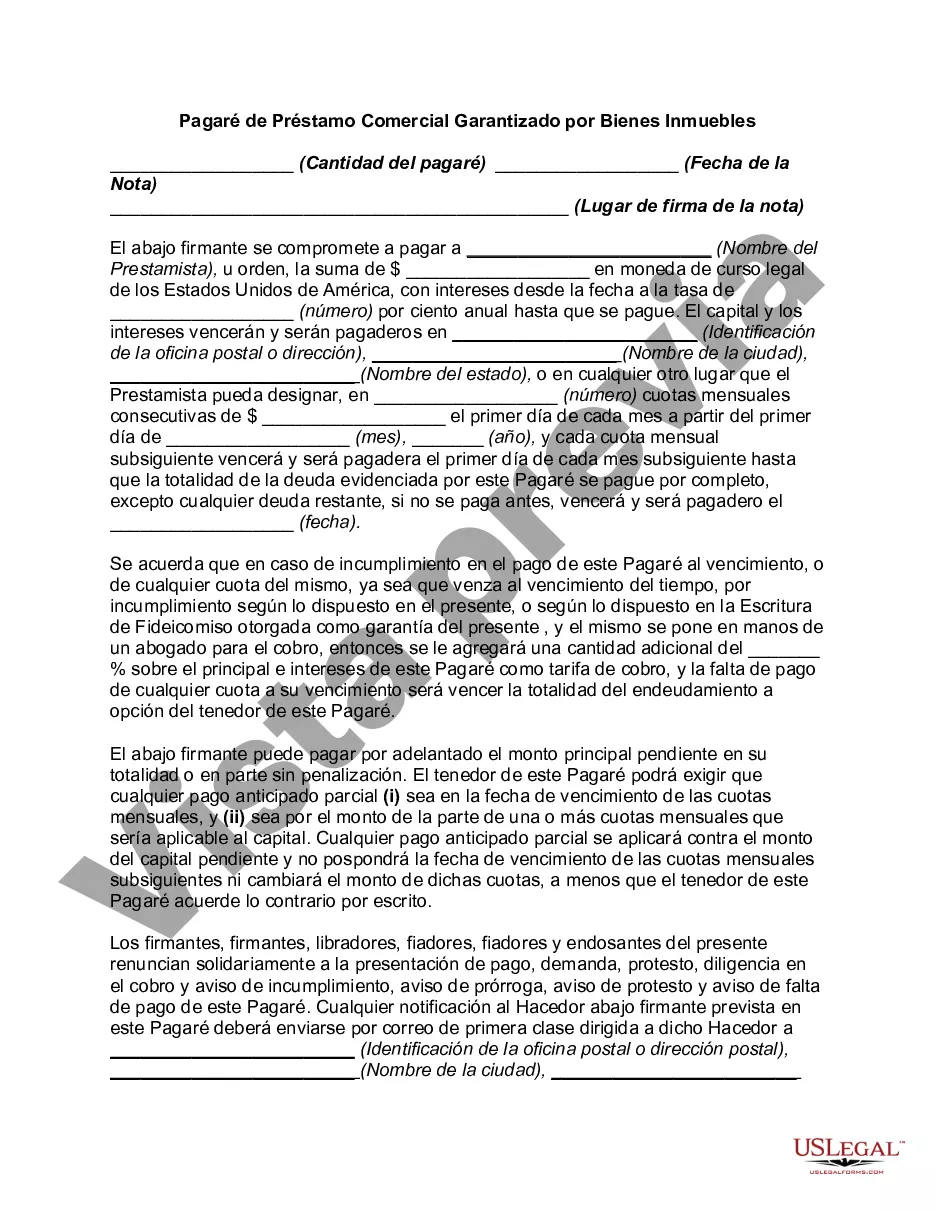

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out District Of Columbia Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

It is possible to devote time on-line searching for the lawful record design which fits the state and federal requirements you require. US Legal Forms supplies a large number of lawful varieties that are evaluated by professionals. It is simple to down load or print out the District of Columbia Promissory Note for Commercial Loan Secured by Real Property from my assistance.

If you already possess a US Legal Forms profile, you may log in and click the Acquire button. Next, you may full, edit, print out, or signal the District of Columbia Promissory Note for Commercial Loan Secured by Real Property. Every single lawful record design you acquire is yours permanently. To obtain one more backup of any bought type, check out the My Forms tab and click the corresponding button.

If you use the US Legal Forms website initially, adhere to the straightforward directions beneath:

- Very first, make certain you have chosen the best record design for the region/metropolis that you pick. Read the type explanation to make sure you have picked the right type. If accessible, make use of the Review button to search with the record design as well.

- If you wish to locate one more edition of your type, make use of the Search area to find the design that fits your needs and requirements.

- After you have located the design you would like, click Purchase now to move forward.

- Find the prices program you would like, key in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal profile to pay for the lawful type.

- Find the structure of your record and down load it to the gadget.

- Make changes to the record if needed. It is possible to full, edit and signal and print out District of Columbia Promissory Note for Commercial Loan Secured by Real Property.

Acquire and print out a large number of record layouts making use of the US Legal Forms site, which offers the largest variety of lawful varieties. Use professional and state-certain layouts to handle your company or specific demands.