The District of Columbia Pot Testamentary Trust is a legal arrangement created to protect and manage assets on behalf of beneficiaries after the death of the testator. This type of trust is established through a will and goes into effect upon the testator's demise. It allows for the consolidation of multiple assets, which are then distributed among different beneficiaries or parties according to the terms specified in the will. One of the different types of District of Columbia Pot Testamentary Trust is the Discretionary Pot Trust. In this variation, the trustee has the discretion to distribute assets to the beneficiaries based on their needs and circumstances. The trustee takes into account various factors such as the beneficiaries' financial situation, education, health, or any other relevant factor when making distribution decisions. Another type is the Fixed Pot Trust, where the testator specifies a fixed share or percentage of the total trust assets to be distributed to each beneficiary. In this case, the trustee does not have discretion and must distribute the assets according to the testator's specific instructions. The District of Columbia Pot Testamentary Trust is a beneficial estate planning tool that allows for flexibility in distributing assets even after the testator's death. It ensures that beneficiaries are provided for and that assets are managed and protected under the guidance of a competent trustee. Important keywords: District of Columbia, Pot Testamentary Trust, legal arrangement, assets, beneficiaries, testator, will, consolidation, distribution, Discretionary Pot Trust, trustee, Fixed Pot Trust, estate planning, flexibility, managed, protected.

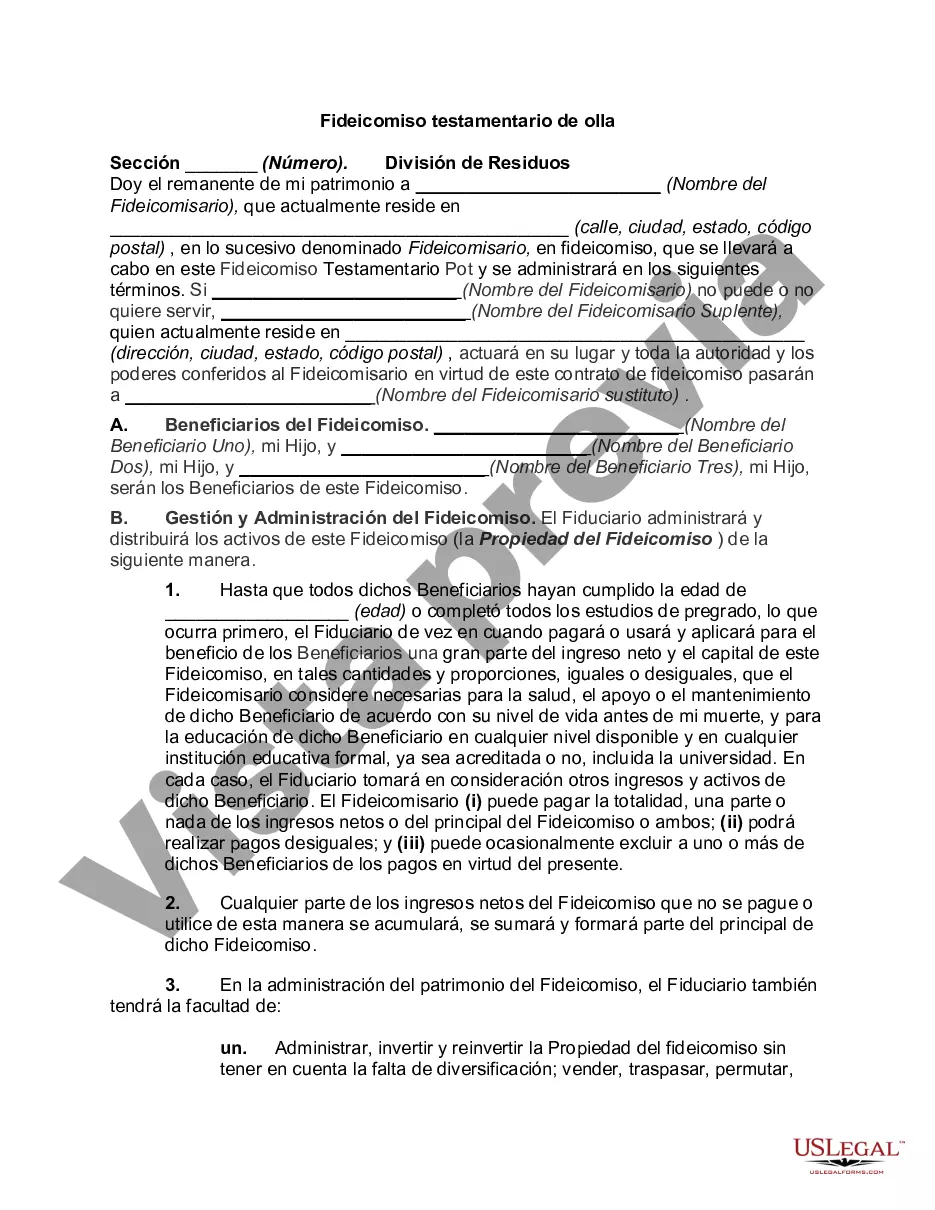

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out District Of Columbia Fideicomiso Testamentario De Olla?

It is possible to devote several hours on-line attempting to find the authorized record web template which fits the state and federal demands you want. US Legal Forms offers thousands of authorized kinds that happen to be analyzed by pros. It is simple to download or print the District of Columbia Pot Testamentary Trust from your service.

If you already have a US Legal Forms accounts, you may log in and then click the Acquire option. After that, you may total, edit, print, or sign the District of Columbia Pot Testamentary Trust. Each and every authorized record web template you get is yours forever. To acquire yet another version of the bought type, check out the My Forms tab and then click the corresponding option.

If you use the US Legal Forms web site initially, stick to the basic instructions beneath:

- Very first, ensure that you have chosen the right record web template to the state/metropolis of your liking. Browse the type explanation to make sure you have selected the correct type. If available, take advantage of the Review option to appear throughout the record web template as well.

- If you wish to locate yet another edition of your type, take advantage of the Lookup industry to find the web template that meets your needs and demands.

- Once you have discovered the web template you need, just click Acquire now to move forward.

- Pick the costs program you need, enter your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal accounts to fund the authorized type.

- Pick the structure of your record and download it in your system.

- Make changes in your record if required. It is possible to total, edit and sign and print District of Columbia Pot Testamentary Trust.

Acquire and print thousands of record web templates making use of the US Legal Forms website, which offers the biggest collection of authorized kinds. Use skilled and state-specific web templates to deal with your organization or individual requires.