The District of Columbia Depreciation Schedule is a crucial document that outlines the systematic allocation of the cost of an asset over its useful life in the District of Columbia, United States. This schedule provides businesses and individuals with a guideline on how to deduct depreciation expenses from their taxable income. By using relevant keywords, we can delve into more specific types of the District of Columbia Depreciation Schedule. 1. Straight-Line Depreciation Method: One common type of depreciation schedule in the District of Columbia is the straight-line method. Under this approach, the cost of an asset is equally distributed over its estimated useful life. This method is relatively simple and widely adopted, enabling businesses to deduct the same amount annually throughout the asset's lifespan. 2. Declining Balance Depreciation Method: The declining balance method is another variant of the District of Columbia Depreciation Schedule. It allows businesses to claim higher depreciation expenses during the earlier years of an asset's life and gradually reduces the deduction amount in subsequent years. This method is especially beneficial when assets tend to lose value more rapidly in their early years. 3. MARS Depreciation Method: In the District of Columbia, businesses can also follow the Modified Accelerated Cost Recovery System (MARS) for their depreciation schedules. This method operates under specific depreciation tables established by the Internal Revenue Service (IRS). It divides assets into different classes, prescribing different recovery periods and depreciation rates for each category. 4. Section 179 Depreciation: The District of Columbia offers an additional depreciation option known as Section 179. This provision allows small businesses to expense the full cost of qualifying assets in the year they are purchased, rather than spreading out deductions over multiple years. Section 179 depreciation can significantly benefit small businesses by accelerating tax savings. 5. Special Depreciation Allowance: Another valuable component of the District of Columbia Depreciation Schedule is the Special Depreciation Allowance. This provision allows businesses to claim an additional bonus deduction for qualifying new assets. This allowance encourages capital investment by letting businesses deduct a percentage of the asset's cost upfront. In summary, the District of Columbia Depreciation Schedule encompasses various methods such as straight-line and declining balance, as well as adherence to MARS regulations. Businesses can also leverage provisions like Section 179 and the Special Depreciation Allowance to maximize tax benefits. It is important to consult with professionals well-versed in tax laws and regulations in the District of Columbia to ensure accurate adherence to the depreciation schedule and optimize tax savings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Programa de depreciación - Depreciation Schedule

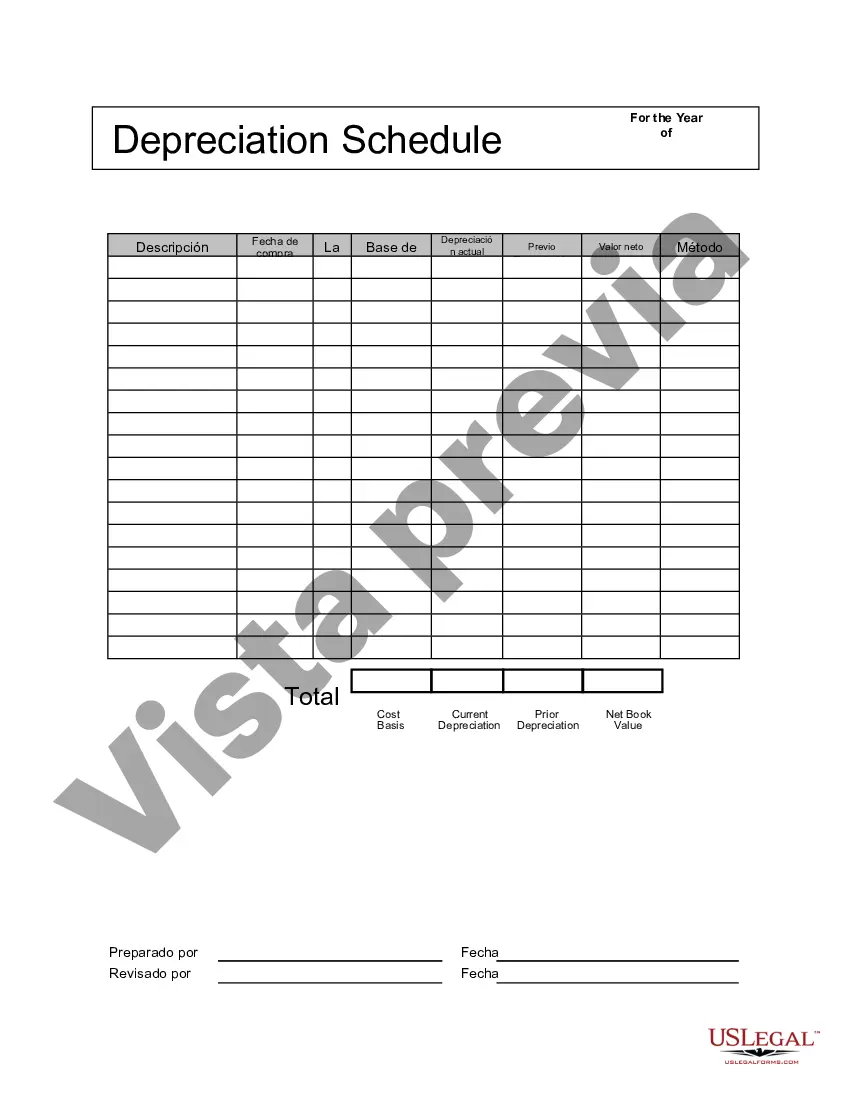

Description

How to fill out District Of Columbia Programa De Depreciación?

If you need to total, acquire, or produce authorized file templates, use US Legal Forms, the biggest selection of authorized varieties, that can be found on the Internet. Take advantage of the site`s simple and easy handy research to discover the papers you will need. Different templates for organization and specific reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to discover the District of Columbia Depreciation Schedule in just a few mouse clicks.

When you are currently a US Legal Forms client, log in to your account and then click the Down load switch to have the District of Columbia Depreciation Schedule. You can even accessibility varieties you in the past downloaded in the My Forms tab of your account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the form to the proper metropolis/land.

- Step 2. Take advantage of the Preview method to look through the form`s content material. Don`t forget about to learn the description.

- Step 3. When you are unhappy with the kind, utilize the Research discipline near the top of the display to get other models of the authorized kind web template.

- Step 4. Upon having located the form you will need, click the Purchase now switch. Choose the rates strategy you favor and put your references to sign up for an account.

- Step 5. Process the financial transaction. You can utilize your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Choose the structure of the authorized kind and acquire it on your system.

- Step 7. Full, edit and produce or indicator the District of Columbia Depreciation Schedule.

Each and every authorized file web template you purchase is yours for a long time. You possess acces to each kind you downloaded in your acccount. Click the My Forms area and decide on a kind to produce or acquire yet again.

Remain competitive and acquire, and produce the District of Columbia Depreciation Schedule with US Legal Forms. There are many skilled and state-distinct varieties you can use for your organization or specific needs.