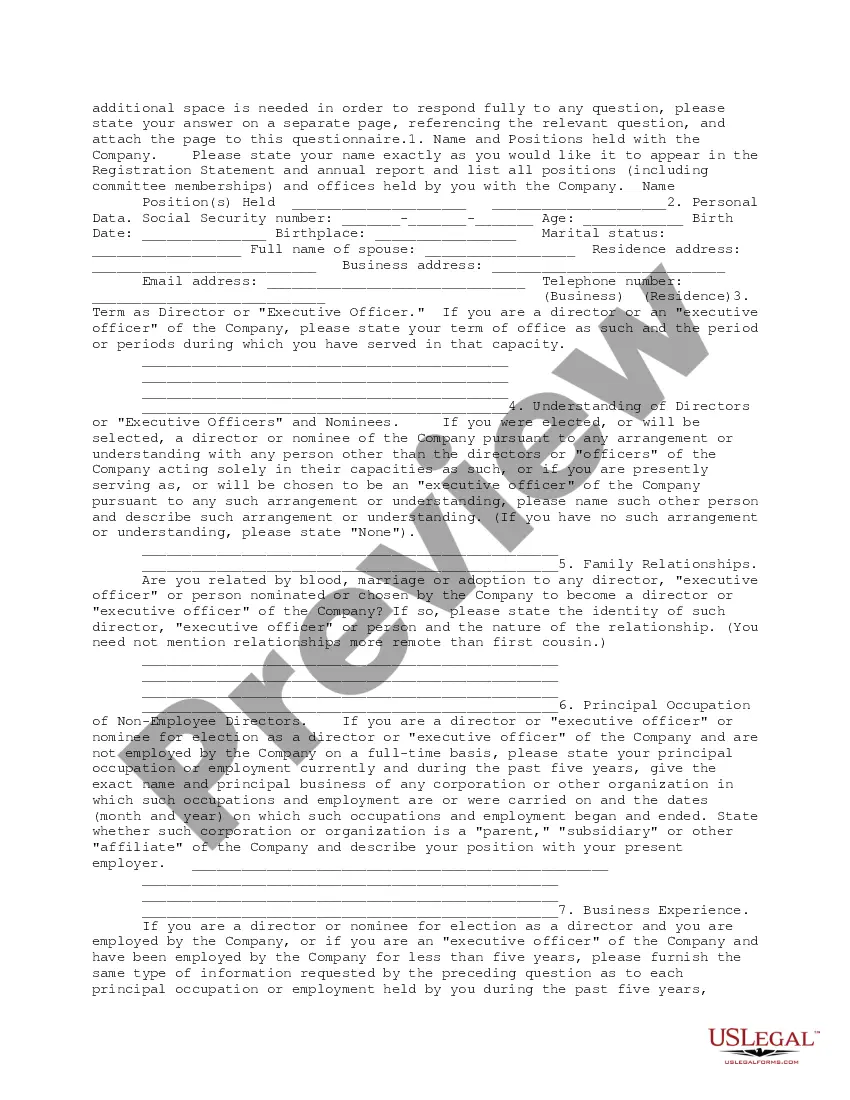

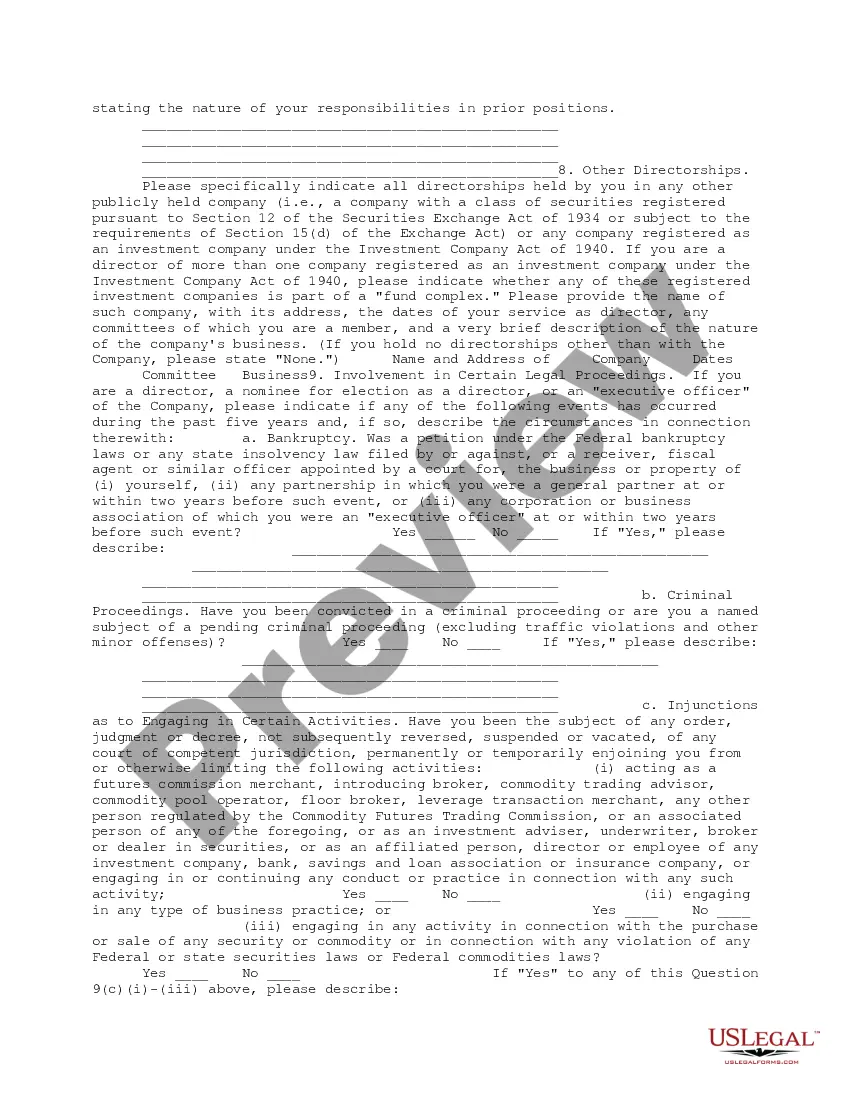

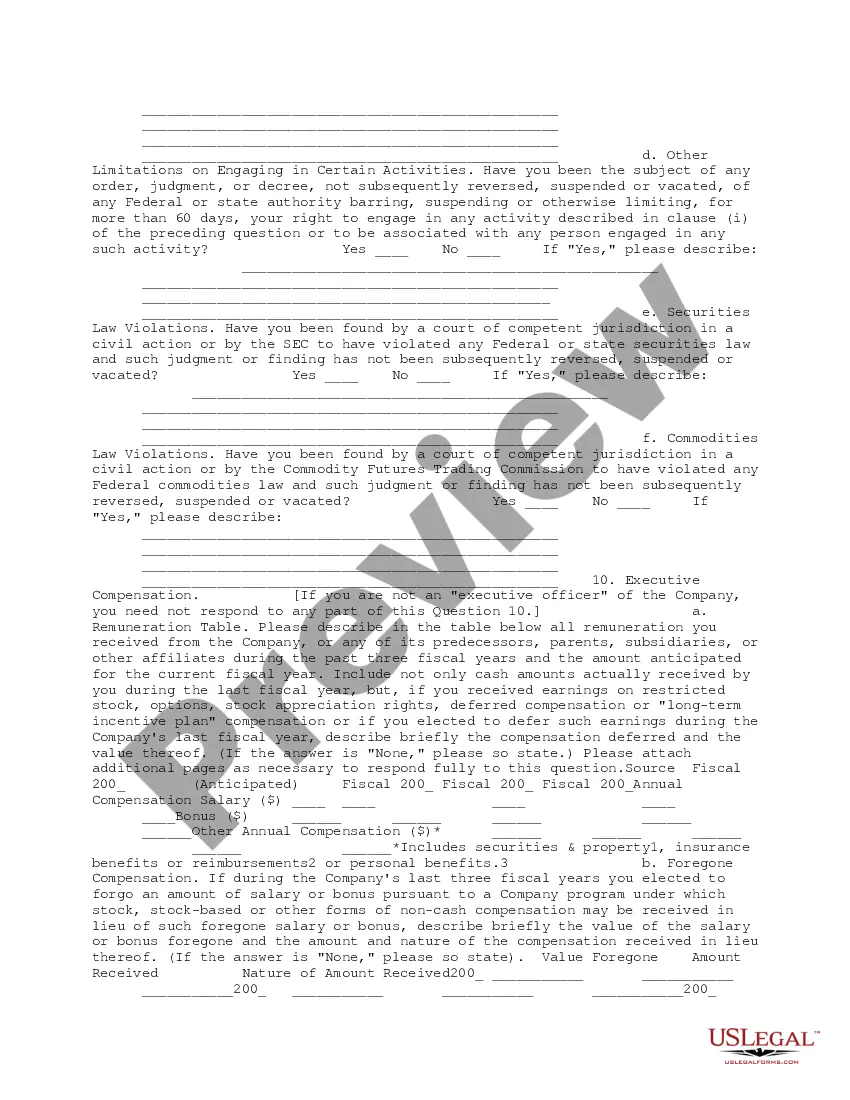

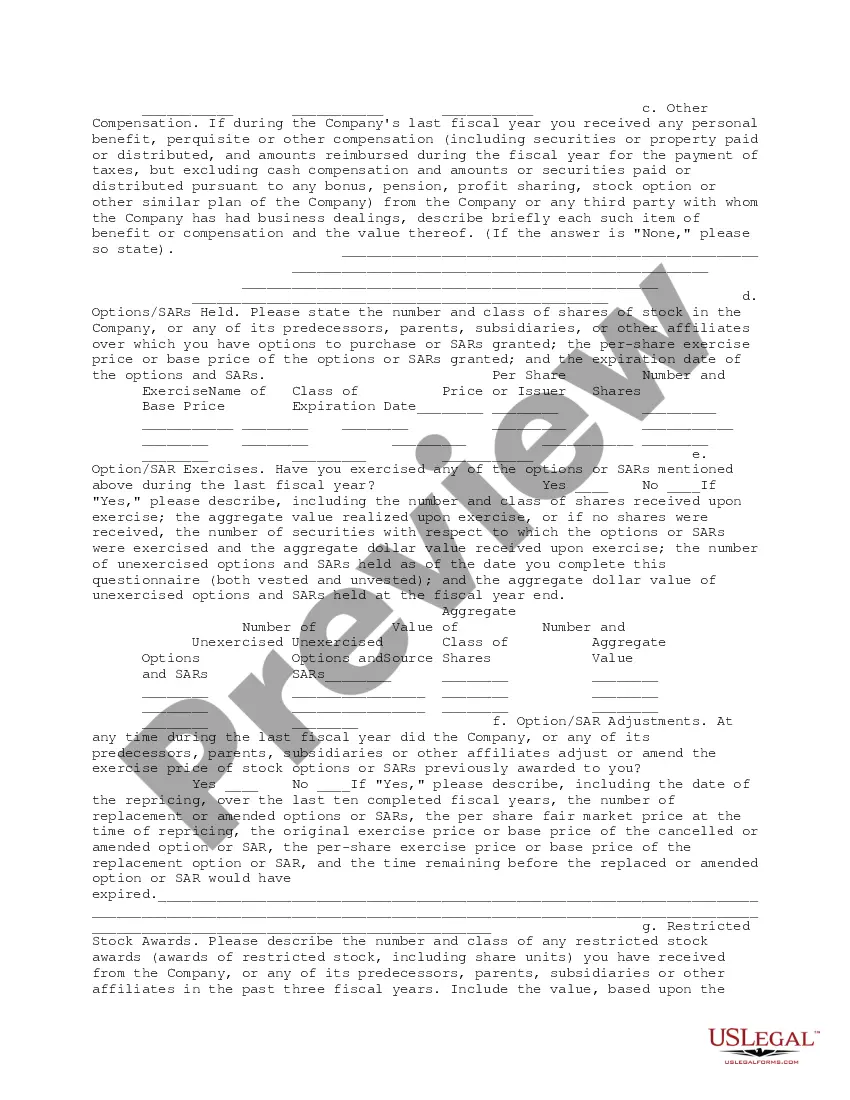

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from directors, officers (and prospective directors and officers) of the company and certain beneficial owners of any class of "voting securities" of the company.

District of Columbia Questionnaire for Directors Officers and Certain Other Individuals Public Offering

Description

How to fill out Questionnaire For Directors Officers And Certain Other Individuals Public Offering?

Discovering the right authorized file template can be a have a problem. Obviously, there are a lot of layouts available online, but how can you discover the authorized kind you require? Make use of the US Legal Forms web site. The service gives 1000s of layouts, for example the District of Columbia Questionnaire for Directors Officers and Certain Other Individuals Public Offering, which you can use for organization and personal needs. All the varieties are checked by specialists and fulfill state and federal demands.

When you are currently authorized, log in in your account and then click the Acquire switch to get the District of Columbia Questionnaire for Directors Officers and Certain Other Individuals Public Offering. Use your account to search from the authorized varieties you possess ordered in the past. Check out the My Forms tab of your own account and obtain an additional version from the file you require.

When you are a whole new user of US Legal Forms, listed here are basic recommendations that you can follow:

- Initially, make sure you have selected the appropriate kind for your personal town/region. You can look through the form using the Preview switch and study the form outline to make sure this is basically the right one for you.

- In the event the kind is not going to fulfill your requirements, make use of the Seach industry to get the appropriate kind.

- When you are certain that the form would work, go through the Purchase now switch to get the kind.

- Choose the pricing plan you want and enter the essential info. Build your account and pay money for an order making use of your PayPal account or Visa or Mastercard.

- Pick the document structure and download the authorized file template in your product.

- Full, change and print out and indication the received District of Columbia Questionnaire for Directors Officers and Certain Other Individuals Public Offering.

US Legal Forms is definitely the largest library of authorized varieties in which you will find numerous file layouts. Make use of the company to download appropriately-produced paperwork that follow status demands.

Form popularity

FAQ

Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as tax-exempt by the IRS does not automatically mean your organization is exempt from local D.C. taxes including income, franchise, sales, use, and personal property taxes.

District Of Columbia has a list of specific excuses that can be used to be exempt from reporting for jury duty, including excuses for military, elected official, student, breastfeeding, age, police, medical worker and firefighter.

Answer ONLY the question that is askeddo NOT include in your answer things that were not asked for. Consider the following question: "Are you involved with any law or justice-focused special interest groups, such as Black Lives Matter, Blue Lives Matter, etc.?"

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

Traditional Goods or Services Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

Washington, D.C., levies income taxes from residents utilizing 5 tax brackets. 4% on the first $10,000 of taxable income. 6% on taxable income between $10,001 and $40,000. 8.5% on taxable income between $60,001 and $350,000.

Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as tax-exempt by the IRS does not automatically mean your organization is exempt from local D.C. taxes including income, franchise, sales, use, and personal property taxes.

You must file a DC return if: You lived in the District of Columbia for 183 days or more during the taxable year, even if your permanent residence was outside the District of Columbia. You were a member of the armed forces and your home of record was the District of Columbia for either part of or the full taxable year.

The District's standard deduction and personal exemption reduce income tax liability by reducing the amount of income that is subject to DC income taxes. The personal exemption is an amount that a tax filer can subtract from their taxable income for themselves and each of their dependents.