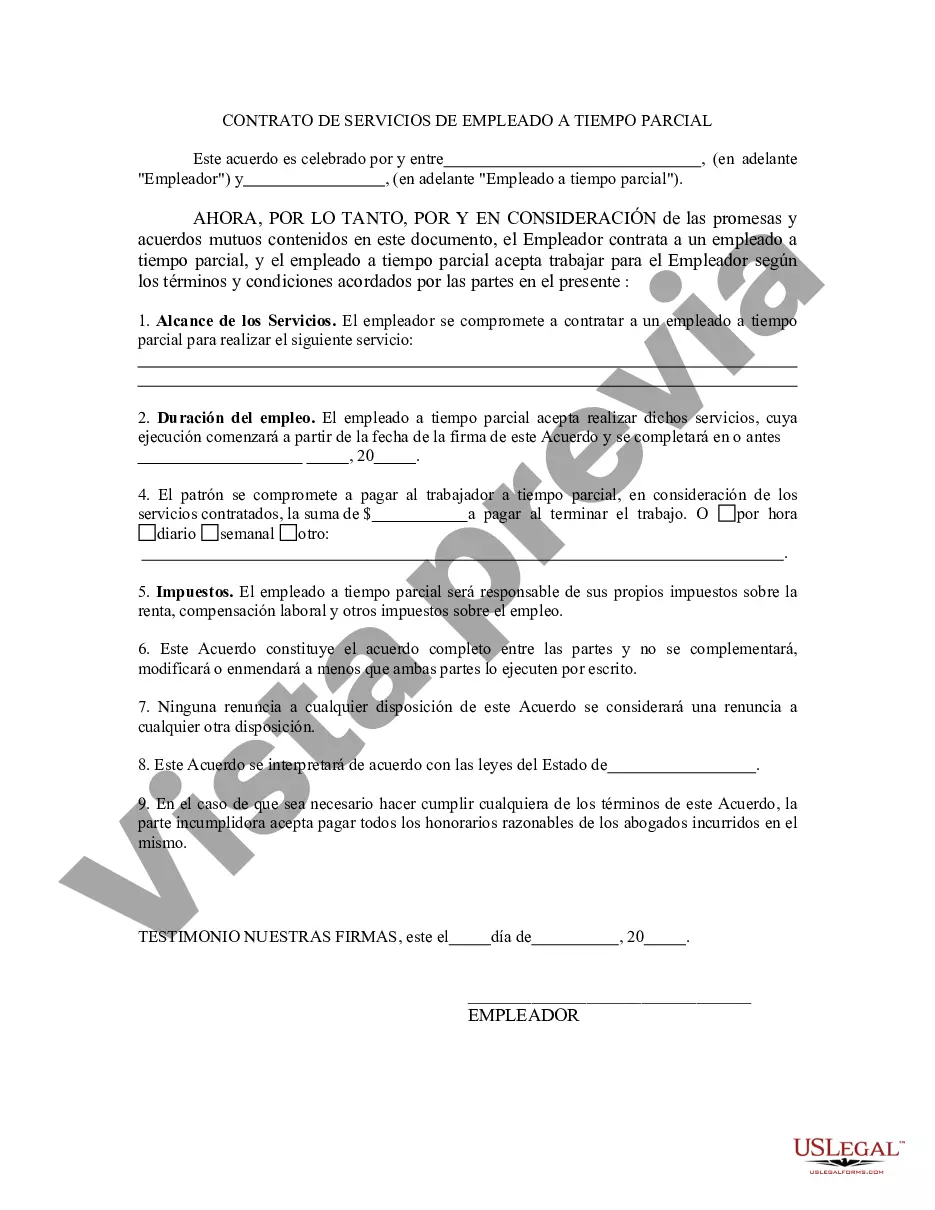

A District of Columbia Self-Employed Part Time Employee Contract is a legal agreement between a self-employed individual and an employer located in the District of Columbia (D.C.) that outlines the rights, obligations, and responsibilities of both parties in a part-time employment arrangement. This contract is designed for individuals who work for an employer on a part-time basis but are considered self-employed rather than regular employees. Keywords: District of Columbia, self-employed, part-time, employee contract, legal agreement, rights, obligations, responsibilities, part-time employment, self-employment. There can be several types of District of Columbia Self-Employed Part Time Employee Contracts, some of which may include: 1. Standard Self-Employed Part Time Employee Contract: This contract includes standard terms and provisions applicable to self-employed part-time employees in the District of Columbia. It outlines the general working arrangements, payment terms, and any additional agreed-upon conditions between the self-employed individual and the employer. 2. Commission-Based Self-Employed Part Time Employee Contract: In this type of contract, a self-employed individual may receive commissions based on their performance or sales. The contract may outline the commission structure, targets, payment frequency, and any specific terms related to the nature of the work. 3. Freelance Self-Employed Part Time Employee Contract: This contract is suitable for self-employed individuals providing freelance services on a part-time basis. It may include details about project scope, deliverables, deadlines, payment terms, and intellectual property rights related to the work provided. 4. Professional Services Self-Employed Part Time Employee Contract: For self-employed professionals, such as lawyers, accountants, or consultants, who offer their services part-time, a professional services contract may be utilized. This type of contract might include provisions specific to the professional services being rendered, confidentiality clauses, liability limitations, and any industry-specific regulations or requirements. It is essential for both the self-employed individual and the employer to thoroughly review and understand the terms and conditions outlined in the District of Columbia Self-Employed Part Time Employee Contract to ensure compliance with D.C. laws and to protect their respective rights and interests. Consulting with an attorney or legal professional specializing in employment law is recommended to ensure the contract accurately reflects the intended employment relationship and is legally enforceable.

A District of Columbia Self-Employed Part Time Employee Contract is a legal agreement between a self-employed individual and an employer located in the District of Columbia (D.C.) that outlines the rights, obligations, and responsibilities of both parties in a part-time employment arrangement. This contract is designed for individuals who work for an employer on a part-time basis but are considered self-employed rather than regular employees. Keywords: District of Columbia, self-employed, part-time, employee contract, legal agreement, rights, obligations, responsibilities, part-time employment, self-employment. There can be several types of District of Columbia Self-Employed Part Time Employee Contracts, some of which may include: 1. Standard Self-Employed Part Time Employee Contract: This contract includes standard terms and provisions applicable to self-employed part-time employees in the District of Columbia. It outlines the general working arrangements, payment terms, and any additional agreed-upon conditions between the self-employed individual and the employer. 2. Commission-Based Self-Employed Part Time Employee Contract: In this type of contract, a self-employed individual may receive commissions based on their performance or sales. The contract may outline the commission structure, targets, payment frequency, and any specific terms related to the nature of the work. 3. Freelance Self-Employed Part Time Employee Contract: This contract is suitable for self-employed individuals providing freelance services on a part-time basis. It may include details about project scope, deliverables, deadlines, payment terms, and intellectual property rights related to the work provided. 4. Professional Services Self-Employed Part Time Employee Contract: For self-employed professionals, such as lawyers, accountants, or consultants, who offer their services part-time, a professional services contract may be utilized. This type of contract might include provisions specific to the professional services being rendered, confidentiality clauses, liability limitations, and any industry-specific regulations or requirements. It is essential for both the self-employed individual and the employer to thoroughly review and understand the terms and conditions outlined in the District of Columbia Self-Employed Part Time Employee Contract to ensure compliance with D.C. laws and to protect their respective rights and interests. Consulting with an attorney or legal professional specializing in employment law is recommended to ensure the contract accurately reflects the intended employment relationship and is legally enforceable.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.