District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor

Description

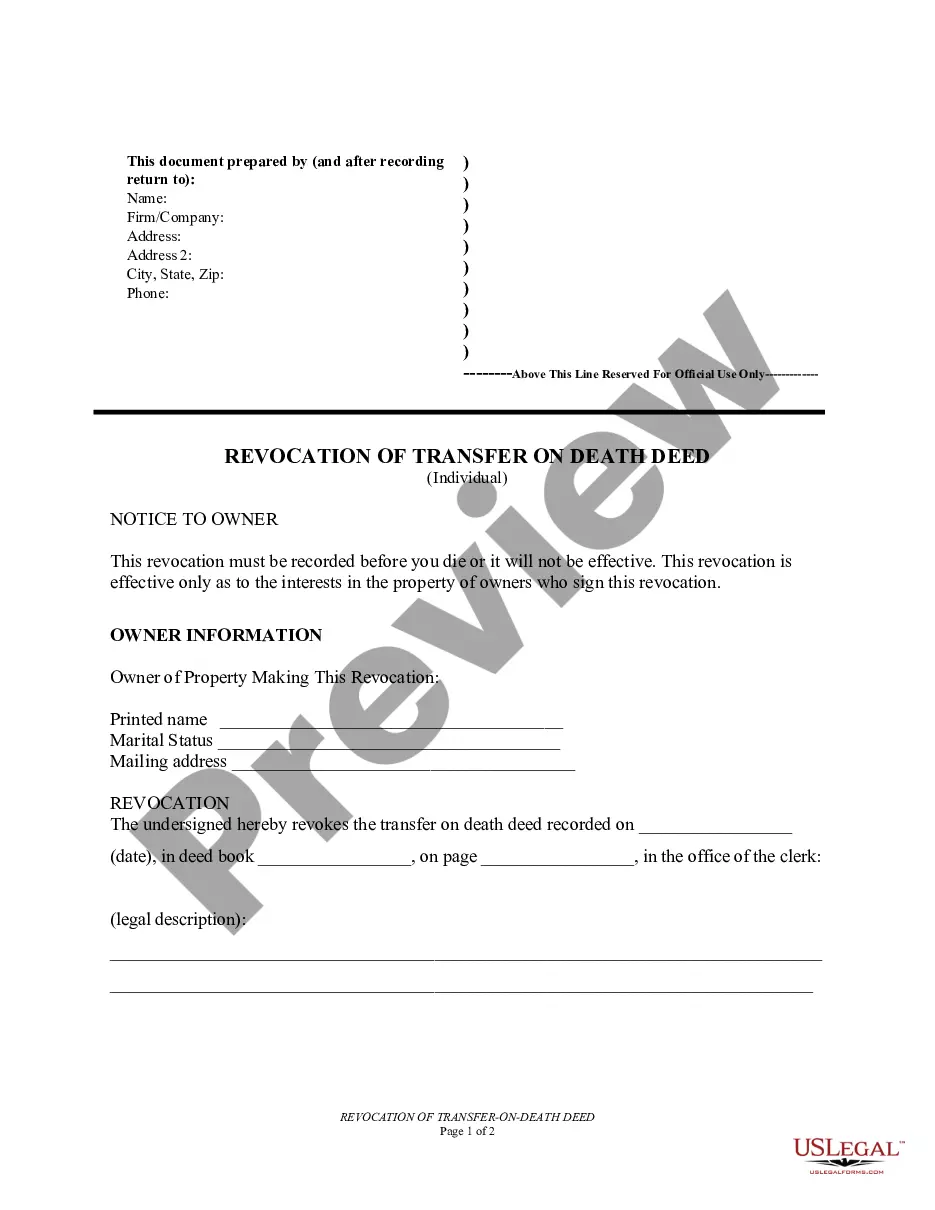

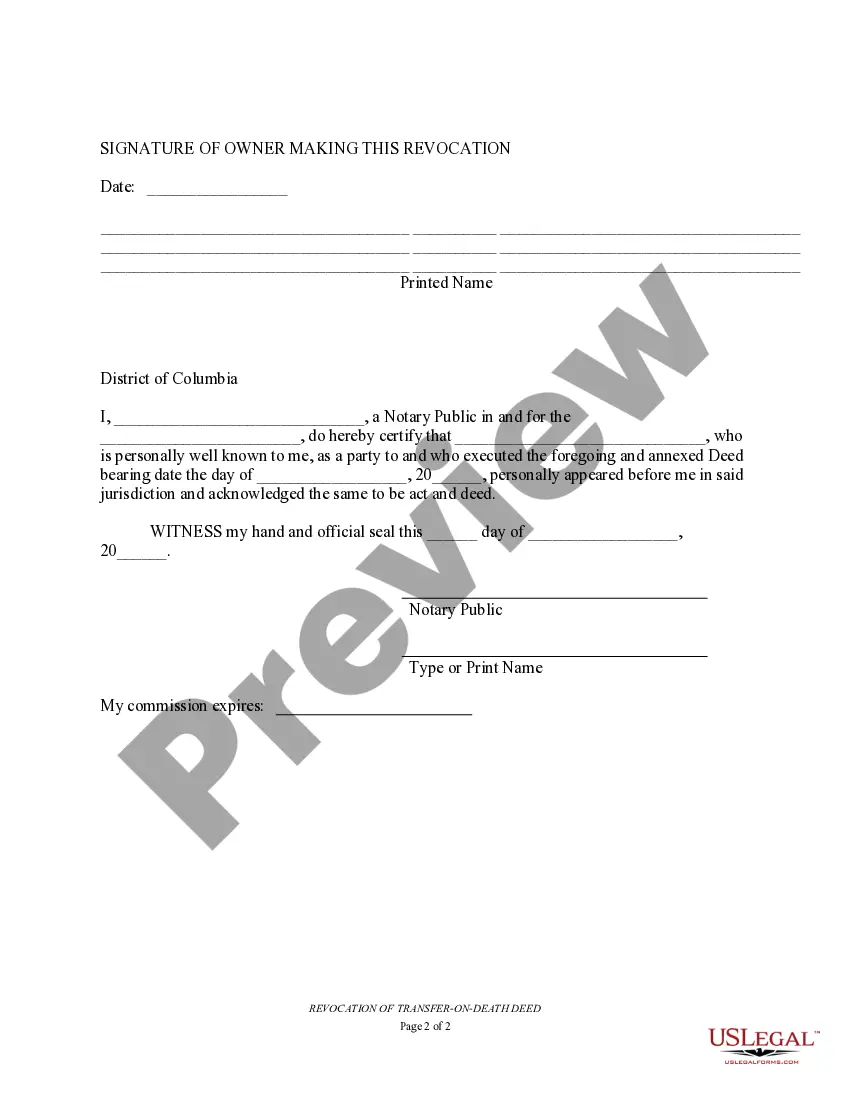

How to fill out District Of Columbia Revocation Of Transfer On Death Deed - Beneficiary Deed For One Grantor?

Use US Legal Forms to obtain a printable District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue on the web and provides affordable and accurate samples for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and a few of them might be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the tips below to easily find and download District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor:

- Check to make sure you get the proper form with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor. Above three million users already have utilized our platform successfully. Choose your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

A beneficiary deed generally does not serve as proof of ownership during the grantor's lifetime, but it operates to transfer ownership automatically upon the grantor's death. This means that while the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor outlines the intended transfer of property, the property remains under the grantor’s control until their passing. Therefore, it's crucial to understand that the deed does facilitate transfer but does not convey ownership rights until that time. If you're navigating this process, consider using US Legal Forms to find the right resources and documentation for your situation.

While a transfer on death deed offers many advantages, there are notable disadvantages as well. It may limit your control over the property as the beneficiaries become owners after your passing. Additionally, creditors can still make claims against the property, potentially affecting your beneficiaries. It is crucial to weigh these factors and consider how a District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor fits into your overall estate plan.

In the District of Columbia, a transfer on death deed does not avoid inheritance tax. However, it effectively allows you to transfer property outside of the probate process, which can simplify the overall transfer of assets. While this method streamlines ownership transition, it’s wise to consult a legal expert regarding tax obligations associated with inherited property.

Filling out a transfer on death affidavit requires clear information about the property and the named beneficiaries. You need to provide details such as the property address, the names of the beneficiaries, and your identification information. It's recommended to consult legal resources or use platforms like USLegalForms to find structured templates that guide you through this process.

A transfer on death deed does not directly avoid capital gains tax. When a beneficiary inherits property through a District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor, they assume the property's basis for tax purposes. This means any capital gains tax will be assessed on the property’s appreciation from the time of inheritance. Therefore, individuals should consult with a tax advisor to better understand any implications.

Yes, the District of Columbia permits the use of transfer on death deeds. This legal tool allows individuals to designate beneficiaries who will receive property upon their passing. You can easily initiate this process by following specific guidelines laid out by the local laws. Utilizing forms from USLegalForms can simplify filling out the necessary documentation.

Yes, a power of attorney can change a deed while the grantor is still alive and competent. The agent can execute a new deed or modify an existing one as outlined in their authority. However, the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor requires careful consideration to protect the grantor's intentions.

Deeds may be transferred through a power of attorney when the grantor is alive and capable of making decisions. The designated agent can manage the property as specified in the power of attorney. Ensure that all transactions align with your future plans, especially if you intend to utilize the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor.

While it is not legally required to hire a lawyer to create a transfer on death deed, it is highly recommended. A lawyer can ensure that the document is properly drafted and executed, minimizing the risk of future disputes. Consulting with a professional is especially beneficial when dealing with the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor.

To contest a transfer on death deed, you must file a legal action in the appropriate court, citing your reasons clearly. Valid grounds include lack of capacity or improper execution of the deed. Understanding the District of Columbia Revocation of Transfer on Death Deed - Beneficiary Deed for One Grantor will guide you in preparing your case effectively.