Satisfaction, Release or Cancellation of Mortgage by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Delaware Law

2109. Assignment of mortgages.

An assignment of a mortgage or any sealed instrument attested by 1 creditable witness shall be valid and effectual to convey all the right and interests of the assignor.

(b)All assignments of mortgages or any sealed instruments heretofore made in the presence of 1 witness and all satisfactions made by assignees in such assignments are made good and valid.

2111 Satisfaction of mortgages; penalty; enforcement in Superior Court.

(a)Whenever the debt or duty secured by a mortgage or conveyance in the nature of a mortgage is satisfied or performed, the legal holder of such mortgage or conveyance at the time the satisfaction or performance is completed shall, within 60 days after satisfaction or performance is completed (including the payment of any required satisfaction fees), cause an entry of such satisfaction or performance to be made upon the record by the procedure enumerated in this subsection. The fee for entering such satisfaction or performance upon the record shall be paid by the debtor or obligor unless the mortgage or conveyance provides otherwise.

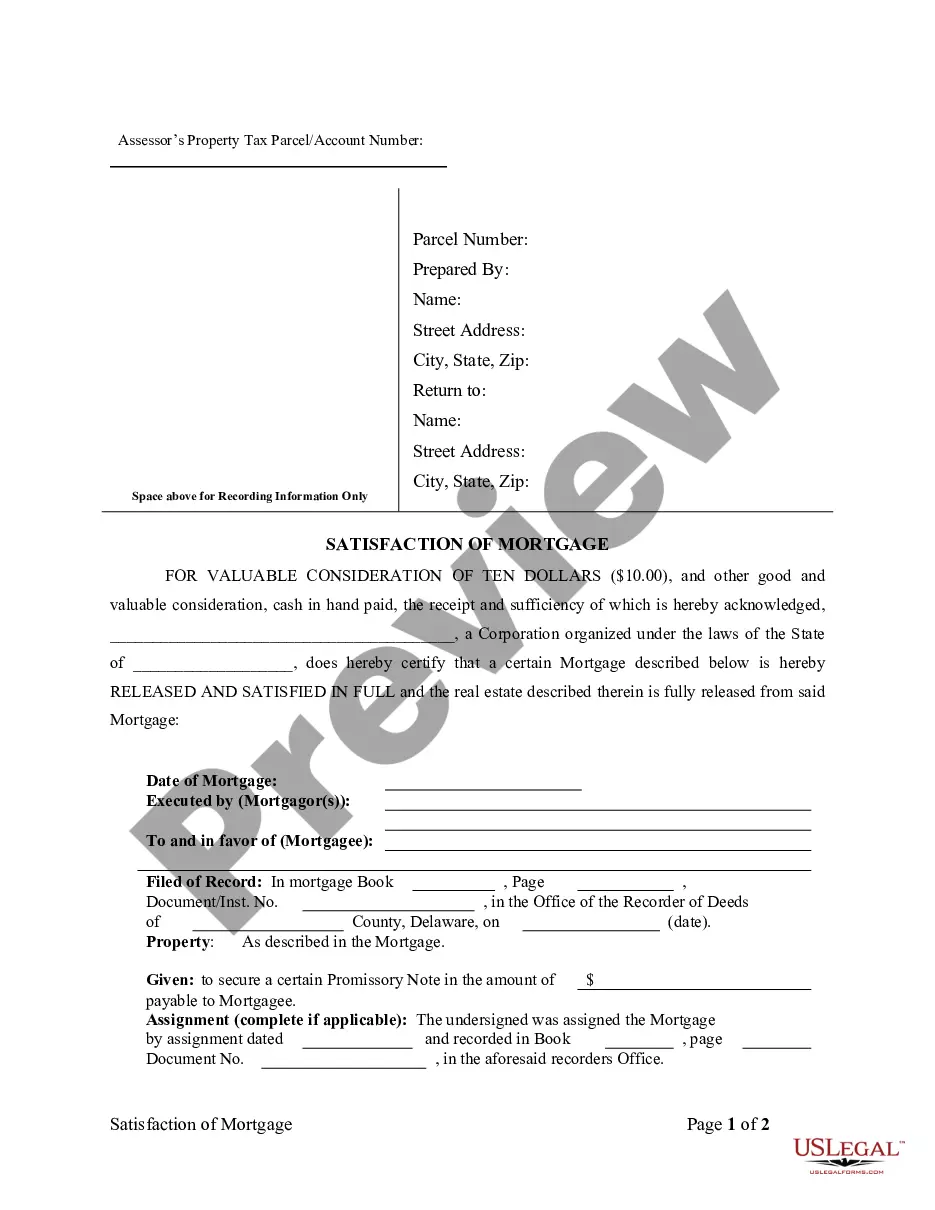

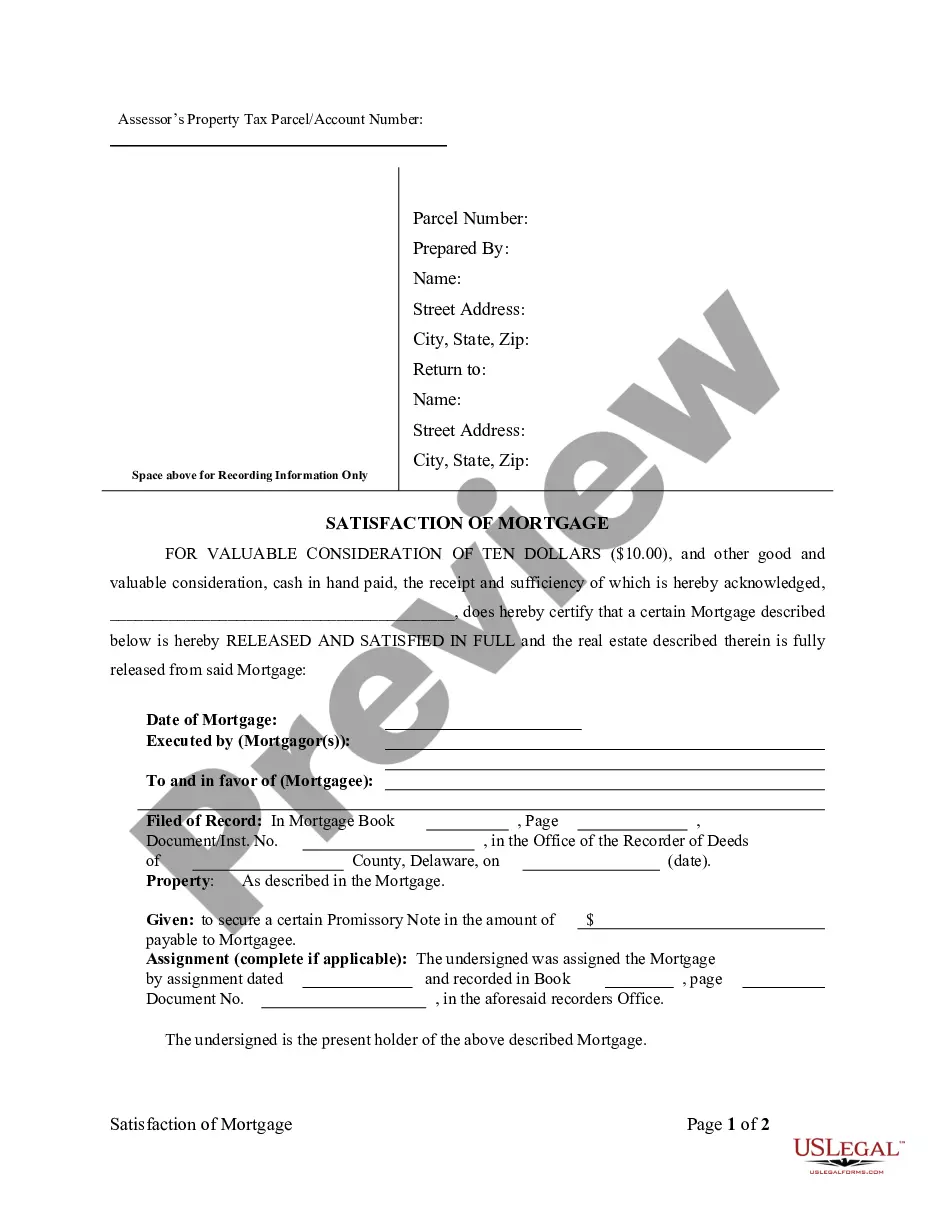

(1)A satisfaction of a mortgage or conveyance shall be made by recordation of either a satisfaction piece, if the instrument is presented in substantially the same form as set out in subsection (b) of this section and acknowledged in the same manner as provided by law for the acknowledgment of deeds, or an attorney's affidavit pursuant to 2120 of this title. The satisfaction piece shall be presented to the recorder, and the recorder shall accept such document for recordation providing such document conforms to the requirements set out in subsection (b) of this section.

(2)If a full or partial release of the mortgage or conveyance is recorded, the recorder of deeds shall place a reference to a book and page number in the indices as to where the release is recorded.

(b)The following shall be a sufficient form of satisfaction piece as authorized by paragraph (a)(1) of this section:

To: Recorder of Deeds This instrument prepared by:

__________ County

Name:

State of Delaware

Address:

Tax Parcel Identification Number: __________

Property Address: __________ .

You are hereby requested and authorized to enter satisfaction of, and cancel of record, the mortgage executed by ____________________, mortgagor, to ____________________, mortgagee, dated __________, _____, and recorded __________, _____, in your office in Mortgage Record __________, at Page __________. [and if applicable, Assigned by ____________________ to ____________________ and recorded in Assignment Record _____, Page _____. ]

INDIVIDUAL SIGNATURE AND ACKNOWLEDGEMENT

IN WITNESS WHEREOF, Mortgagee(s), [Assignee(s)] has(ve) hereunto set its/their hand(s) and seal(s) this _____ day of __________, _____.

______________________________

______________________________ (Seal)

WITNESS

MORTGAGEE

State of __________

County of __________

This instrument was acknowledged before me on (date) by (Name(s) of person(s).

(Signature of notarial officer)

(Seal, if any)

(Title and rank)

My commission expires

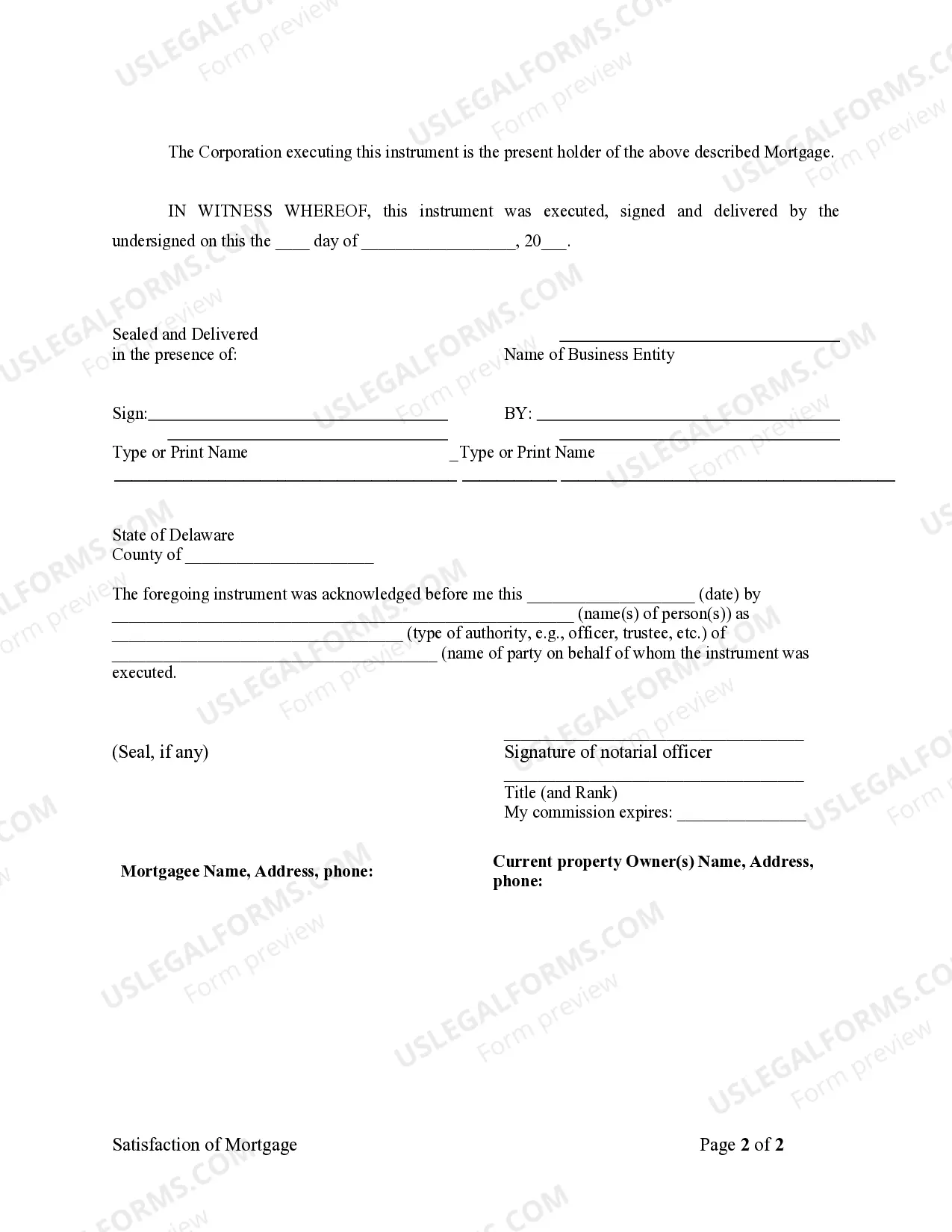

SIGNATURE AND ACKNOWLEDGEMENT IN A REPRESENTATIVE CAPACITY

IN WITNESS WHEREOF, Mortgagee [Assignee] has hereunto set its hand and seal this _____ day of ______________________________, _____.

MORTGAGEE [ASSIGNEE] NAME

____________________

BY: __________ (SEAL)

WITNESS

ATTEST: __________ (SEAL)

State of ____________

County of __________

This Instrument was acknowledged before me on __________ (date), by __________ [name(s) of person(s)] as __________ [type of authority, e.g., officer, trustee, etc.] of __________ [name of party on behalf of whom instrument was executed].

(Seal, if any)

(Title and rank)

My commission expires __________

(c)Each recorder shall either create and maintain a separate index and record of the recording of documents which are authorized to be recorded by this chapter including, but not limited to, powers of attorney to satisfy mortgages, satisfaction pieces, partial and complete releases of mortgages and security interests or index the same in the index used for recorded mortgages. If the recorder creates a separate index, it may be called the Release and Satisfaction Index, which shall reference the mortgagor, mortgagee, record book and page of the mortgage being released or satisfied and the address or lot number, if any, of the property being released or satisfied. The recorder may also maintain a separate record of said instruments and shall not be required to maintain other than a micrographic or electronic record of said instruments.

(d)If the legal holder of a mortgage fails to satisfy the mortgage in accordance with the requirements of subsection (a) of this section, the mortgagor, or that mortgager's agent, shall be entitled to submit a notice to the legal holder of the mortgage demanding that the mortgage be satisfied. The notice shall be sent by certified or registered mail, return receipt requested. The notice shall be sent to the legal holder of the mortgage at the address designated in the payoff statement, or to such other person and/or address as the legal holder may designate in the payoff statement. If:

(1)No payoff statement is received by the mortgagor or that mortgager's agent; or

(2)No address is provided in the payoff statement and the person issuing the notice has received no address to which to send such notices; or

(3)Payments are made electronically and no payment address is given by the legal holder; or

(4)Payment in satisfaction has been made at maturity or otherwise when due and without a payoff statement having been issued, then the address for notice shall be deemed to be the last address used by the legal holder in written communications with the mortgagor, and the notice shall be sent to the attention of Mortgage Satisfaction Department. A copy of such notice shall also be sent to the registered agent (if any) in the State of Delaware of the legal holder.

(e)Whoever, being the holder of a mortgage, wilfully fails to satisfy a mortgage upon the record as required by subsection (a) of this section shall be fined not more than $1,000 for each such failure together with assessed costs, for each failure, not to exceed $1,000.

(f)The recorder of deeds or the mortgage commissioner of the county in which any mortgage is recorded that has been satisfied or performed shall file a complaint with the Attorney General's office in said county against any mortgage holder who has not satisfied of record said mortgage within 60 days of its satisfaction or performance.

(g)The Superior Court shall have jurisdiction of offenses under this section.

2113 Effect of entry of satisfaction.

An entry of satisfaction or performance made in accordance with this chapter shall extinguish the mortgage or conveyance, and the effect shall be the same as if such mortgage or conveyance had not been made.

2114 Damages for nonentry of satisfaction.

If any person commits a default under 2111 of this title, such person, that person's executors or administrators, or if it is a corporation, such corporation, in addition to the other penalties provided for shall be liable to the party by or on whose behalf the satisfaction or performance has been made or completed, in damages to be recovered by a civil action. The damages shall not be less than $10 nor more than $500, except when special damage to a larger amount is alleged in the complaint and proved.

2116 Reconveyance upon satisfaction or performance.

When a debt or duty, secured by a mortgage, or conveyance in the nature of a mortgage is satisfied or performed, the person or corporation in whom the title under such mortgage or conveyance is, shall upon the reasonable request and at the proper cost of the mortgagor, that mortgagor's heirs or assigns, execute and acknowledge a sufficient reconveyance of the premises contained in such mortgage, or conveyance in the nature of a mortgage.