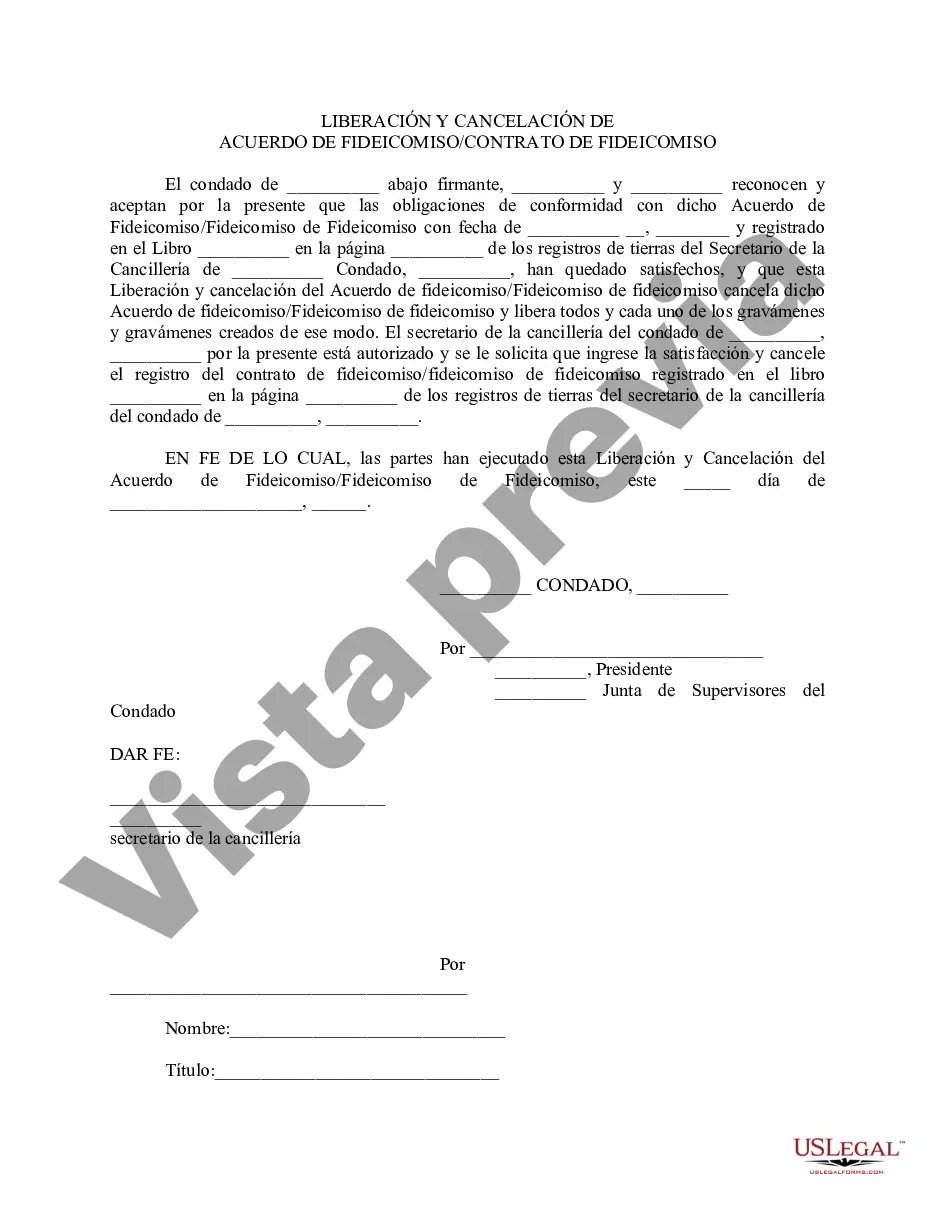

A Delaware Release and Cancellation of Trust Agreement — Trust Indenture is a legal document that terminates and cancels a trust agreement in Delaware. This agreement is used in the context of a trust, which is a legal arrangement where assets are held by one party (the trustee) for the benefit of another party (the beneficiary). The purpose of a Delaware Release and Cancellation of Trust Agreement — Trust Indenture is to formally dissolve the trust and release the trustee from their obligations and responsibilities outlined in the original trust agreement. It effectively terminates the trust and transfers the remaining assets back to the beneficiaries or another designated entity. This document is typically used in situations where the trust has fulfilled its purpose, the beneficiaries have received their entitlements, or there is a need to terminate the trust for legal or administrative reasons. The Delaware Release and Cancellation of Trust Agreement — Trust Indenture outlines the specific terms and conditions under which the trust is being released and canceled. It typically includes details such as the trust's name, the date of its creation, and the identities of the trustee(s) and beneficiary(IES). The agreement also clarifies the distribution of any remaining assets and provides a full release of liability for the trustee. There may be different types or variations of the Delaware Release and Cancellation of Trust Agreement — Trust Indenture depending on the specific circumstances or requirements of the trust. For example: 1. Revocable Trust Release and Cancellation Agreement: This type of agreement is used when a revocable trust, which can be amended or revoked by the creator of the trust during their lifetime, is terminated. 2. Irrevocable Trust Release and Cancellation Agreement: In contrast to a revocable trust, an irrevocable trust cannot be amended or revoked without the consent of the beneficiaries or a court order. The Release and Cancellation Agreement for an irrevocable trust outlines the process and conditions for terminating this type of trust. 3. Testamentary Trust Release and Cancellation Agreement: Testamentary trusts are created through provisions in a person's will and only become effective upon their death. A Release and Cancellation Agreement for a testamentary trust would involve the termination of the trust after its purpose has been fulfilled or certain conditions have been met. It is essential to consult with a qualified attorney or legal expert who specializes in trust law when drafting or executing a Delaware Release and Cancellation of Trust Agreement — Trust Indenture to ensure compliance with applicable laws and regulations.

A Delaware Release and Cancellation of Trust Agreement — Trust Indenture is a legal document that terminates and cancels a trust agreement in Delaware. This agreement is used in the context of a trust, which is a legal arrangement where assets are held by one party (the trustee) for the benefit of another party (the beneficiary). The purpose of a Delaware Release and Cancellation of Trust Agreement — Trust Indenture is to formally dissolve the trust and release the trustee from their obligations and responsibilities outlined in the original trust agreement. It effectively terminates the trust and transfers the remaining assets back to the beneficiaries or another designated entity. This document is typically used in situations where the trust has fulfilled its purpose, the beneficiaries have received their entitlements, or there is a need to terminate the trust for legal or administrative reasons. The Delaware Release and Cancellation of Trust Agreement — Trust Indenture outlines the specific terms and conditions under which the trust is being released and canceled. It typically includes details such as the trust's name, the date of its creation, and the identities of the trustee(s) and beneficiary(IES). The agreement also clarifies the distribution of any remaining assets and provides a full release of liability for the trustee. There may be different types or variations of the Delaware Release and Cancellation of Trust Agreement — Trust Indenture depending on the specific circumstances or requirements of the trust. For example: 1. Revocable Trust Release and Cancellation Agreement: This type of agreement is used when a revocable trust, which can be amended or revoked by the creator of the trust during their lifetime, is terminated. 2. Irrevocable Trust Release and Cancellation Agreement: In contrast to a revocable trust, an irrevocable trust cannot be amended or revoked without the consent of the beneficiaries or a court order. The Release and Cancellation Agreement for an irrevocable trust outlines the process and conditions for terminating this type of trust. 3. Testamentary Trust Release and Cancellation Agreement: Testamentary trusts are created through provisions in a person's will and only become effective upon their death. A Release and Cancellation Agreement for a testamentary trust would involve the termination of the trust after its purpose has been fulfilled or certain conditions have been met. It is essential to consult with a qualified attorney or legal expert who specializes in trust law when drafting or executing a Delaware Release and Cancellation of Trust Agreement — Trust Indenture to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.