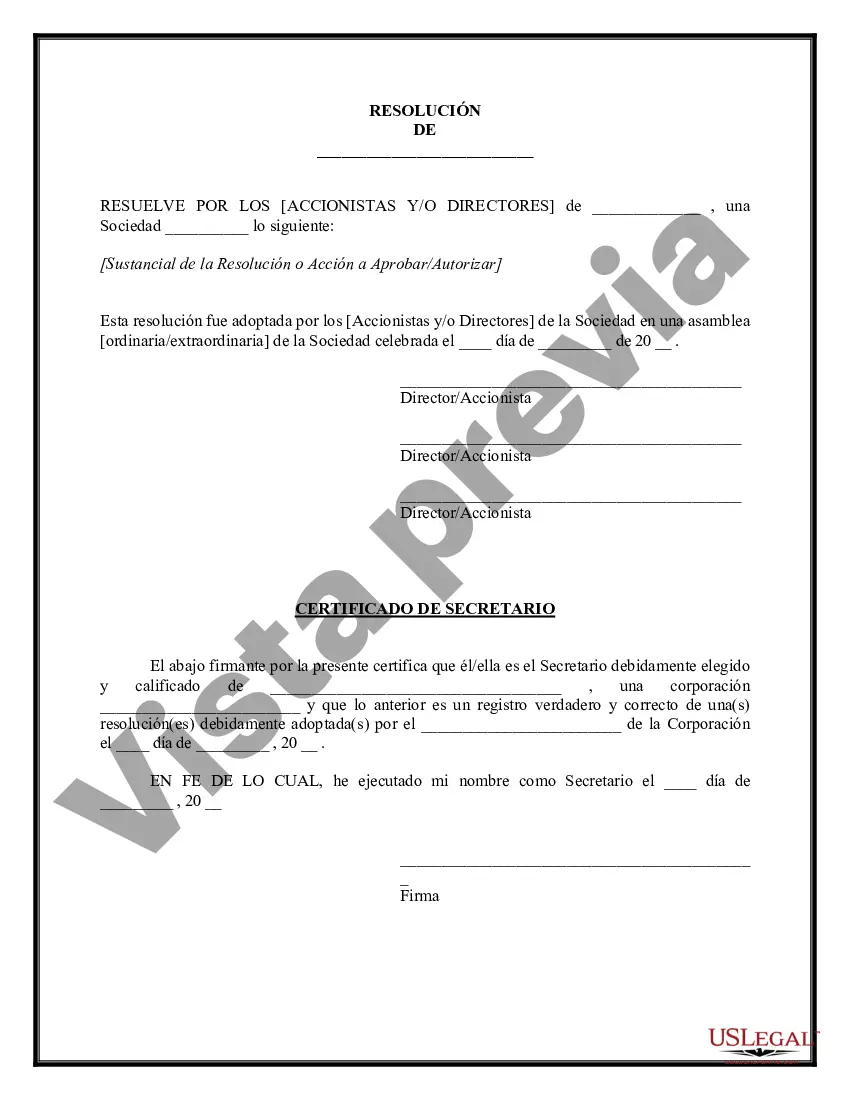

A Delaware Corporate Resolution for LLC is a legal document that outlines and formalizes decisions made by the members or managers of a Limited Liability Company (LLC) in the state of Delaware. It serves as evidence of the approval and authorization of certain actions or transactions undertaken by the LLC. A corporate resolution typically includes details such as the date, the names of the members or managers present, and the specific resolution being passed. It is essential for maintaining a record of important decisions, ensuring compliance with legal requirements, and clarifying the intentions of the LLC. There are several types of Delaware Corporate Resolutions for LLC, each serving a different purpose and reflecting various aspects of the LLC's operations. Some common types include: 1. Resolutions for Formation: These resolutions are passed during the establishment of the LLC and cover matters such as the approval of the LLC's operating agreement, the appointment of initial managers or members, and the designation of a registered agent. 2. Resolutions for Day-to-Day Operations: These resolutions address routine matters related to the ongoing activities of the LLC. They can include granting powers or responsibilities to managers, approving contracts or leases, authorizing banking transactions, and making decisions regarding the LLC's operations. 3. Resolutions for Capital Contributions: These resolutions involve decisions regarding the contribution of assets or funds by members to the LLC. They specify the terms and conditions for capital contributions, including the amount, timing, and nature of the contribution. 4. Resolutions for Amendments: These resolutions are passed when the LLC needs to amend its operating agreement or undertake significant changes to its structure. This can include modifications to the LLC's name, registered agent, registered office, or the addition/removal of members or managers. 5. Resolutions for Dissolution or Liquidation: These resolutions outline the process for winding up and dissolving the LLC, ensuring proper distribution of assets, settlement of debts, and the legal termination of the LLC's existence. By maintaining accurate and detailed Delaware Corporate Resolutions for LLC, the LLC can demonstrate its adherence to corporate formalities, safeguard against disputes, provide transparency to members, and maintain compliance with state laws. It is crucial to consult legal professionals or utilize customizable templates for drafting these resolutions to ensure their accuracy and compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Resolución Corporativa para LLC - Corporate Resolution for LLC

Description

How to fill out Delaware Resolución Corporativa Para LLC?

Choosing the best authorized file template can be quite a have a problem. Naturally, there are plenty of layouts available on the net, but how will you obtain the authorized develop you want? Utilize the US Legal Forms site. The assistance offers a huge number of layouts, like the Delaware Corporate Resolution for LLC, that you can use for enterprise and private needs. All the kinds are inspected by professionals and fulfill federal and state specifications.

Should you be currently authorized, log in in your account and then click the Obtain option to obtain the Delaware Corporate Resolution for LLC. Use your account to look through the authorized kinds you possess acquired in the past. Visit the My Forms tab of your account and obtain another version in the file you want.

Should you be a fresh consumer of US Legal Forms, allow me to share simple recommendations for you to adhere to:

- First, ensure you have chosen the correct develop for the metropolis/area. You can check out the form while using Preview option and study the form outline to guarantee it will be the right one for you.

- In case the develop does not fulfill your requirements, make use of the Seach field to find the correct develop.

- Once you are certain the form is proper, select the Acquire now option to obtain the develop.

- Opt for the pricing strategy you need and enter in the required information and facts. Make your account and pay money for your order making use of your PayPal account or bank card.

- Choose the data file formatting and acquire the authorized file template in your system.

- Total, edit and print out and indication the attained Delaware Corporate Resolution for LLC.

US Legal Forms is definitely the largest local library of authorized kinds in which you can discover different file layouts. Utilize the service to acquire professionally-produced files that adhere to state specifications.