Delaware Lease or Rental of Computer Equipment refers to an agreement between a lessor (the owner of the computer equipment) and a lessee (the individual or business entity seeking to use the equipment) in the state of Delaware. This agreement allows the lessee to utilize the computer equipment for a specified duration and in exchange for monetary compensation. The lease or rental of computer equipment is prevalent in various industries, including technology, research, education, and even small businesses. Companies often find it more cost-effective to lease computer equipment rather than purchasing it outright, as it reduces the initial investment and enables them to have access to the latest technology without the hassle of maintenance and upgrades. The Delaware Lease or Rental of Computer Equipment agreement should include important details such as the names and contact information of both parties, a description of the computer equipment being leased, the terms of the lease (duration, start and end dates), the rental payment structure (monthly, quarterly, annual), and the responsibilities of both parties regarding maintenance, repairs, and insurance. In addition to the general Delaware Lease or Rental of Computer Equipment, there may be specific types based on the purpose or nature of the equipment being leased. Some common types include: 1. Desktop Computer Lease: This type of lease involves the rental of desktop computers specifically. It may include the monitor, CPU, keyboard, mouse, and other essential peripherals. 2. Laptop Lease: In this type of lease, laptops or notebooks are rented out to the lessee. Laptops are portable and are often preferred by individuals needing flexibility in their work or businesses with remote teams. 3. Server Lease: Servers are powerful computers that store, manage, and distribute data within a network. This type of lease enables businesses to utilize servers without the need for extensive infrastructure investments. 4. Printer and Copier Lease: This lease agreement focuses on renting printing and copying equipment, which can include standalone printers, multifunction devices, or large-scale commercial printers. 5. Networking Equipment Lease: This type of lease involves the rental of networking equipment, such as routers, switches, and firewalls. It allows businesses to establish and maintain a robust computer network infrastructure. By tailoring the Delaware Lease or Rental of Computer Equipment agreement to the specific needs and equipment involved, both lessors and lessees can protect their interests and ensure a mutually beneficial arrangement.

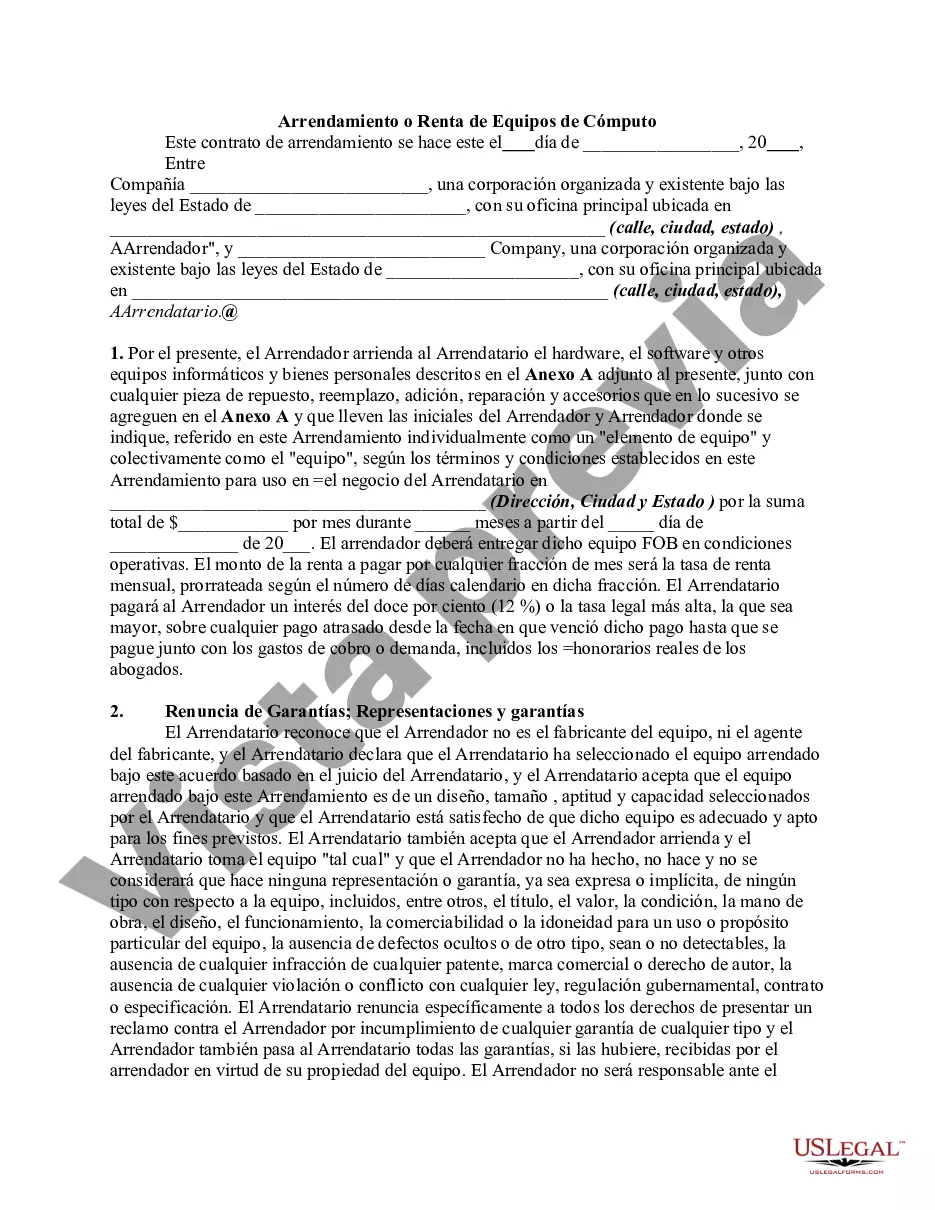

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Arrendamiento o Renta de Equipos de Cómputo - Lease or Rental of Computer Equipment

Description

How to fill out Delaware Arrendamiento O Renta De Equipos De Cómputo?

Selecting the appropriate legal documents format can be a challenge.

Of course, there are numerous templates accessible online, but how do you locate the legal document you seek.

Leverage the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct template for your city/state. You can preview the form using the Review button and read the form details to verify it meets your needs. If the form does not satisfy your requirements, use the Search field to find the right form. Once you are confident that the form is appropriate, click the Get now button to obtain the form. Choose the pricing plan you prefer and provide the necessary details. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, review, print, and sign the received Delaware Lease or Rental of Computer Equipment. US Legal Forms boasts the largest collection of legal templates where you can find countless document designs. Utilize the service to acquire professionally crafted documents that comply with state regulations.

- The platform offers a plethora of templates, such as the Delaware Lease or Rental of Computer Equipment, suitable for both business and personal purposes.

- All forms are reviewed by experts and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Delaware Lease or Rental of Computer Equipment.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the documents you need.

Form popularity

FAQ

The primary reason for renting or leasing equipment lies in flexibility and financial management. By opting for a Delaware Lease or Rental of Computer Equipment, you can access the latest technology without large upfront investments. This strategy enables businesses and individuals to allocate funds more efficiently, supporting growth and innovation.

Renting a computer can be a smart choice, especially if you need it for a short period or specific project without the burden of ownership. The flexibility of a Delaware Lease or Rental of Computer Equipment allows you to adapt your technology needs as your tasks evolve. Additionally, this option can help you save on maintenance costs and upgrades.

Renting and leasing equipment are similar but not identical. Renting is usually short-term and more casual, while leasing is a structured agreement that often includes responsibilities like repairs and services. If you're exploring options for a Delaware Lease or Rental of Computer Equipment, consider how these terms affect your financial planning.

Leased equipment generally involves a formal agreement that lasts for a specified period, often with additional terms regarding maintenance and upgrades. In contrast, rented equipment may not have such commitments, making it more flexible but potentially less secure. Knowing this difference can greatly influence your decision in a Delaware Lease or Rental of Computer Equipment.

The terms 'rented' and 'leased' often cause confusion, but they have distinct meanings. Renting typically refers to a short-term arrangement, while leasing usually signifies a longer commitment. In the context of a Delaware Lease or Rental of Computer Equipment, understanding these differences helps you choose the best option for your needs.

In Delaware, equipment rentals, including computer equipment, typically are not subject to sales tax, making it an attractive option. This exemption means your focus can remain on business operations without worrying about added tax costs. However, ensure any related fees are understood when finalizing agreements in the Delaware lease or rental of computer equipment. Staying informed about local regulations remains essential.

In Delaware, since there is no rental tax on leased equipment, businesses engaging in the Delaware lease or rental of computer equipment do not need to calculate a rental tax. This simplifies your financial planning and keeps your costs lower. However, consider other applicable taxes and fees that could affect your calculations. Seeking guidance from a tax expert can provide clarity on any obligations.

Delaware does not have a rental tax specifically for leased equipment, including computer devices. This lack of rental tax can make it a favorable location for businesses involved in the Delaware lease or rental of computer equipment. However, businesses should be cautious of any fees that municipalities may impose. Being informed about tax obligations can help you make the most of your rental agreements.

Delaware does not impose a personal property tax on tangible personal property, including computer equipment. However, businesses should be aware of other taxes that may apply to their operations. This means that if you engage in the Delaware lease or rental of computer equipment, you may find it financially advantageous. Permanent fixtures may be subject to taxation, so review your equipment's status carefully.

Businesses that generate revenue in Delaware must file the gross receipts tax, including those involved in the Delaware lease or rental of computer equipment. This tax applies to all income, regardless of profit or loss. Additionally, even if a business operates out of state, it may still need to file if it has nexus in Delaware. Always consult a tax professional for specific obligations.

Interesting Questions

More info

We have collected a wealth of legal information and useful templates for different types of commercial tenants in order to create strong rental agreements that your tenants will love. Rent agreement templates available in over 20 languages. We have collected all kinds of templates in PDF format in all languages. Legal Templates and documents for commercial tenant Free rental agreement templates with your own photos Rent agreement templates for commercial tenants that are easy to understand and ready to use Free rental agreement download packages Rent agreement templates for leaseholders and buyers Rent agreement templates — the Ultimate Resource Rent Agreements in various languages Download rent agreement for your language Contract template for legal agreement Business-Type Lease Business-types lease agreements are legally binding and enforceable, which is an important factor in business success.