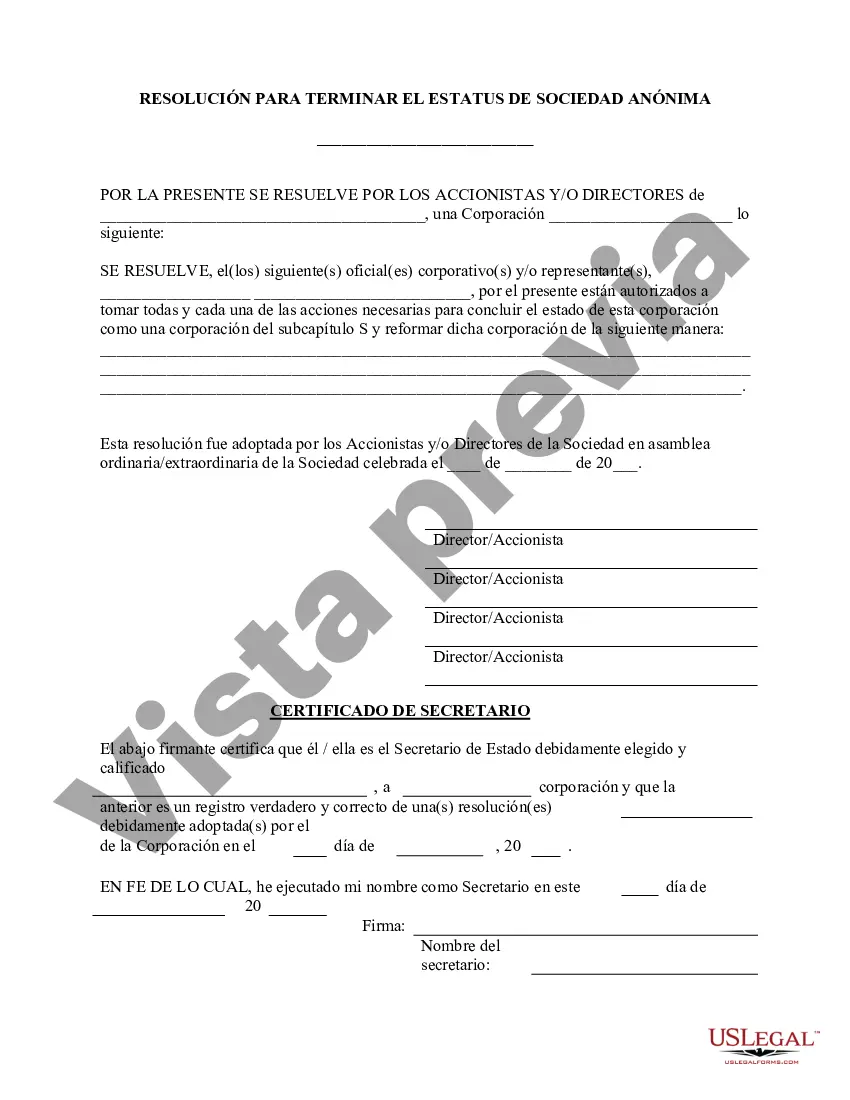

Delaware Terminate S Corporation Status — Resolution For— - Corporate Resolutions is a legally binding document that S corporations in Delaware should use when deciding to terminate their S corporation status. This form outlines the specific resolutions and actions required to dissolve the S corporation for tax purposes. The termination of S corporation status is a significant decision for businesses, as it involves changing the tax structure from a pass-through entity to a C corporation. By completing this resolution form, S corporations can ensure they follow the necessary procedures and comply with Delaware state regulations when terminating their S corporation status. The Delaware Terminate S Corporation Status — Resolution For— - Corporate Resolutions typically includes essential information such as the company's name, legal address, and federal employer identification number (EIN). Additionally, the form provides space to specify the resolution and the date of approval. It may also include sections to document any additional details or considerations related to the termination. It's important to note that there might be variations of this form depending on the specific circumstances of the S corporation. Some common types of Delaware Terminate S Corporation Status — Resolution Form— - Corporate Resolutions include: 1. Voluntary Dissolution Resolution Form: This form is used when an S corporation decides to voluntarily dissolve and terminate it's S corporation status. It outlines the company's intention to cease operations, liquidate assets, distribute remaining assets to shareholders, and comply with any outstanding obligations. 2. Involuntary Dissolution Resolution Form: In rare cases, an S corporation's status may be involuntarily terminated due to non-compliance with state regulations or failure to meet specific tax requirements. This form helps document the authorization and acceptance of the involuntary dissolution of the S corporation. 3. Conversion to C Corporation Resolution Form: If an S corporation decides to change its tax status and convert to a C corporation, this form is required. It outlines the company's decision, includes any necessary approvals from shareholders or directors, and specifies the effective date of the conversion. 4. Merger or Acquisition Resolution Form: In the event of a merger or acquisition involving the S corporation, this form is used to document the decision to terminate the S corporation status. It includes details about the merger/acquisition, the resulting entity, and any necessary approvals. By utilizing the Delaware Terminate S Corporation Status — Resolution For— - Corporate Resolutions, businesses can ensure that the process of ending their S corporation status is conducted legally and in accordance with Delaware state laws. It serves as a comprehensive record of the resolutions passed and the actions taken during the termination process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Delaware Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

Choosing the right legitimate file format could be a have a problem. Needless to say, there are plenty of layouts accessible on the Internet, but how do you obtain the legitimate type you need? Make use of the US Legal Forms website. The assistance offers a huge number of layouts, like the Delaware Terminate S Corporation Status - Resolution Form - Corporate Resolutions, which can be used for company and private requirements. All the kinds are examined by experts and satisfy federal and state demands.

In case you are presently authorized, log in to the accounts and then click the Obtain button to find the Delaware Terminate S Corporation Status - Resolution Form - Corporate Resolutions. Utilize your accounts to check with the legitimate kinds you might have purchased formerly. Go to the My Forms tab of your accounts and get yet another version of the file you need.

In case you are a brand new end user of US Legal Forms, listed here are simple guidelines that you should stick to:

- Initially, be sure you have selected the appropriate type to your area/county. You may check out the shape utilizing the Preview button and read the shape information to guarantee this is the right one for you.

- If the type will not satisfy your expectations, take advantage of the Seach discipline to discover the appropriate type.

- Once you are sure that the shape is suitable, click the Buy now button to find the type.

- Choose the rates program you want and type in the needed details. Design your accounts and pay for the order making use of your PayPal accounts or Visa or Mastercard.

- Choose the document file format and down load the legitimate file format to the system.

- Complete, modify and produce and indication the received Delaware Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

US Legal Forms is the biggest library of legitimate kinds for which you will find a variety of file layouts. Make use of the service to down load skillfully-produced documents that stick to state demands.