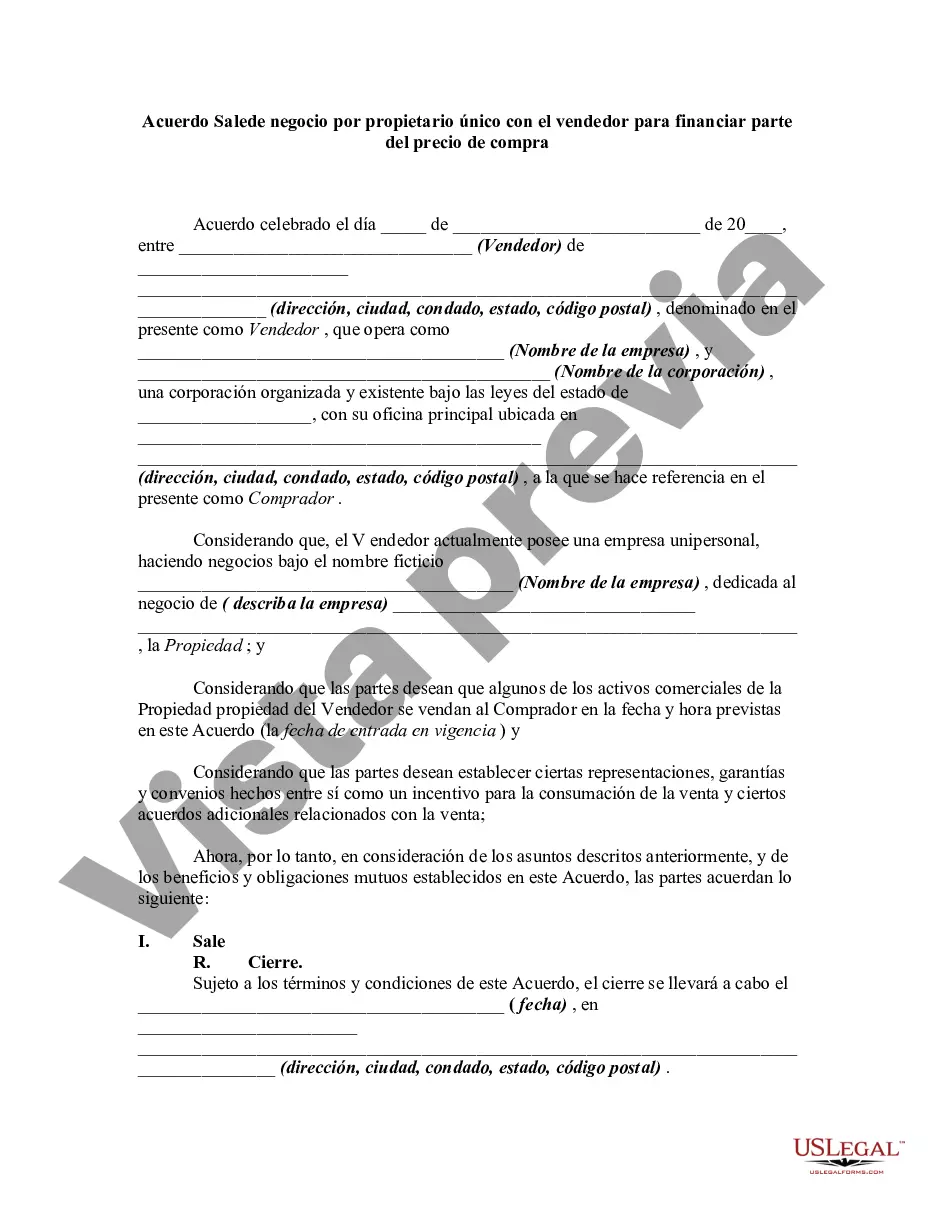

The Delaware Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legal document that outlines the terms and conditions of a business sale transaction in the state of Delaware. This agreement specifically caters to sole proprietorship where the seller is willing to finance a portion of the purchase price for the buyer. This agreement is designed to protect both parties involved in the sale. It includes detailed provisions regarding the business being sold, such as its name, location, assets, liabilities, and any relevant permits or licenses. The agreement also covers the purchase price, specifying the total amount and the portion that the seller will finance. The repayment terms for the seller-financed portion of the purchase price are clearly outlined in the agreement. It may include the amount of down payment required, the interest rate, and the repayment schedule. This gives both parties a clear understanding of their financial obligations and ensures that the buyer has a feasible plan to repay the seller. Additionally, the agreement addresses any warranties or representations made by the seller regarding the business. This protects the buyer from any misrepresentations or undisclosed issues that may arise after the purchase. It also sets out the conditions for closing the sale, including any necessary approvals or inspections. Different types of Delaware Agreements for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price may include variations in terms and conditions based on the specific needs of the parties involved. Some examples of these variations could be: 1. Fixed Interest Rate Agreement: In this type of agreement, the interest rate remains constant throughout the repayment period. 2. Variable Interest Rate Agreement: Here, the interest rate may fluctuate based on market conditions or predetermined factors, such as an index rate. 3. Balloon Payment Agreement: This agreement may include a large final payment that is due at the end of the repayment period, providing flexibility for the buyer to manage their cash flow in the early stages of ownership. 4. Collateral Agreement: If the seller requires additional security for the seller-financed portion, a collateral agreement may be included, specifying the assets or property that will act as collateral. It is important for both parties to thoroughly review and understand the agreement before signing. Seeking legal counsel is highly recommended ensuring compliance with Delaware laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Acuerdo de Venta de Negocio por Propietario Único con el Vendedor para Financiar Parte del Precio de Compra - Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Delaware Acuerdo De Venta De Negocio Por Propietario Único Con El Vendedor Para Financiar Parte Del Precio De Compra?

If you wish to total, down load, or printing legal papers templates, use US Legal Forms, the greatest assortment of legal types, that can be found on the Internet. Take advantage of the site`s simple and easy practical research to obtain the papers you require. Numerous templates for business and specific functions are categorized by types and claims, or key phrases. Use US Legal Forms to obtain the Delaware Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price in a couple of clicks.

Should you be previously a US Legal Forms consumer, log in for your profile and click on the Obtain key to find the Delaware Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price. You can even gain access to types you formerly acquired inside the My Forms tab of your respective profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape for that right town/country.

- Step 2. Make use of the Review choice to look over the form`s content. Do not overlook to read through the outline.

- Step 3. Should you be unhappy using the form, take advantage of the Look for industry at the top of the display to get other versions of the legal form template.

- Step 4. After you have located the shape you require, select the Get now key. Opt for the pricing prepare you prefer and add your credentials to sign up to have an profile.

- Step 5. Process the deal. You can utilize your credit card or PayPal profile to accomplish the deal.

- Step 6. Find the formatting of the legal form and down load it on your gadget.

- Step 7. Comprehensive, change and printing or sign the Delaware Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price.

Every legal papers template you acquire is yours permanently. You have acces to each form you acquired with your acccount. Click on the My Forms portion and choose a form to printing or down load again.

Compete and down load, and printing the Delaware Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price with US Legal Forms. There are millions of expert and condition-specific types you may use for the business or specific demands.