No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

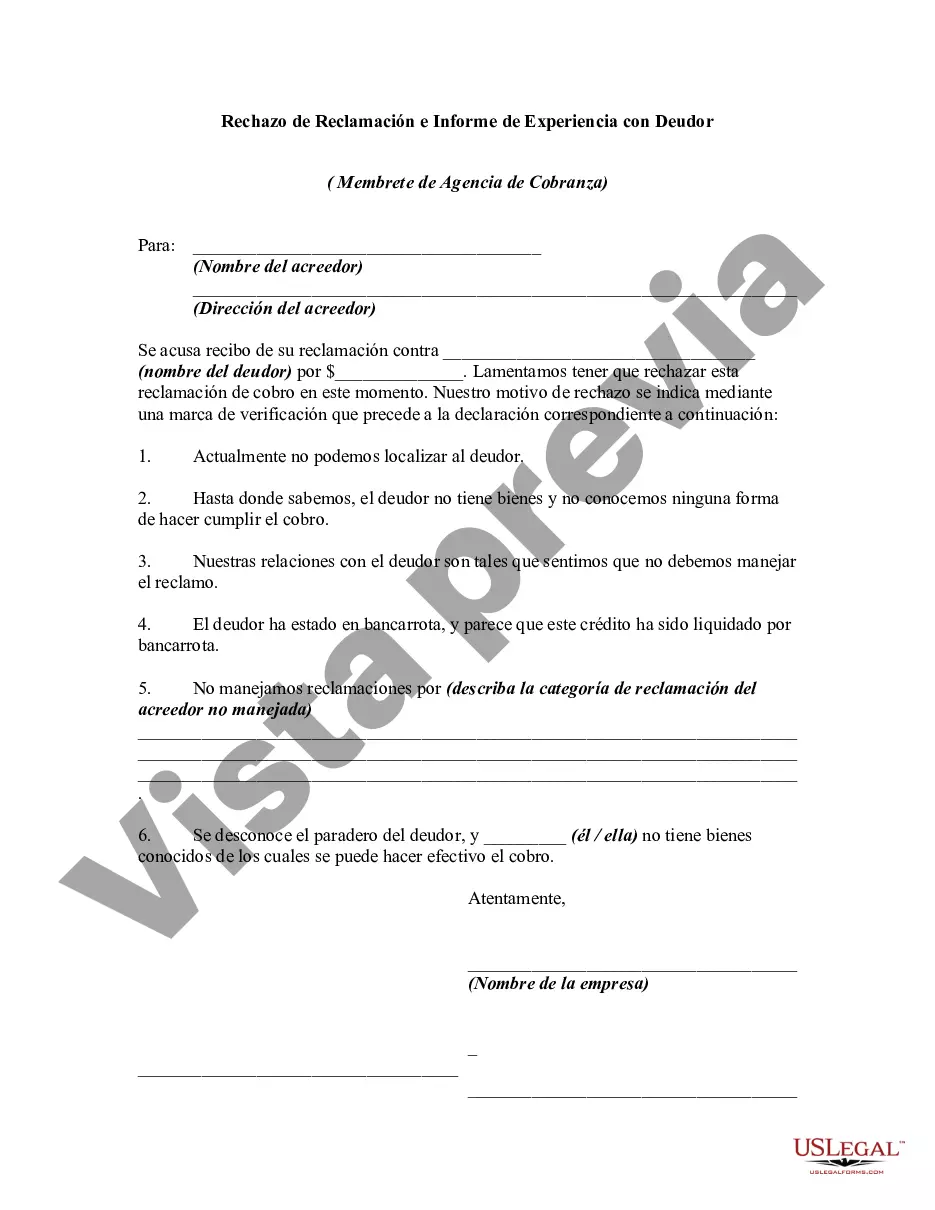

Delaware Rejection of Claim and Report of Experience with Debtor: The Delaware Rejection of Claim and Report of Experience with Debtor is a legal document that provides an avenue for creditors to officially dispute or reject claims made by debtors. This report, often required during bankruptcy proceedings, allows creditors to give a detailed account of their experience and dealings with a specific debtor. In Delaware, the rejection of claim process serves as a means for creditors to express their objections to the validity, accuracy, or legitimacy of a debtor's claim. This rejection can be based on various factors such as incomplete information, incorrect documentation, lack of supporting evidence, or suspicion of fraud. Different Types of Delaware Rejection of Claim and Report of Experience with Debtor: 1. Standard Rejection of Claim: This type of rejection is the most common and occurs when a creditor believes that the debtor's claim lacks proper substantiation or doesn't meet the necessary criteria for approval. Creditors must provide detailed reasons, supporting documents, and evidence to justify their rejection. 2. Fraudulent Claim Rejection: In cases where a creditor suspects fraudulent activity or misrepresentation by the debtor, they can file a fraudulent claim rejection. This type of rejection signifies that the creditor believes the debtor intentionally provided false information or manipulated the bankruptcy process for personal gain. 3. Incomplete Documentation Rejection: Creditors may encounter situations where the debtor fails to provide complete documentation to support their claim. In such cases, the creditor can reject the claim based on insufficient evidence or lack of necessary paperwork. This rejection urges the debtor to provide the required documentation to substantiate their claim. 4. Disputed Amount Rejection: If a creditor disagrees with the value or amount stated in the debtor's claim, they can file a disputed amount rejection. This type of rejection highlights the discrepancy in the claimed amount and prompts a reassessment or negotiation between the creditor and debtor to reach a fair resolution. 5. Non-Compliance Rejection: Non-compliance rejections occur when a debtor fails to meet certain legal requirements or regulations while filing their claim. Creditors can reject the claim based on the debtor's non-compliance with specific laws, procedures, or even court orders. It is essential for creditors to carefully consider their reasons for rejecting a debtor's claim and provide comprehensive documentation to support their case. The Delaware Rejection of Claim and Report of Experience with Debtor ensures a fair and transparent process during bankruptcy proceedings, protecting the rights and interests of both creditors and debtors.Delaware Rejection of Claim and Report of Experience with Debtor: The Delaware Rejection of Claim and Report of Experience with Debtor is a legal document that provides an avenue for creditors to officially dispute or reject claims made by debtors. This report, often required during bankruptcy proceedings, allows creditors to give a detailed account of their experience and dealings with a specific debtor. In Delaware, the rejection of claim process serves as a means for creditors to express their objections to the validity, accuracy, or legitimacy of a debtor's claim. This rejection can be based on various factors such as incomplete information, incorrect documentation, lack of supporting evidence, or suspicion of fraud. Different Types of Delaware Rejection of Claim and Report of Experience with Debtor: 1. Standard Rejection of Claim: This type of rejection is the most common and occurs when a creditor believes that the debtor's claim lacks proper substantiation or doesn't meet the necessary criteria for approval. Creditors must provide detailed reasons, supporting documents, and evidence to justify their rejection. 2. Fraudulent Claim Rejection: In cases where a creditor suspects fraudulent activity or misrepresentation by the debtor, they can file a fraudulent claim rejection. This type of rejection signifies that the creditor believes the debtor intentionally provided false information or manipulated the bankruptcy process for personal gain. 3. Incomplete Documentation Rejection: Creditors may encounter situations where the debtor fails to provide complete documentation to support their claim. In such cases, the creditor can reject the claim based on insufficient evidence or lack of necessary paperwork. This rejection urges the debtor to provide the required documentation to substantiate their claim. 4. Disputed Amount Rejection: If a creditor disagrees with the value or amount stated in the debtor's claim, they can file a disputed amount rejection. This type of rejection highlights the discrepancy in the claimed amount and prompts a reassessment or negotiation between the creditor and debtor to reach a fair resolution. 5. Non-Compliance Rejection: Non-compliance rejections occur when a debtor fails to meet certain legal requirements or regulations while filing their claim. Creditors can reject the claim based on the debtor's non-compliance with specific laws, procedures, or even court orders. It is essential for creditors to carefully consider their reasons for rejecting a debtor's claim and provide comprehensive documentation to support their case. The Delaware Rejection of Claim and Report of Experience with Debtor ensures a fair and transparent process during bankruptcy proceedings, protecting the rights and interests of both creditors and debtors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.