Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

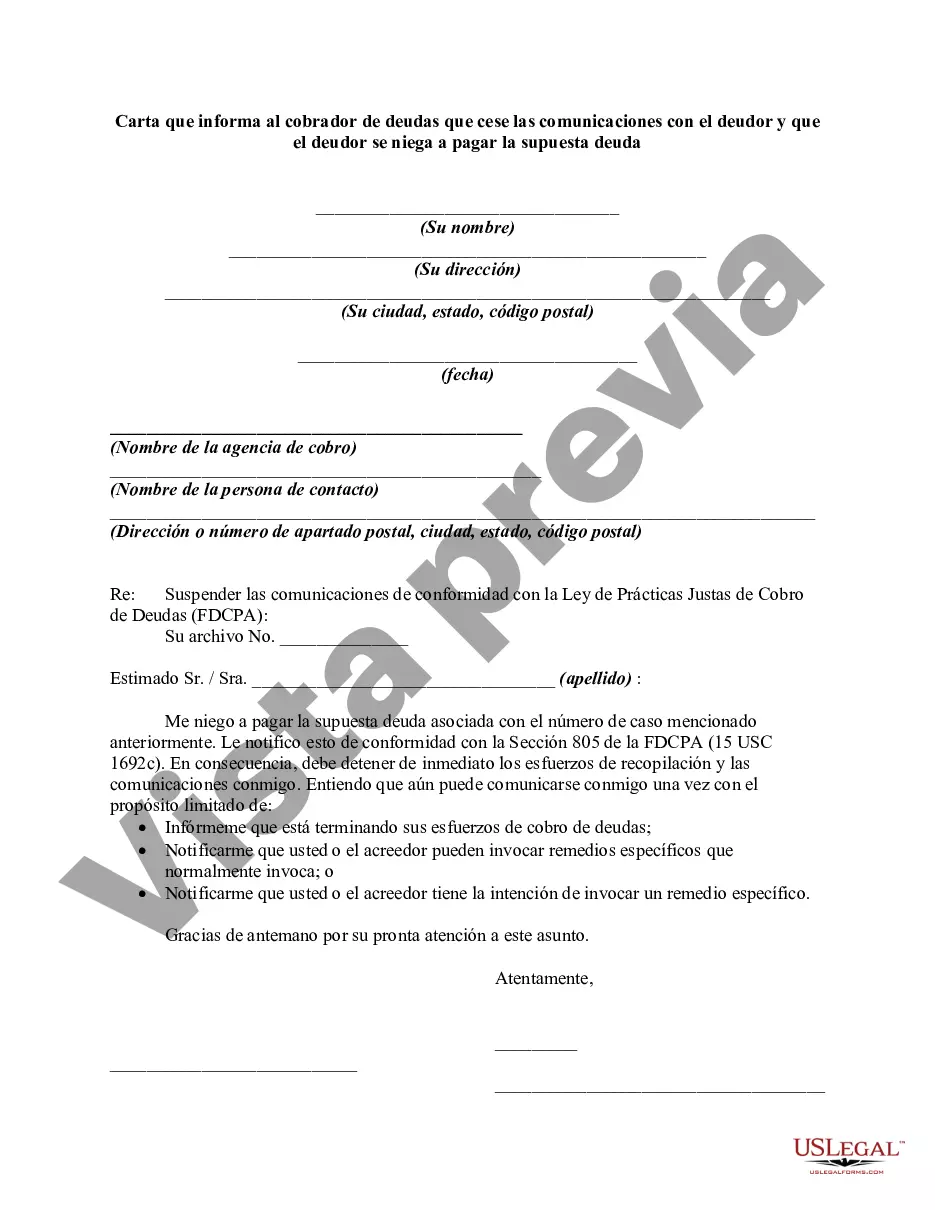

Title: Delaware Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt Keywords: Delaware, letter, debt collector, cease communications, debtor, refuse to pay, alleged debt Introduction: In the state of Delaware, it is important for debtors to understand their rights and options when dealing with debt collectors. One such option is to send a formal letter to the debt collector requesting them to cease all communications with the debtor and notifying them of the debtor's refusal to pay the alleged debt. This article will provide a detailed description of what a Delaware Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt entails. 1. Purpose of the Letter: The purpose of a Delaware Letter Informing Debt Collector to Cease Communications with Debtor is to assert the debtor's rights under the Fair Debt Collection Practices Act (FD CPA). It serves as a formal notice to the debt collector, informing them that the debtor refuses to pay the alleged debt and requesting them to cease all communication attempts. 2. Basic Structure of the Letter: A. Heading: The letter should include the debtor's name, address, and contact information, as well as the debt collector's name, address, and contact information. B. Date: The date the letter is being sent. C. Salutation: A formal greeting addressing the debt collector or collection agency. D. Body: The letter should clearly state the debtor's refusal to pay the alleged debt and assert their rights under the FD CPA. It should insist that the debt collector cease all communication attempts, including calls, letters, emails, and any other form of contact. E. Supporting Documents: If applicable, the debtor may attach copies of any evidence or documentation that disprove the alleged debt. F. Closing: A closing statement emphasizing the debtor's expectation for the debt collector to comply with the request, and a signature with the debtor's printed name. G. Certified Mail: It is advisable to send the letter via certified mail with a return receipt request, ensuring proof of delivery. 3. Different Types of Delaware Letter Informing Debt Collector to Cease Communications with Debtor: While the basic structure remains the same, there can be variations in the specific content depending on the debtor's circumstances. Some common variations may include: — Letter disputing the validity of the alleged debt — Letter asserting the statute of limitations on the debt — Letter requesting the debt collector to provide verification of the debt — Letter sent in response to harassment or unfair collection tactics — Letter sent on behalf of the debtor by an attorney or a debt relief agency Conclusion: Sending a Delaware Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt is a necessary step to protect a debtor's rights and communicate their refusal to accept liability for the alleged debt. Adhering to the proper structure and effectively communicating the debtor's intentions can play a significant role in resolving debt-related issues amicably.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.