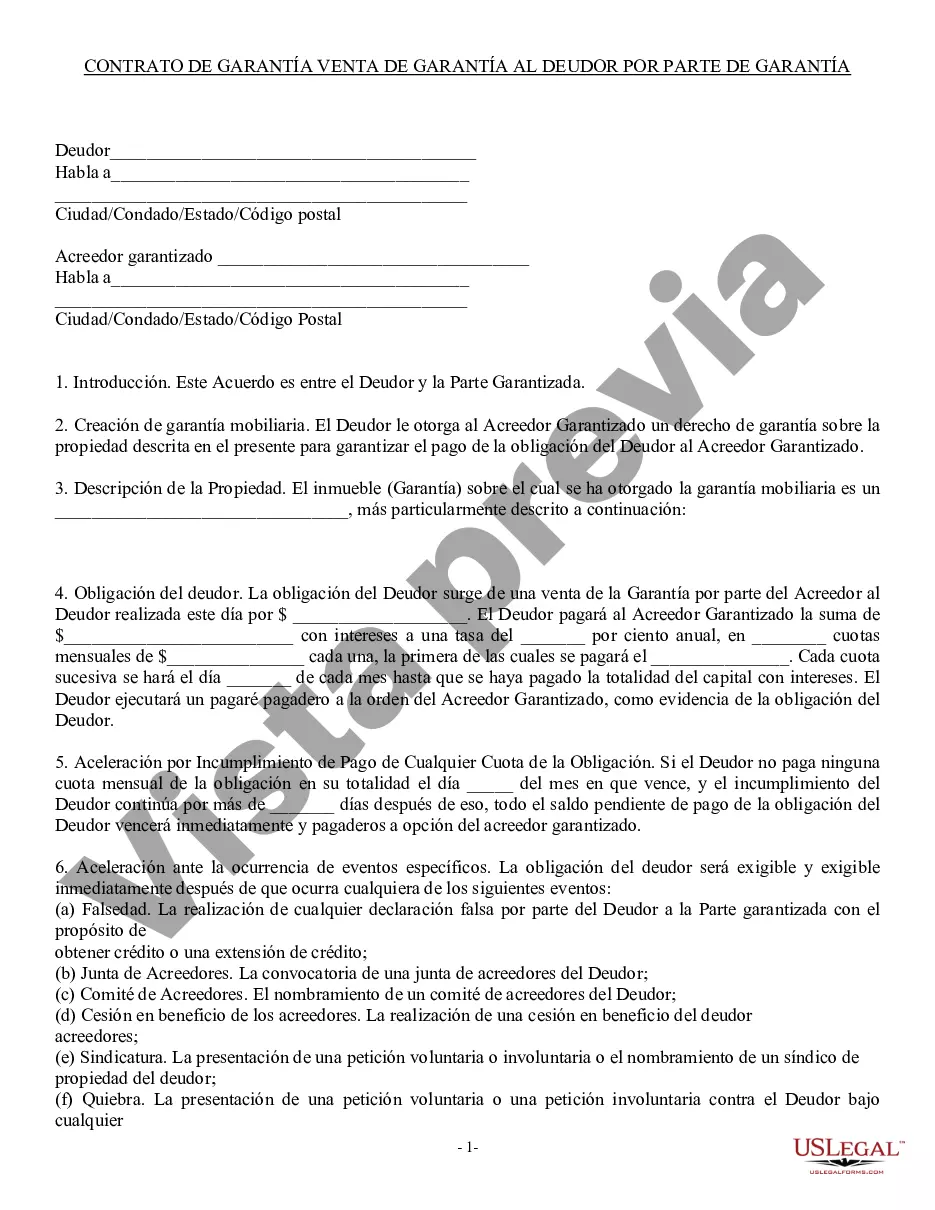

Delaware Security Agreement involving Sale of Collateral by Debtor is a legal document that establishes a lien on collateral, which may include personal property, accounts receivable, inventory, or other assets, in order to secure a debt or obligation owed by the debtor to the secured party. This agreement is frequently used in commercial transactions, where a debtor grants a security interest in their assets to a creditor to ensure repayment of a loan or fulfillment of other obligations. The Delaware Security Agreement involving Sale of Collateral by Debtor typically includes several provisions to protect the interests of both the debtor and the secured party. It outlines the rights, obligations, and remedies available to each party and serves as evidence of the security interest held by the secured party. One key aspect of this agreement is the provision regarding the sale of collateral by the debtor. In situations where the debtor defaults on their obligations, the secured party may have the right to sell the collateral to recover the debt owed. By including this provision, the debtor agrees to allow the sale of the collateral, subject to certain conditions, enabling the secured party to satisfy the debt from the proceeds of the sale. Different types of Delaware Security Agreement involving Sale of Collateral by Debtor may vary based on the type of collateral involved or the specific terms and conditions agreed upon by the parties. Some common variations include: 1. Delaware Security Agreement involving Sale of Personal Property: This type of agreement focuses on securing a debt with personal property, such as vehicles, equipment, or machinery owned by the debtor. 2. Delaware Security Agreement involving Sale of Accounts Receivable: In this case, the debtor grants a security interest in their accounts receivable, ensuring that the creditor is repaid from the proceeds generated by the collection of outstanding invoices. 3. Delaware Security Agreement involving Sale of Inventory: This agreement is commonly used by businesses that want to secure their inventory as collateral for a loan. The debtor grants a security interest in the inventory, allowing the creditor to sell it in case of default. It is important to note that each Delaware Security Agreement involving Sale of Collateral by Debtor should be carefully reviewed and customized according to the specific requirements of the transaction and the parties involved. Seeking legal advice before entering into such an agreement is strongly recommended ensuring compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Acuerdo de garantía que involucra la venta de garantía por parte del deudor - Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Delaware Acuerdo De Garantía Que Involucra La Venta De Garantía Por Parte Del Deudor?

Are you presently in a position where you need papers for either business or individual reasons almost every working day? There are a variety of legal file templates accessible on the Internet, but locating kinds you can depend on is not effortless. US Legal Forms gives thousands of type templates, just like the Delaware Security Agreement involving Sale of Collateral by Debtor, which are written to satisfy state and federal requirements.

In case you are currently familiar with US Legal Forms website and possess a free account, simply log in. Following that, it is possible to download the Delaware Security Agreement involving Sale of Collateral by Debtor web template.

If you do not offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Discover the type you want and ensure it is for that correct town/area.

- Utilize the Preview option to check the form.

- Read the explanation to actually have selected the proper type.

- In the event the type is not what you`re trying to find, utilize the Research field to obtain the type that meets your requirements and requirements.

- Once you find the correct type, click Purchase now.

- Choose the costs plan you would like, fill in the specified info to produce your bank account, and pay money for an order utilizing your PayPal or credit card.

- Choose a hassle-free data file format and download your duplicate.

Find every one of the file templates you may have bought in the My Forms menu. You can obtain a further duplicate of Delaware Security Agreement involving Sale of Collateral by Debtor whenever, if possible. Just go through the required type to download or print out the file web template.

Use US Legal Forms, the most considerable variety of legal varieties, to conserve time and prevent mistakes. The support gives professionally produced legal file templates which you can use for a selection of reasons. Generate a free account on US Legal Forms and start making your lifestyle a little easier.