Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to impart validity to the instrument and entitle it to probate. A valid testamentary trust is created only where the purported will attempting to create it complies with the formalities of the statute of wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling provisions governing the execution of wills. Pertinent statutes should be consulted.

In general terms, a remainder interest refers to someone with a future interest in an asset. It may be a future interest in the estate created by a trust, a contingent interest when a life tenant surrenders a claim to the estate, or a vested interest that becomes effective at a specified future date. It is often created when a grantor leaves property to pass to a family member upon the grantor's death.

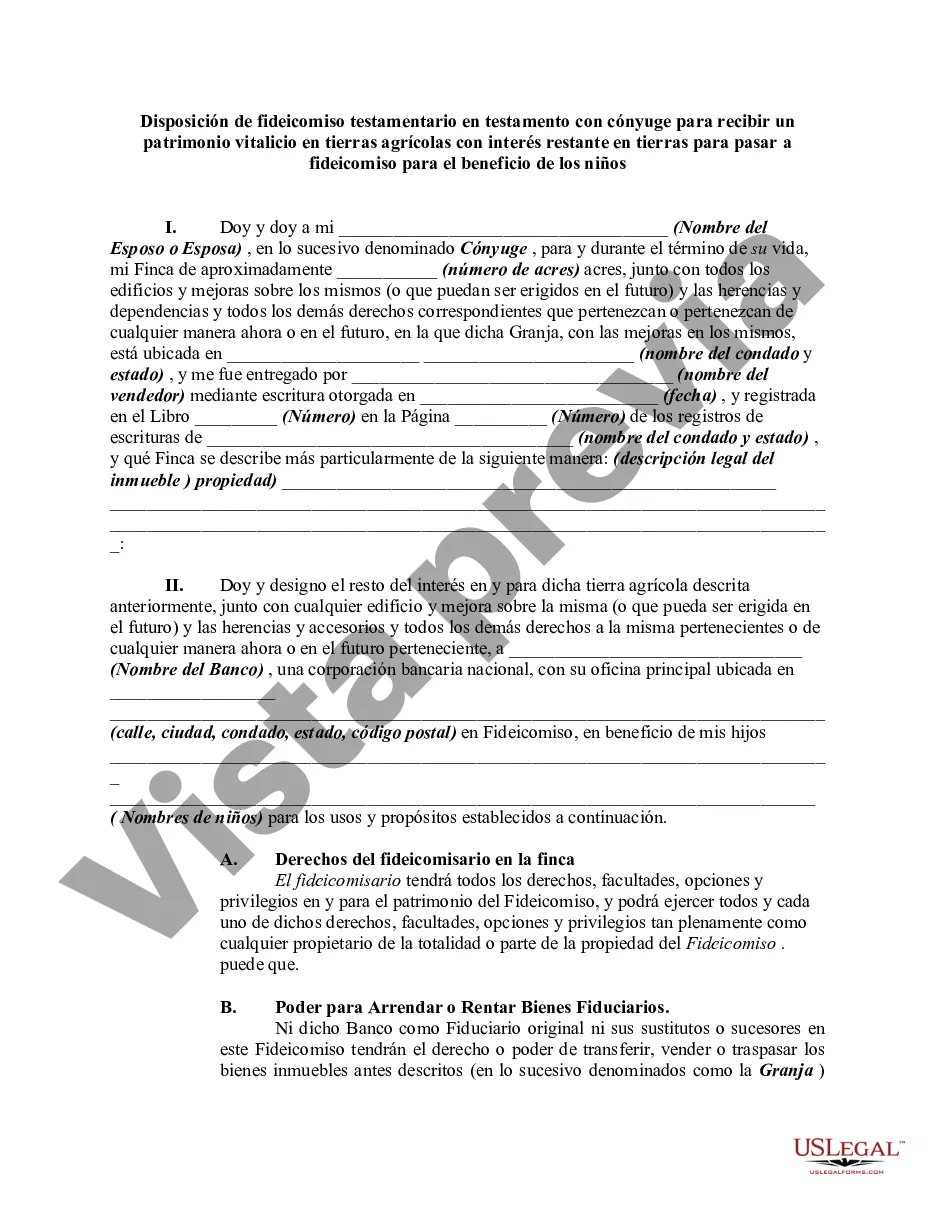

Delaware Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farm Land with Remainder Interest in Land to Pass to Trust for the Benefit of Children In Delaware, a testamentary trust provision in a will can be created to ensure the preservation and management of farm land while also providing for the surviving spouse and children. This estate planning strategy allows the surviving spouse to have a life estate in the farm land, providing them with the use and enjoyment of the property during their lifetime. Upon the death of the surviving spouse, the remainder interest in the land passes to a trust established for the benefit of the children, ensuring the long-term sustainability of the property and its income-generating potential. This particular type of trust provision stands out as a common approach for individuals who wish to keep the family farm within the family, providing for the financial well-being and future generations. The trust offers several benefits, including asset protection, tax advantages, and the ability to control and distribute assets according to the testator's wishes. Key elements of the Delaware Testamentary Trust Provision: 1. Life Estate for the Surviving Spouse: The surviving spouse is granted the right to use and occupy the farm land, including any structures and improvements, for their lifetime. This allows them to have a secure place to reside and enjoy the benefits of the property without the concern of ownership. 2. Remainder Interest in Land: Upon the death of the surviving spouse, the ownership of the farm land passes to a trust that has been established for the benefit of the children. This remainder interest ensures that the land is effectively preserved for future generations, maintaining its agricultural value and potential. 3. Trust Administration: The testamentary trust is typically administered by a trustee, who has the responsibility to manage and distribute the trust assets appropriately. The trustee can be a professional entity or an individual trusted by the testator, ensuring the assets are safeguarded and prudently invested. 4. Beneficiary Designations: The children or designated beneficiaries receive the remainder interest in the land upon the death of the surviving spouse. The testator can specify how the assets should be distributed, whether equally among the children or in any other desired proportion. Different types of Delaware Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farm Land with Remainder Interest in Land to Pass to Trust for the Benefit of Children: 1. Revocable Testamentary Trust: This trust provision can be altered or revoked during the testator's lifetime, providing flexibility in case of changing circumstances. 2. Irrevocable Testamentary Trust: Once established, this trust provision cannot be modified or terminated without the consent of the beneficiaries, offering more control over the distribution and preservation of assets. 3. Generation-Skipping Testamentary Trust: This type of trust provision allows for the assets to "skip" a generation, benefiting grandchildren directly. This can provide potential tax advantages and long-term financial planning for future descendants. In summary, the Delaware Testamentary Trust Provision in a Will with a Spouse to Receive a Life Estate in Farm Land and Remainder Interest in Land to Pass to a Trust for the Benefit of Children is a powerful estate planning tool for individuals seeking to secure the continuity of their family farm and provide for their loved ones. With carefully drafted provisions and the appropriate choice of trust type, this strategy can ensure the preservation, management, and sustainable growth of the land for generations to come.Delaware Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farm Land with Remainder Interest in Land to Pass to Trust for the Benefit of Children In Delaware, a testamentary trust provision in a will can be created to ensure the preservation and management of farm land while also providing for the surviving spouse and children. This estate planning strategy allows the surviving spouse to have a life estate in the farm land, providing them with the use and enjoyment of the property during their lifetime. Upon the death of the surviving spouse, the remainder interest in the land passes to a trust established for the benefit of the children, ensuring the long-term sustainability of the property and its income-generating potential. This particular type of trust provision stands out as a common approach for individuals who wish to keep the family farm within the family, providing for the financial well-being and future generations. The trust offers several benefits, including asset protection, tax advantages, and the ability to control and distribute assets according to the testator's wishes. Key elements of the Delaware Testamentary Trust Provision: 1. Life Estate for the Surviving Spouse: The surviving spouse is granted the right to use and occupy the farm land, including any structures and improvements, for their lifetime. This allows them to have a secure place to reside and enjoy the benefits of the property without the concern of ownership. 2. Remainder Interest in Land: Upon the death of the surviving spouse, the ownership of the farm land passes to a trust that has been established for the benefit of the children. This remainder interest ensures that the land is effectively preserved for future generations, maintaining its agricultural value and potential. 3. Trust Administration: The testamentary trust is typically administered by a trustee, who has the responsibility to manage and distribute the trust assets appropriately. The trustee can be a professional entity or an individual trusted by the testator, ensuring the assets are safeguarded and prudently invested. 4. Beneficiary Designations: The children or designated beneficiaries receive the remainder interest in the land upon the death of the surviving spouse. The testator can specify how the assets should be distributed, whether equally among the children or in any other desired proportion. Different types of Delaware Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farm Land with Remainder Interest in Land to Pass to Trust for the Benefit of Children: 1. Revocable Testamentary Trust: This trust provision can be altered or revoked during the testator's lifetime, providing flexibility in case of changing circumstances. 2. Irrevocable Testamentary Trust: Once established, this trust provision cannot be modified or terminated without the consent of the beneficiaries, offering more control over the distribution and preservation of assets. 3. Generation-Skipping Testamentary Trust: This type of trust provision allows for the assets to "skip" a generation, benefiting grandchildren directly. This can provide potential tax advantages and long-term financial planning for future descendants. In summary, the Delaware Testamentary Trust Provision in a Will with a Spouse to Receive a Life Estate in Farm Land and Remainder Interest in Land to Pass to a Trust for the Benefit of Children is a powerful estate planning tool for individuals seeking to secure the continuity of their family farm and provide for their loved ones. With carefully drafted provisions and the appropriate choice of trust type, this strategy can ensure the preservation, management, and sustainable growth of the land for generations to come.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.