When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Delaware Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties: Dear [Credit Card Company], I hope this letter finds you well. I am writing to express my current financial difficulties and to request a modification in my credit card payment plan. I have been a loyal customer of your esteemed institution for [number] of years and have always strived to make timely payments. However, due to unforeseen circumstances, I am currently facing significant financial hardship that makes it increasingly difficult for me to meet my monthly payment obligations. First and foremost, as a resident of Delaware, I understand the importance of fulfilling my financial obligations. However, given the ongoing pandemic and the resulting economic downturn, my financial situation has significantly deteriorated. I have encountered unexpected medical expenses, loss of income, and other financial burdens that have made it increasingly challenging for me to maintain my standard of living, let alone meet my credit card payment obligations. Considering my dedication to maintaining a good credit history, I am determined to find a viable solution to my current financial predicament. I am eager to continue my financial relationship with your esteemed institution and believe that by modifying my payment plan, I will be better positioned to fulfill my obligations over time while minimizing the impact on both parties involved. I would greatly appreciate it if we could explore the following options to address my financial difficulties: 1. Payment Reduction: Requesting a temporary reduction in my monthly payments until I can stabilize my financial situation. This could include a decrease in the minimum payment amount, a lower interest rate, or the suspension of late payment fees. 2. Extended Repayment Plan: Inquire about the possibility of extending the repayment term for a specific period, allowing for smaller, more manageable monthly payments. 3. Balance Transfer: Discuss the potential option of transferring my credit card balance to a lower interest rate credit card or consolidating my debts into a personal loan in order to reduce the overall financial burden. 4. Financial Hardship Program: Explore your institution's financial hardship programs, if available, that could provide temporary relief and modified payment plans specifically designed for customers going through these challenging economic times. Furthermore, I would be more than willing to provide you with any additional documentation or information necessary to support my request. This includes bank statements, pay stubs, income verification, or any other form of relevant proof that may help clarify my current financial situation. I genuinely value the relationship I have built with your company over the years, and I am committed to openly communicate and work towards a resolution that benefits both parties. I kindly request your understanding, flexibility, and consideration in addressing my financial difficulties promptly. Thank you for your time and attention to this matter. I eagerly await your reply and hope for a positive outcome that will enable me to continue meeting my financial obligations. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Other Types of Delaware Letters to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties: — Delaware Letter to Credit Card Company Seeking to Lower Interest Rates — Delaware Letter to Credit Card Company Explaining Unemployment and Requesting Payment Adjustment — Delaware Letter to Credit Card Company Requesting Debt Settlement Options — Delaware Letter to Credit Card Company Seeking Temporary Payment Suspension — Delaware Letter to Credit Card Company Requesting Financial Aid or Grants for Emergency SituationsDelaware Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties: Dear [Credit Card Company], I hope this letter finds you well. I am writing to express my current financial difficulties and to request a modification in my credit card payment plan. I have been a loyal customer of your esteemed institution for [number] of years and have always strived to make timely payments. However, due to unforeseen circumstances, I am currently facing significant financial hardship that makes it increasingly difficult for me to meet my monthly payment obligations. First and foremost, as a resident of Delaware, I understand the importance of fulfilling my financial obligations. However, given the ongoing pandemic and the resulting economic downturn, my financial situation has significantly deteriorated. I have encountered unexpected medical expenses, loss of income, and other financial burdens that have made it increasingly challenging for me to maintain my standard of living, let alone meet my credit card payment obligations. Considering my dedication to maintaining a good credit history, I am determined to find a viable solution to my current financial predicament. I am eager to continue my financial relationship with your esteemed institution and believe that by modifying my payment plan, I will be better positioned to fulfill my obligations over time while minimizing the impact on both parties involved. I would greatly appreciate it if we could explore the following options to address my financial difficulties: 1. Payment Reduction: Requesting a temporary reduction in my monthly payments until I can stabilize my financial situation. This could include a decrease in the minimum payment amount, a lower interest rate, or the suspension of late payment fees. 2. Extended Repayment Plan: Inquire about the possibility of extending the repayment term for a specific period, allowing for smaller, more manageable monthly payments. 3. Balance Transfer: Discuss the potential option of transferring my credit card balance to a lower interest rate credit card or consolidating my debts into a personal loan in order to reduce the overall financial burden. 4. Financial Hardship Program: Explore your institution's financial hardship programs, if available, that could provide temporary relief and modified payment plans specifically designed for customers going through these challenging economic times. Furthermore, I would be more than willing to provide you with any additional documentation or information necessary to support my request. This includes bank statements, pay stubs, income verification, or any other form of relevant proof that may help clarify my current financial situation. I genuinely value the relationship I have built with your company over the years, and I am committed to openly communicate and work towards a resolution that benefits both parties. I kindly request your understanding, flexibility, and consideration in addressing my financial difficulties promptly. Thank you for your time and attention to this matter. I eagerly await your reply and hope for a positive outcome that will enable me to continue meeting my financial obligations. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Other Types of Delaware Letters to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties: — Delaware Letter to Credit Card Company Seeking to Lower Interest Rates — Delaware Letter to Credit Card Company Explaining Unemployment and Requesting Payment Adjustment — Delaware Letter to Credit Card Company Requesting Debt Settlement Options — Delaware Letter to Credit Card Company Seeking Temporary Payment Suspension — Delaware Letter to Credit Card Company Requesting Financial Aid or Grants for Emergency Situations

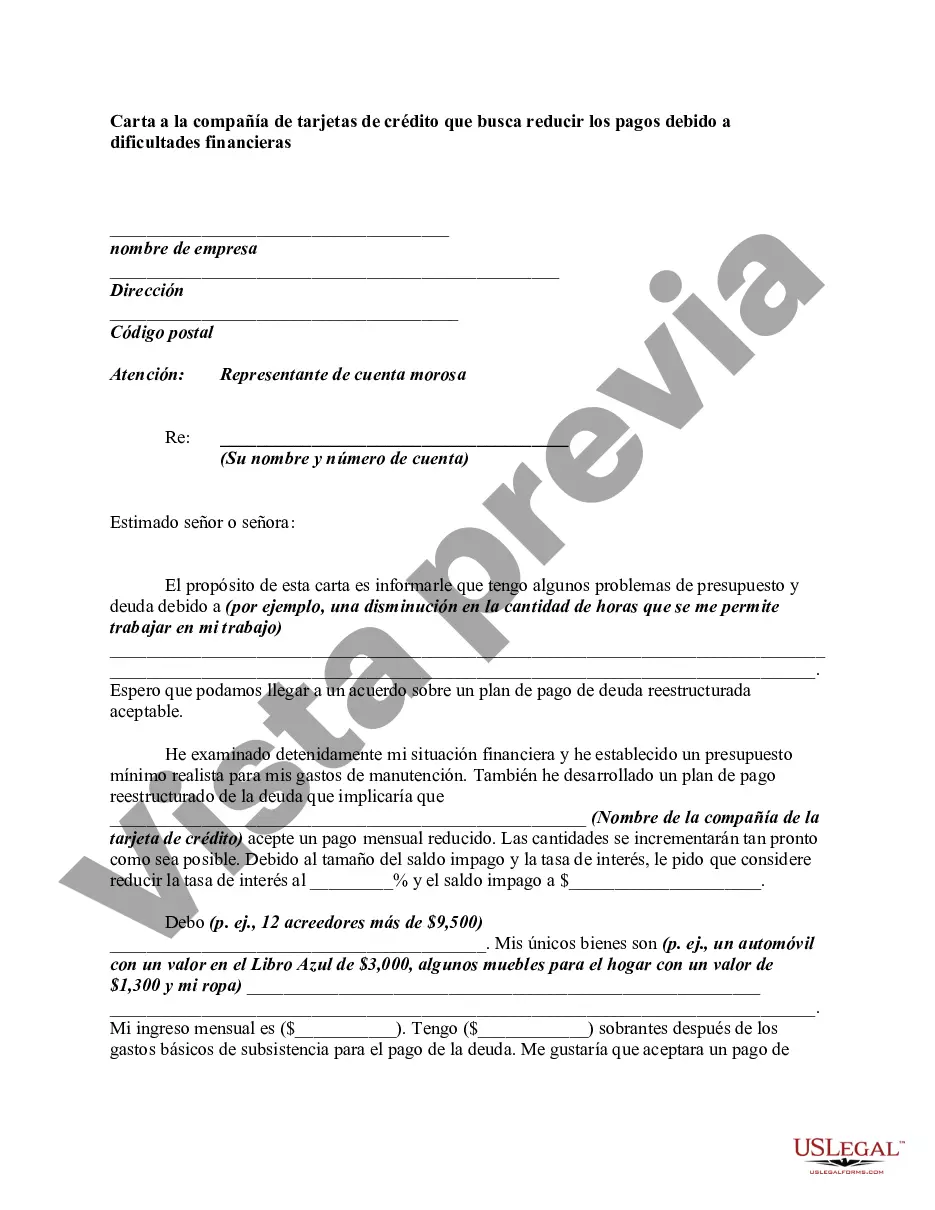

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.