In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Delaware Report from Review of Financial Statements and Compilation by Accounting Firm: A Comprehensive Overview Introduction: In the field of accounting and financial reporting, the Delaware Report from Review of Financial Statements and Compilation by an Accounting Firm plays a vital role. This report, commonly prepared by certified public accountants (CPA's) or accounting firms, serves as a detailed analysis of a company's financial health and compliance with regulations. Covering various aspects such as balance sheets, income statements, cash flows, and notes to financial statements, the Delaware report provides investors, lenders, and stakeholders with accurate and reliable information for decision-making. Types of Delaware Report from Review of Financial Statements and Compilation by Accounting Firm: 1. Compilation Report: A compilation report is a type of Delaware report prepared by an accounting firm that serves to present financial information in the form of financial statements, without providing any level of assurance regarding their accuracy or conformity with generally accepted accounting principles (GAAP). This report is appropriate when users of the financial statements do not need assurance on their reliability but still require assistance in presenting the information in a proper format. 2. Review Report: A review report is another type of Delaware report prepared by an accounting firm, which provides limited assurance that the financial statements are free of material misstatement. Unlike an audit report, a review report only expresses moderate assurance, making it a more cost-effective option for companies and stakeholders who do not require a higher degree of assurance but still need confidence in the financial statements. Components of the Delaware Report from Review of Financial Statements and Compilation by an Accounting Firm: 1. Introduction and Scope: The report begins with an introduction that outlines the purpose, scope, and limitations of the review or compilation engagement. It clarifies the specific regulations and accounting standards followed, ensuring the readers have a clear understanding of the report's objective and the information contained within. 2. Management's Responsibility: This section outlines the responsibility of the company's management in preparing and presenting the financial statements in accordance with applicable accounting principles. It states that the management is responsible for the preparation, accuracy, and completeness of the financial information provided in the report. 3. Accountant's Responsibility: Here, the accounting firm describes its role and responsibilities in relation to the review or compilation engagement. It explains that the firm conducts the engagement in accordance with applicable professional standards, ensuring independence, objectivity, and due care throughout the process. 4. Review Procedures or Compilation Process: In a review report, this section provides an overview of the procedures performed by the accounting firm to obtain limited assurance on the financial statements. It may include inquiries, analytical procedures, and other review techniques employed to assess the reasonableness of the financial information. In a compilation report, this section describes the process of compilation, which involves gathering, classifying, and summarizing financial data provided by the management. It explains that no assessment of the reasonableness and accuracy of the information has been made. 5. Findings and Recommendations: The report summarizes the identified findings, if any, resulting from the review or compilation procedures performed. Recommendations may be provided to address any significant issues or potential areas of improvement, aiming to enhance the reliability and usefulness of the financial statements. If no material misstatements or concerns are found, this section states the absence thereof. 6. Report Opinion or Disclaimer: In a review report, this section expresses the accountant's professional opinion on whether the financial statements present fairly, in all material respects, the financial position, results of operations, and cash flows of the company in accordance with the applicable financial reporting framework. In a compilation report, this section includes a disclaimer, stating that no assurance is provided regarding the accuracy or conformity of the financial statements to the applicable financial reporting framework. Conclusion: In conclusion, the Delaware Report from Review of Financial Statements and Compilation by an Accounting Firm is a crucial tool for businesses, investors, and stakeholders. These reports, available in various types, provide valuable insights into a company's financial performance and serve as a basis for decision-making. By presenting accurate and relevant financial information, accounting firms play a pivotal role in maintaining transparency and trust in the financial markets.Delaware Report from Review of Financial Statements and Compilation by Accounting Firm: A Comprehensive Overview Introduction: In the field of accounting and financial reporting, the Delaware Report from Review of Financial Statements and Compilation by an Accounting Firm plays a vital role. This report, commonly prepared by certified public accountants (CPA's) or accounting firms, serves as a detailed analysis of a company's financial health and compliance with regulations. Covering various aspects such as balance sheets, income statements, cash flows, and notes to financial statements, the Delaware report provides investors, lenders, and stakeholders with accurate and reliable information for decision-making. Types of Delaware Report from Review of Financial Statements and Compilation by Accounting Firm: 1. Compilation Report: A compilation report is a type of Delaware report prepared by an accounting firm that serves to present financial information in the form of financial statements, without providing any level of assurance regarding their accuracy or conformity with generally accepted accounting principles (GAAP). This report is appropriate when users of the financial statements do not need assurance on their reliability but still require assistance in presenting the information in a proper format. 2. Review Report: A review report is another type of Delaware report prepared by an accounting firm, which provides limited assurance that the financial statements are free of material misstatement. Unlike an audit report, a review report only expresses moderate assurance, making it a more cost-effective option for companies and stakeholders who do not require a higher degree of assurance but still need confidence in the financial statements. Components of the Delaware Report from Review of Financial Statements and Compilation by an Accounting Firm: 1. Introduction and Scope: The report begins with an introduction that outlines the purpose, scope, and limitations of the review or compilation engagement. It clarifies the specific regulations and accounting standards followed, ensuring the readers have a clear understanding of the report's objective and the information contained within. 2. Management's Responsibility: This section outlines the responsibility of the company's management in preparing and presenting the financial statements in accordance with applicable accounting principles. It states that the management is responsible for the preparation, accuracy, and completeness of the financial information provided in the report. 3. Accountant's Responsibility: Here, the accounting firm describes its role and responsibilities in relation to the review or compilation engagement. It explains that the firm conducts the engagement in accordance with applicable professional standards, ensuring independence, objectivity, and due care throughout the process. 4. Review Procedures or Compilation Process: In a review report, this section provides an overview of the procedures performed by the accounting firm to obtain limited assurance on the financial statements. It may include inquiries, analytical procedures, and other review techniques employed to assess the reasonableness of the financial information. In a compilation report, this section describes the process of compilation, which involves gathering, classifying, and summarizing financial data provided by the management. It explains that no assessment of the reasonableness and accuracy of the information has been made. 5. Findings and Recommendations: The report summarizes the identified findings, if any, resulting from the review or compilation procedures performed. Recommendations may be provided to address any significant issues or potential areas of improvement, aiming to enhance the reliability and usefulness of the financial statements. If no material misstatements or concerns are found, this section states the absence thereof. 6. Report Opinion or Disclaimer: In a review report, this section expresses the accountant's professional opinion on whether the financial statements present fairly, in all material respects, the financial position, results of operations, and cash flows of the company in accordance with the applicable financial reporting framework. In a compilation report, this section includes a disclaimer, stating that no assurance is provided regarding the accuracy or conformity of the financial statements to the applicable financial reporting framework. Conclusion: In conclusion, the Delaware Report from Review of Financial Statements and Compilation by an Accounting Firm is a crucial tool for businesses, investors, and stakeholders. These reports, available in various types, provide valuable insights into a company's financial performance and serve as a basis for decision-making. By presenting accurate and relevant financial information, accounting firms play a pivotal role in maintaining transparency and trust in the financial markets.

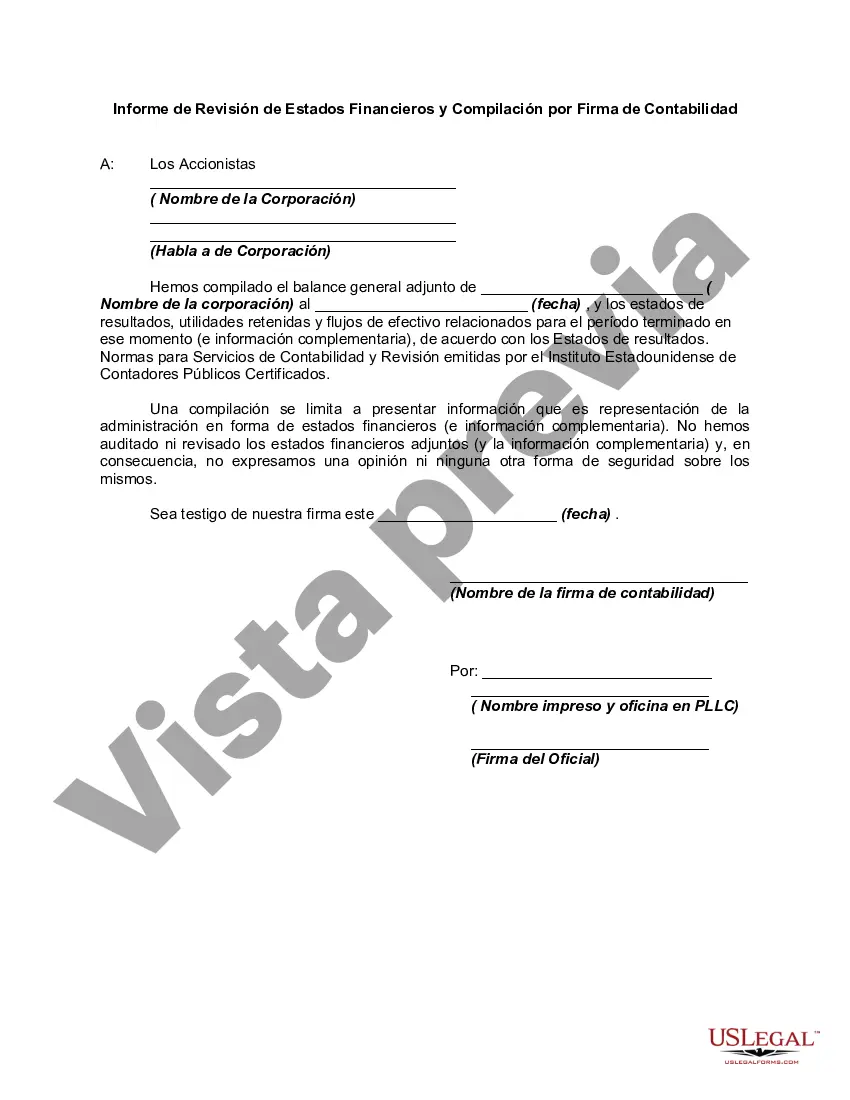

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.