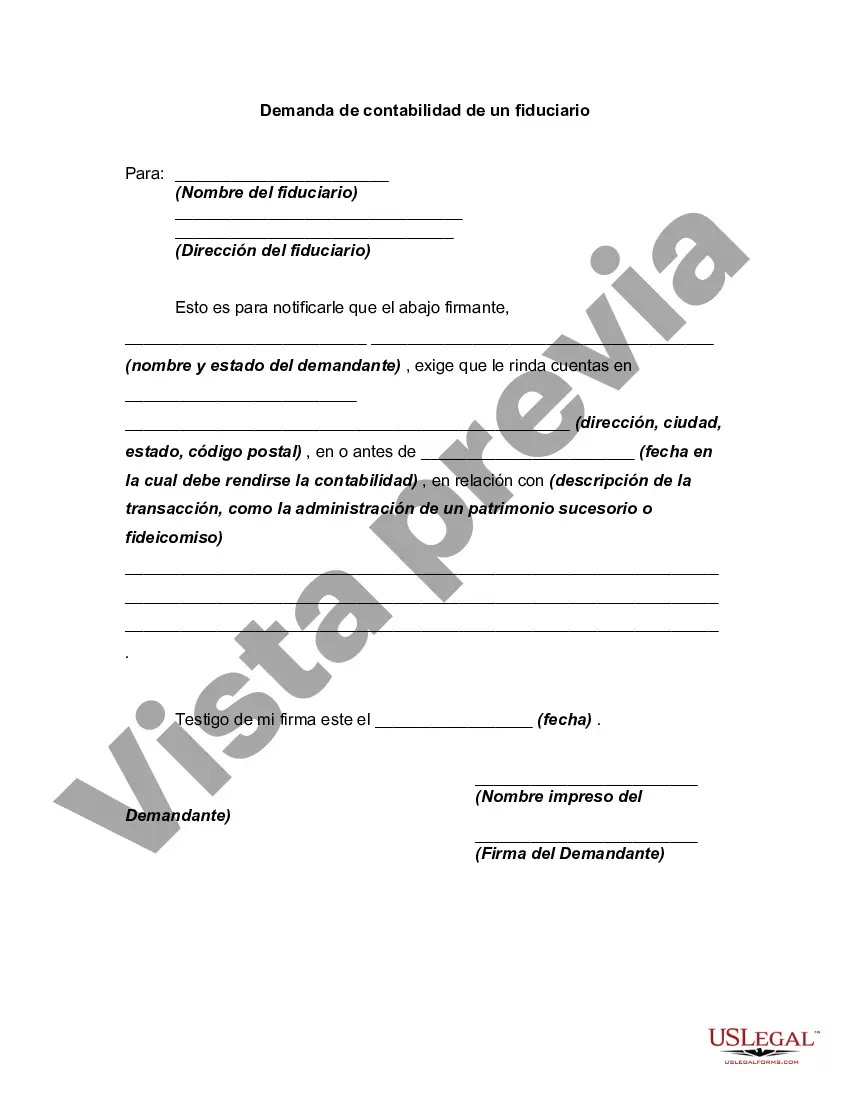

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Demand for Accounting from a Fiduciary Introduction: In Delaware, a fiduciary is expected to act in the best interests of the beneficiaries and manage their assets or affairs diligently. To ensure transparency and accountability, beneficiaries have the right to demand accounting information from their fiduciaries. Delaware Demand for Accounting from a Fiduciary refers to the legal process through which beneficiaries can request a detailed report of the fiduciary's financial activities, transactions, and overall management performance. This helps protect the interests of beneficiaries and encourages fiduciaries to act prudently and responsibly. Types of Delaware Demand for Accounting from a Fiduciary: 1. Traditional Demand for Accounting: This is the standard type of demand for accounting, where beneficiaries request a comprehensive report of the fiduciary's actions, including financial statements, disbursements, investments, and financial performance. It provides a complete overview of the fiduciary's activities to ensure compliance with their duties. 2. Limited Demand for Accounting: In certain cases, beneficiaries may only require limited information on specific aspects of the fiduciary's management, such as certain financial transactions or investment decisions. A limited demand for accounting allows beneficiaries to focus on specific concerns or areas of interest while obtaining targeted information. 3. Periodic Demand for Accounting: Some beneficiaries may prefer to receive regular accounting reports at set intervals rather than initiating demands on an ad hoc basis. Periodic demands for accounting allow beneficiaries to receive routine updates and observe the fiduciary's ongoing activities and performance without the need for specific triggers or events. 4. Contested Demand for Accounting: In situations where beneficiaries suspect mismanagement, embezzlement, or breach of fiduciary duties, they may file a contested demand for accounting. This type of demand often arises when conflicts of interest or improper financial transactions are suspected. It triggers a more extensive investigation of the fiduciary's actions, involving courts or alternative dispute resolution methods. Keywords: — Delaware fiduciaraccountabilityit— - Demand for Accounting from a Fiduciary Delaware — Delaware fiduciardutiesie— - Delaware beneficiaries' rights — Delaware fiduciartransparentnc— - Delaware fiduciary reporting — Delaware standardized accounting demand — Delaware periodic accountinrequestes— - Delaware contested accounting demand — Delaware fiduciary mismanagement investigationDelaware Demand for Accounting from a Fiduciary Introduction: In Delaware, a fiduciary is expected to act in the best interests of the beneficiaries and manage their assets or affairs diligently. To ensure transparency and accountability, beneficiaries have the right to demand accounting information from their fiduciaries. Delaware Demand for Accounting from a Fiduciary refers to the legal process through which beneficiaries can request a detailed report of the fiduciary's financial activities, transactions, and overall management performance. This helps protect the interests of beneficiaries and encourages fiduciaries to act prudently and responsibly. Types of Delaware Demand for Accounting from a Fiduciary: 1. Traditional Demand for Accounting: This is the standard type of demand for accounting, where beneficiaries request a comprehensive report of the fiduciary's actions, including financial statements, disbursements, investments, and financial performance. It provides a complete overview of the fiduciary's activities to ensure compliance with their duties. 2. Limited Demand for Accounting: In certain cases, beneficiaries may only require limited information on specific aspects of the fiduciary's management, such as certain financial transactions or investment decisions. A limited demand for accounting allows beneficiaries to focus on specific concerns or areas of interest while obtaining targeted information. 3. Periodic Demand for Accounting: Some beneficiaries may prefer to receive regular accounting reports at set intervals rather than initiating demands on an ad hoc basis. Periodic demands for accounting allow beneficiaries to receive routine updates and observe the fiduciary's ongoing activities and performance without the need for specific triggers or events. 4. Contested Demand for Accounting: In situations where beneficiaries suspect mismanagement, embezzlement, or breach of fiduciary duties, they may file a contested demand for accounting. This type of demand often arises when conflicts of interest or improper financial transactions are suspected. It triggers a more extensive investigation of the fiduciary's actions, involving courts or alternative dispute resolution methods. Keywords: — Delaware fiduciaraccountabilityit— - Demand for Accounting from a Fiduciary Delaware — Delaware fiduciardutiesie— - Delaware beneficiaries' rights — Delaware fiduciartransparentnc— - Delaware fiduciary reporting — Delaware standardized accounting demand — Delaware periodic accountinrequestes— - Delaware contested accounting demand — Delaware fiduciary mismanagement investigation

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.