A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

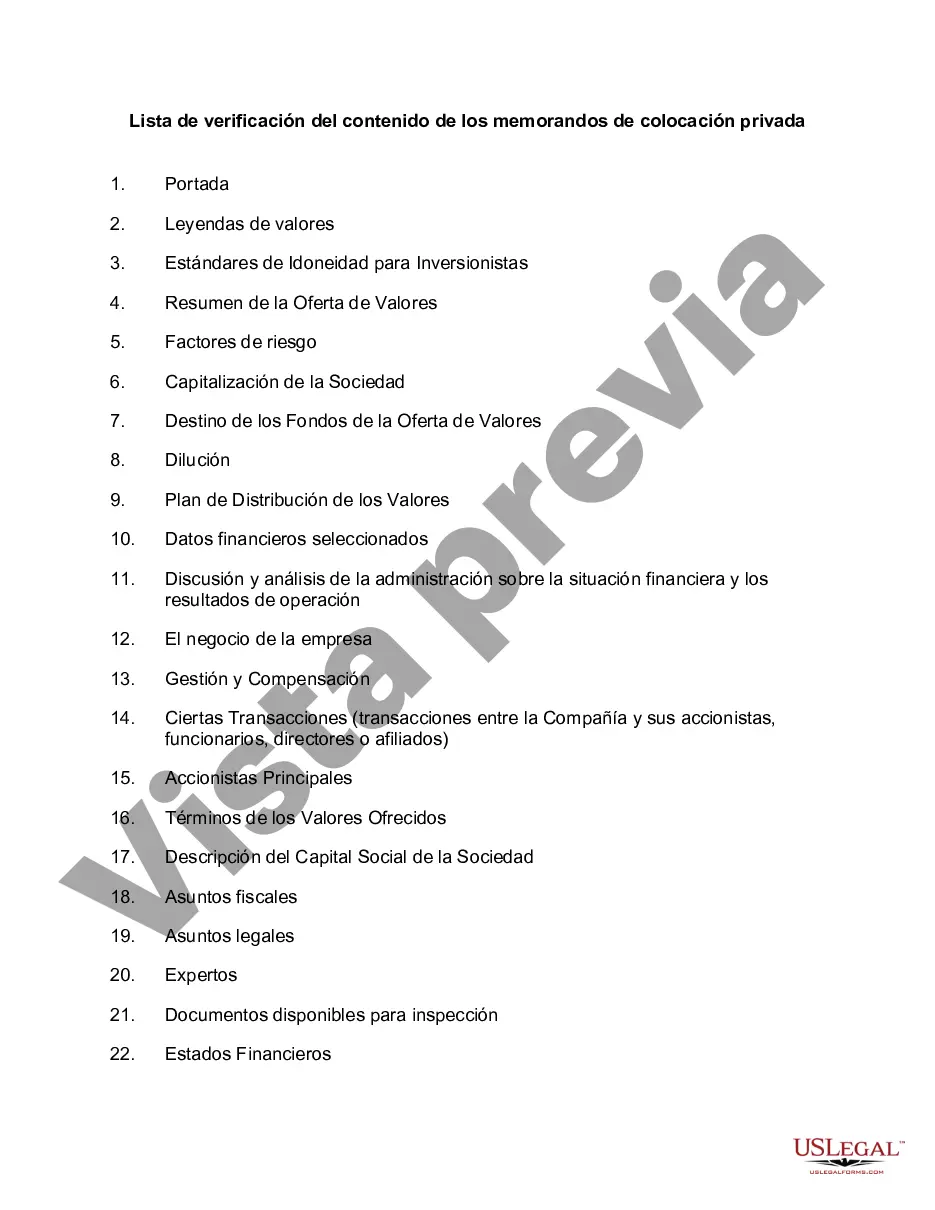

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Delaware Checklist for Contents of Private Placement Memorandum A private placement memorandum (PPM) is a legal document that outlines the terms and conditions of a securities offering to potential investors. In Delaware, there are certain requirements regarding the contents of a PPM that issuers must adhere to in order to comply with state regulations. This comprehensive checklist provides an overview of the key components that should be included in a Delaware PPM. 1. Cover Page: The PPM should start with a cover page that includes the name of the issuer, the type of securities being offered, and the date of the memorandum. 2. Table of Contents: A table of contents is essential for easy navigation within the PPM. It should list all the sections and subsections along with their respective page numbers. 3. Introduction: This section provides a brief introduction to the issuer, its business, and the purpose of the PPM. It may also include a disclaimer regarding the document's legal nature and investment risks. 4. Summary of Offering: This section presents an overview of the securities being offered, including the total offering amount, price per security, and any minimum investment requirements. 5. Risk Factors: A comprehensive list of potential risks associated with the investment should be outlined in this section. These risks may include market volatility, regulatory changes, competition, or specific risks related to the issuer's industry. 6. Business Overview: Here, issuers must provide a detailed description of their business operations, including its history, products or services offered, target market, competitive advantages, and future growth prospects. 7. Management Team: This section should introduce the key members of the management team, including their professional backgrounds, relevant experience, and areas of expertise. 8. Plan of Distribution: The PPM should specify how the securities will be offered and sold. This includes information about any underwriters, agents, or brokers involved in the distribution process. 9. Use of Proceeds: Issuers must detail how the funds raised from the offering will be used. It should outline specific purposes such as product development, marketing, working capital, or debt repayment. 10. Financial Information: This section requires the inclusion of audited financial statements for the issuer. These statements should provide a clear picture of the company's financial performance, including balance sheets, income statements, and cash flow statements. 11. Legal Matters: Any pending or potential legal proceedings, regulatory investigations, or intellectual property issues should be disclosed in this section. 12. Subscription Agreement: The PPM should include a subscription agreement that potential investors can use to subscribe to the securities being offered. This agreement should outline the terms and conditions of the investment. Different Types of Delaware Checklist for Contents of Private Placement Memorandum: 1. Equity Securities Offering: This type of PPM is used when an issuer wants to offer equity securities such as common stock or preferred shares to investors. 2. Debt Securities Offering: A PPM for debt securities, like bonds or notes, will have additional sections detailing the terms of the debt, including interest rates, maturity dates, and repayment terms. 3. Real Estate Investment Offering: For real estate investment offerings, the PPM will have specific sections covering property details, market analysis, rental income projections, and property management considerations. 4. Start-up Offering: When a start-up company seeks investment through a private placement, the PPM will emphasize the company's growth potential, technology innovation, and scalability. In conclusion, a Delaware private placement memorandum must follow a well-defined checklist, including sections on the cover page, table of contents, introduction, summary of offering, risk factors, business overview, management team, plan of distribution, use of proceeds, financial information, legal matters, and subscription agreement. Additional variations exist depending on the specific type of offering, such as equity securities, debt securities, real estate investments, or start-up ventures. By ensuring compliance with the Delaware checklist, issuers can provide potential investors with a comprehensive understanding of their offering while satisfying state regulatory requirements.Delaware Checklist for Contents of Private Placement Memorandum A private placement memorandum (PPM) is a legal document that outlines the terms and conditions of a securities offering to potential investors. In Delaware, there are certain requirements regarding the contents of a PPM that issuers must adhere to in order to comply with state regulations. This comprehensive checklist provides an overview of the key components that should be included in a Delaware PPM. 1. Cover Page: The PPM should start with a cover page that includes the name of the issuer, the type of securities being offered, and the date of the memorandum. 2. Table of Contents: A table of contents is essential for easy navigation within the PPM. It should list all the sections and subsections along with their respective page numbers. 3. Introduction: This section provides a brief introduction to the issuer, its business, and the purpose of the PPM. It may also include a disclaimer regarding the document's legal nature and investment risks. 4. Summary of Offering: This section presents an overview of the securities being offered, including the total offering amount, price per security, and any minimum investment requirements. 5. Risk Factors: A comprehensive list of potential risks associated with the investment should be outlined in this section. These risks may include market volatility, regulatory changes, competition, or specific risks related to the issuer's industry. 6. Business Overview: Here, issuers must provide a detailed description of their business operations, including its history, products or services offered, target market, competitive advantages, and future growth prospects. 7. Management Team: This section should introduce the key members of the management team, including their professional backgrounds, relevant experience, and areas of expertise. 8. Plan of Distribution: The PPM should specify how the securities will be offered and sold. This includes information about any underwriters, agents, or brokers involved in the distribution process. 9. Use of Proceeds: Issuers must detail how the funds raised from the offering will be used. It should outline specific purposes such as product development, marketing, working capital, or debt repayment. 10. Financial Information: This section requires the inclusion of audited financial statements for the issuer. These statements should provide a clear picture of the company's financial performance, including balance sheets, income statements, and cash flow statements. 11. Legal Matters: Any pending or potential legal proceedings, regulatory investigations, or intellectual property issues should be disclosed in this section. 12. Subscription Agreement: The PPM should include a subscription agreement that potential investors can use to subscribe to the securities being offered. This agreement should outline the terms and conditions of the investment. Different Types of Delaware Checklist for Contents of Private Placement Memorandum: 1. Equity Securities Offering: This type of PPM is used when an issuer wants to offer equity securities such as common stock or preferred shares to investors. 2. Debt Securities Offering: A PPM for debt securities, like bonds or notes, will have additional sections detailing the terms of the debt, including interest rates, maturity dates, and repayment terms. 3. Real Estate Investment Offering: For real estate investment offerings, the PPM will have specific sections covering property details, market analysis, rental income projections, and property management considerations. 4. Start-up Offering: When a start-up company seeks investment through a private placement, the PPM will emphasize the company's growth potential, technology innovation, and scalability. In conclusion, a Delaware private placement memorandum must follow a well-defined checklist, including sections on the cover page, table of contents, introduction, summary of offering, risk factors, business overview, management team, plan of distribution, use of proceeds, financial information, legal matters, and subscription agreement. Additional variations exist depending on the specific type of offering, such as equity securities, debt securities, real estate investments, or start-up ventures. By ensuring compliance with the Delaware checklist, issuers can provide potential investors with a comprehensive understanding of their offering while satisfying state regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.