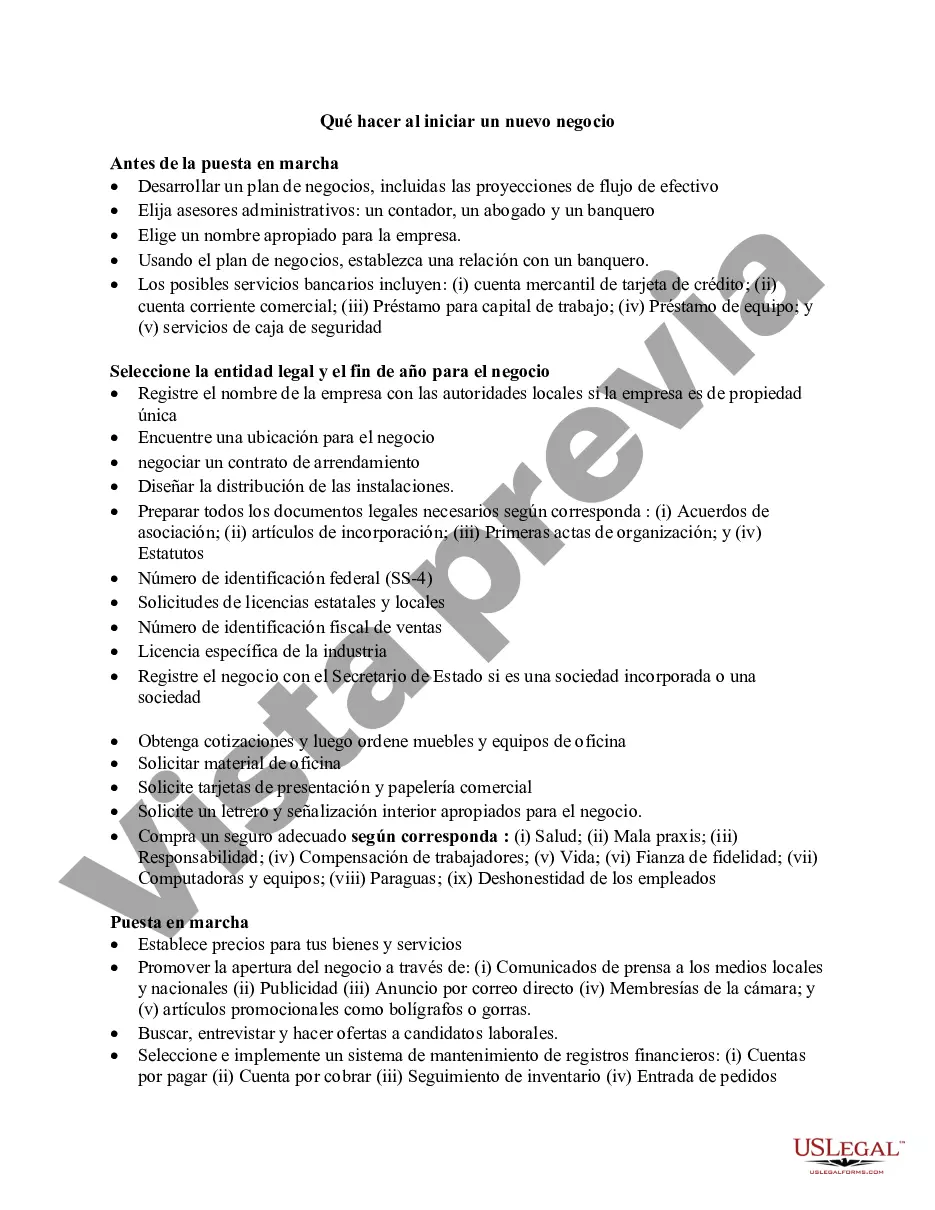

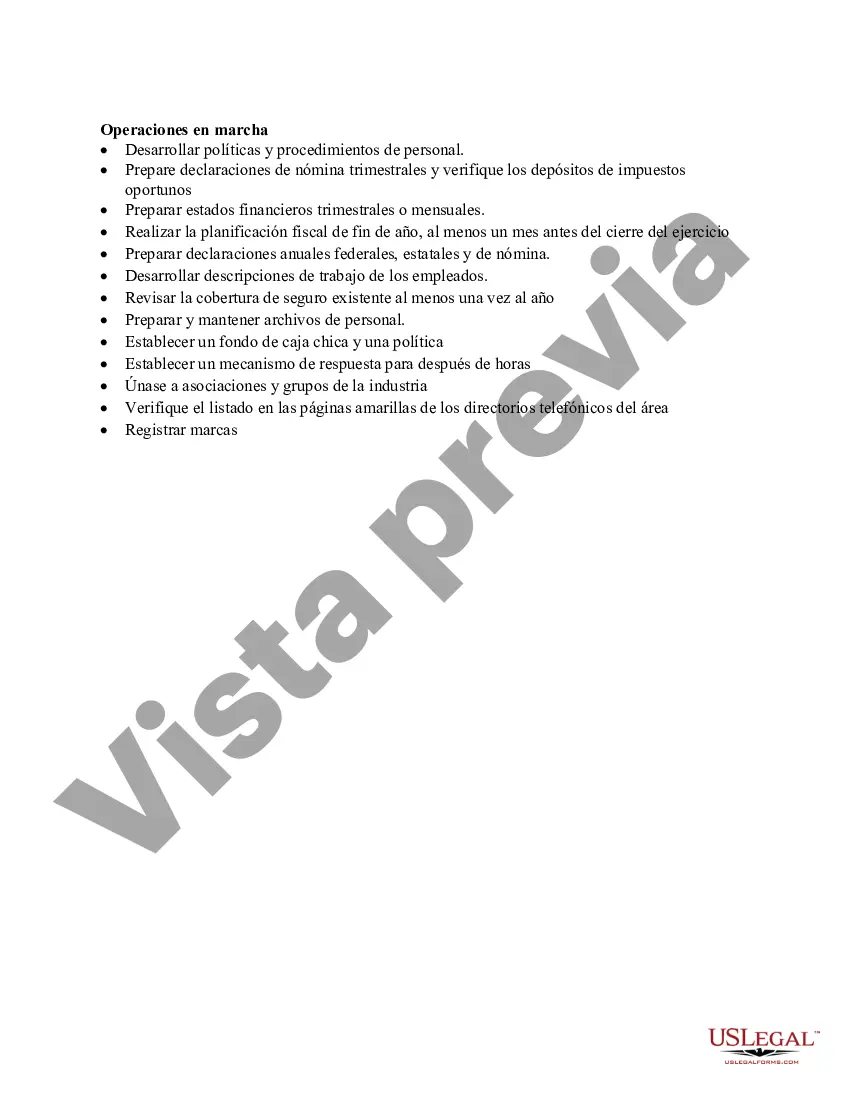

Delaware is a state located in the Mid-Atlantic region of the United States. It is known for its business-friendly environment, low taxes, and robust legal system. Many entrepreneurs choose Delaware as the preferred state to incorporate their businesses or establish a headquarters due to its favorable corporate laws and established business infrastructure. When starting a new business in Delaware, there are several crucial steps to take to ensure a smooth and successful launch. Here are some key aspects to consider: 1. Business Entity Selection: Before starting a new business, it is vital to choose the appropriate business entity type. Delaware offers various options such as Limited Liability Companies (LCS), corporations (C-corp and S-corp), partnerships, and sole proprietorship. Each entity type has its advantages and disadvantages, so understanding the implications of each is crucial for determining the most suitable structure for your business. 2. Registering a Business: Once the appropriate business structure is chosen, registering the business with the Delaware Division of Corporations is necessary. This involves filing the necessary forms, paying the required fees, and providing the required information such as the business name, registered agent details, and incorporation articles. 3. Obtain Necessary Permits and Licenses: Depending on the nature of the business, certain permits and licenses may be required for legal operation. It is essential to research and acquire the appropriate licenses and permits before commencing business activities to ensure compliance with relevant laws and regulations. 4. Tax Obligations: Understanding and fulfilling the tax obligations is crucial for any new business. Delaware offers various tax advantages and incentives, including a low corporate income tax rate. However, businesses still need to register for federal and state taxes, including employer identification numbers, sales tax permits, and payroll taxes. 5. Developing a Business Plan: Having a well-structured and comprehensive business plan is fundamental for success. It helps outline the company's goals, strategies, target market, competition analysis, financial projections, and more. A thorough business plan not only serves as a roadmap for the business but also helps attract potential investors and financing. 6. Securing Financing: Identifying and securing the necessary financing for your business is crucial. Delaware offers access to a robust network of venture capitalists, angel investors, and small business grants and loans. Researching and exploring these opportunities can help in obtaining the required capital to fund business operations. 7. Protecting Intellectual Property: If your business involves unique inventions, trademarks, copyrights, or trade secrets, it is vital to protect your intellectual property rights through patents, trademarks, and copyrights. Delaware has a strong legal system known for its expertise in intellectual property matters, making it an ideal jurisdiction for such protection. Different types of Delaware What To Do When Starting a New Business might include Delaware Business Formation Guidelines, How to Incorporate in Delaware, Starting a Delaware LLC, Delaware Corporate Law Compliance, Delaware Tax Planning for New Businesses, and Delaware Business Licensing Process. These variations cater to specific topics related to starting a business in Delaware, ensuring comprehensive guidance tailored to different aspects of the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Qué hacer al iniciar un nuevo negocio - What To Do When Starting a New Business

Description

How to fill out Delaware Qué Hacer Al Iniciar Un Nuevo Negocio?

US Legal Forms - one of several greatest libraries of authorized types in the States - offers an array of authorized document layouts you can down load or printing. Using the internet site, you will get 1000s of types for organization and personal functions, categorized by groups, claims, or keywords and phrases.You can find the latest models of types much like the Delaware What To Do When Starting a New Business in seconds.

If you currently have a subscription, log in and down load Delaware What To Do When Starting a New Business through the US Legal Forms catalogue. The Obtain key will appear on every single kind you see. You have access to all in the past delivered electronically types within the My Forms tab of your respective accounts.

If you want to use US Legal Forms for the first time, allow me to share straightforward directions to help you started out:

- Be sure to have chosen the best kind to your area/region. Click the Preview key to examine the form`s content. Read the kind explanation to ensure that you have selected the proper kind.

- In case the kind does not suit your needs, take advantage of the Lookup field at the top of the display screen to discover the the one that does.

- If you are content with the shape, confirm your option by clicking on the Get now key. Then, choose the prices strategy you favor and supply your credentials to register to have an accounts.

- Method the deal. Make use of your credit card or PayPal accounts to perform the deal.

- Choose the format and down load the shape on your product.

- Make changes. Fill out, revise and printing and indication the delivered electronically Delaware What To Do When Starting a New Business.

Every template you included with your money lacks an expiry time and it is your own property for a long time. So, if you wish to down load or printing yet another duplicate, just proceed to the My Forms area and click on in the kind you want.

Get access to the Delaware What To Do When Starting a New Business with US Legal Forms, by far the most comprehensive catalogue of authorized document layouts. Use 1000s of specialist and state-certain layouts that satisfy your business or personal requires and needs.