Delaware General Form of Assignment as Collateral for Note is a legal document utilized in the state of Delaware to secure a debt obligation by assigning certain assets as collateral. This form is commonly employed in financial transactions, such as loans, where a party grants a lender an interest in specific assets to ensure repayment of the debt. The use of keywords within this context includes "Delaware General Form of Assignment," "collateral," "note," and "types." The Delaware General Form of Assignment as Collateral for Note can encompass various types, each tailored to specific assets or circumstances. Some noteworthy varieties are: 1. Real Estate Assignment: This type involves assigning real property as collateral. Land, buildings, or any other immovable assets are transferred to the lender, securing the note with the property's value. 2. Intellectual Property Assignment: Intellectual property rights, including trademarks, copyrights, or patents, can be assigned as collateral to secure a note. This type of assignment allows the lender to claim ownership rights to the assets in case of default. 3. Accounts Receivable Assignment: In situations where a borrower has outstanding invoices, they may assign these accounts receivable as collateral. The lender then has the right to collect the payments directly from the debtor if the borrower fails to meet their obligations. 4. Securities Assignment: This type involves assigning stocks, bonds, or other securities as collateral for a note. The lender gains the authority to sell these assets to recover the outstanding debt in case of a default. 5. Equipment Assignment: Borrowers can assign machinery, vehicles, or other equipment as collateral. If the borrower fails to repay the note, the lender can seize and sell the assigned assets to recover the outstanding amount. 6. General Asset Assignment: This form of assignment encompasses a broad range of assets, including inventory, receivables, equipment, and real estate. The borrower assigns all available assets to secure the note, providing the lender with multiple options for recovery in the event of default. It is crucial to create a Delaware General Form of Assignment as Collateral for Note with precision and accuracy to ensure the validity and enforceability of the assigned collateral. Consulting with legal professionals experienced in this area is highly recommended understanding the specific requirements and regulations associated with each type of collateral assignment.

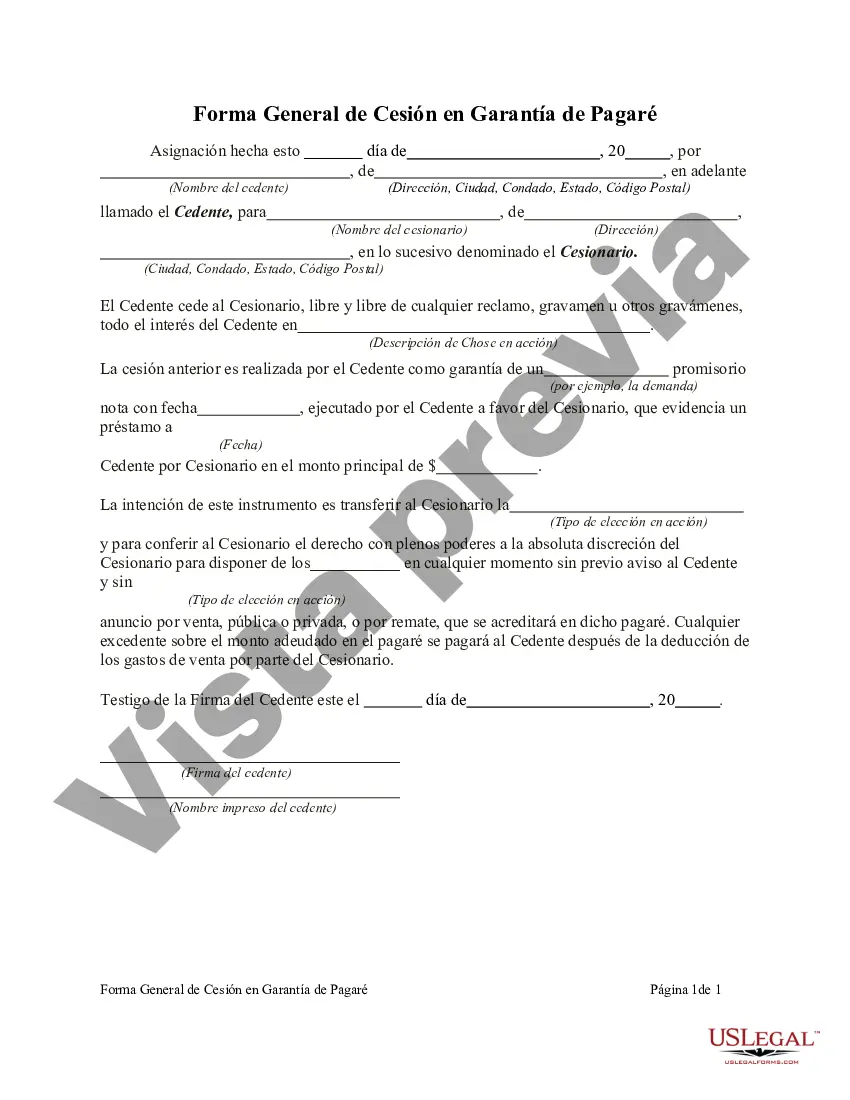

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Delaware Forma General De Cesión En Garantía De Pagaré?

It is possible to commit hours on-line trying to find the lawful papers template that meets the federal and state specifications you require. US Legal Forms offers 1000s of lawful forms that are evaluated by experts. It is possible to download or printing the Delaware General Form of Assignment as Collateral for Note from your assistance.

If you currently have a US Legal Forms account, it is possible to log in and then click the Obtain key. Afterward, it is possible to total, edit, printing, or sign the Delaware General Form of Assignment as Collateral for Note. Every single lawful papers template you buy is the one you have for a long time. To acquire yet another duplicate of any bought type, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms website initially, adhere to the straightforward guidelines beneath:

- Initial, be sure that you have selected the right papers template to the area/city that you pick. Look at the type explanation to make sure you have selected the appropriate type. If available, utilize the Preview key to appear with the papers template as well.

- If you want to get yet another variation of the type, utilize the Look for field to get the template that fits your needs and specifications.

- Upon having located the template you desire, click on Get now to continue.

- Find the costs prepare you desire, type in your references, and sign up for your account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal account to cover the lawful type.

- Find the formatting of the papers and download it in your product.

- Make changes in your papers if possible. It is possible to total, edit and sign and printing Delaware General Form of Assignment as Collateral for Note.

Obtain and printing 1000s of papers themes while using US Legal Forms Internet site, which offers the greatest variety of lawful forms. Use expert and condition-certain themes to tackle your organization or personal needs.