The Delaware Crummy Trust Agreement for the Benefit of Child with Parents as Trustees is a legal document that establishes a unique type of trust arrangement in the state of Delaware. It provides a mechanism for parents (as trustees) to transfer assets or property into a trust for the benefit of their child. This trust is often used as an estate planning tool to ensure that the child receives financial support and management of assets even after the parents' demise. The Delaware Crummy Trust Agreement operates under specific guidelines, referencing the Crummy power which allows the beneficiaries to withdraw and receive a certain portion of the contribution made to the trust within a limited period, typically 30 days. This provision helps qualify the trust contributions for certain gift tax exclusions. There are several types of Delaware Crummy Trust Agreements available, each serving specific purposes: 1. Irrevocable Delaware Crummy Trust: This trust arrangement, once created, cannot be altered or revoked by the trustees (parents). It provides a legally binding commitment to preserving assets for the child's benefit and offers potential tax advantages. 2. Revocable Delaware Crummy Trust: Unlike the irrevocable version, this trust allows the trustees to modify or revoke the trust terms at any time during their lifetime. However, it becomes irrevocable upon the trustees' death, ensuring the intended benefit for the child. 3. Testamentary Delaware Crummy Trust: Created through a will, this trust activates upon the trustees' death and provides for the child's financial needs as outlined in the trust document. This type of trust may bypass probate, offering a smoother transition of assets. The Delaware Crummy Trust Agreement can include specific provisions and preferences stipulated by the trustees, such as limitations on the child's access to funds until reaching a certain age or achieving specific milestones. Furthermore, provisions for the appointment of a trustee to manage the trust assets and make distributions on behalf of the child can be incorporated into the agreement. Overall, the Delaware Crummy Trust Agreement for the Benefit of Child with Parents as Trustees is an estate planning tool that enables parents to safeguard their assets for the well-being of their child. It incorporates the Crummy power to optimize gift tax treatment and offers flexibility through various types of trusts.

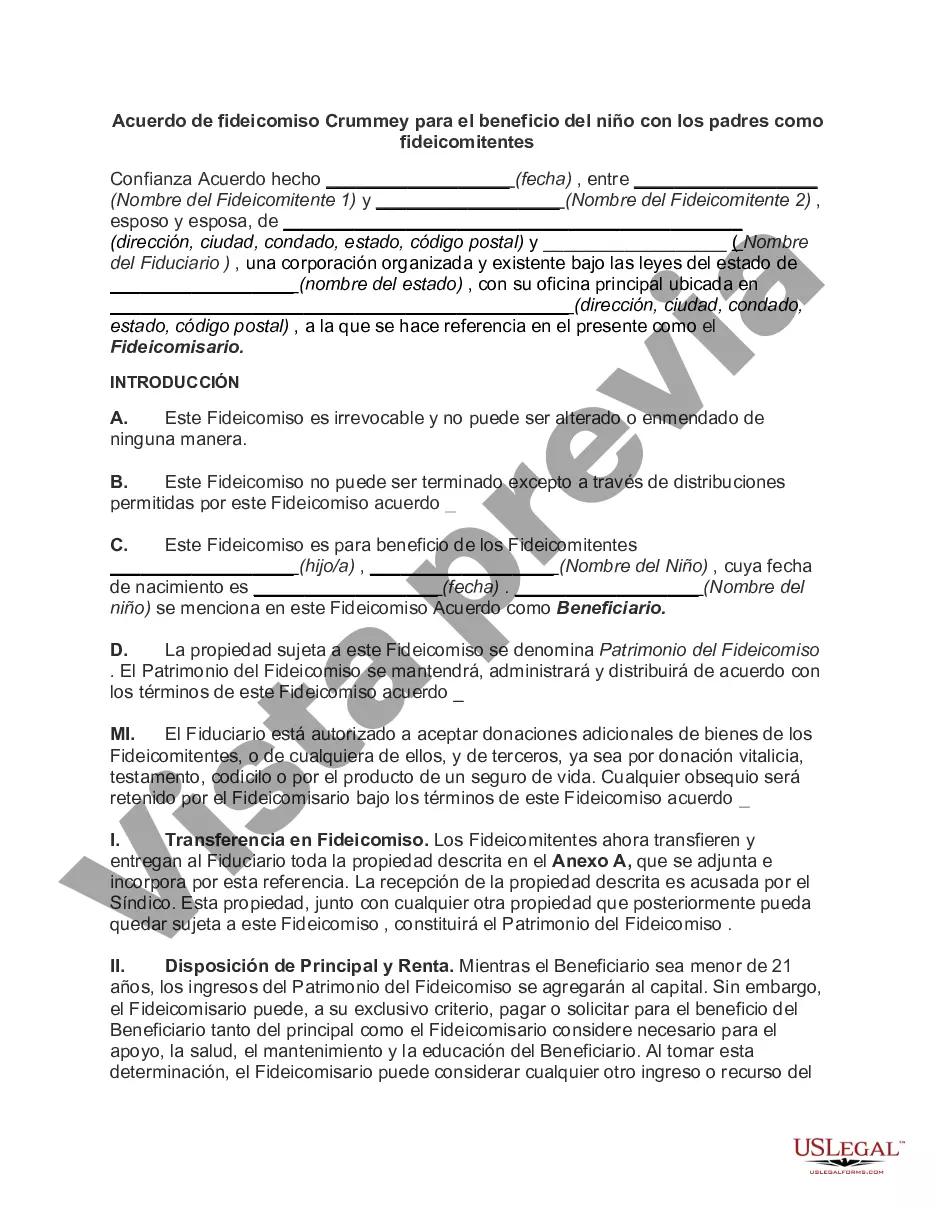

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Delaware Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

US Legal Forms - one of the greatest libraries of lawful types in America - delivers a variety of lawful document web templates you can obtain or print out. Making use of the site, you will get 1000s of types for company and personal reasons, sorted by groups, states, or keywords and phrases.You will find the most up-to-date types of types just like the Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors within minutes.

If you already have a monthly subscription, log in and obtain Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors in the US Legal Forms library. The Down load button will appear on every type you see. You gain access to all formerly saved types from the My Forms tab of your respective account.

In order to use US Legal Forms the first time, allow me to share straightforward guidelines to obtain began:

- Ensure you have chosen the proper type for your personal town/state. Click on the Preview button to check the form`s content material. Look at the type outline to ensure that you have selected the right type.

- When the type does not match your demands, make use of the Lookup discipline towards the top of the monitor to discover the one which does.

- If you are pleased with the shape, affirm your choice by visiting the Buy now button. Then, select the prices strategy you like and offer your qualifications to sign up to have an account.

- Method the purchase. Utilize your credit card or PayPal account to complete the purchase.

- Choose the file format and obtain the shape on your own device.

- Make adjustments. Fill up, revise and print out and sign the saved Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

Each and every design you added to your bank account lacks an expiration time and is your own property forever. So, if you would like obtain or print out an additional duplicate, just visit the My Forms area and click around the type you need.

Obtain access to the Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors with US Legal Forms, one of the most comprehensive library of lawful document web templates. Use 1000s of skilled and condition-distinct web templates that fulfill your company or personal requires and demands.