Delaware Partnership Agreement for Investment Club is a legally binding document that outlines the terms and conditions governing the establishment and operations of an investment club in Delaware. It sets forth the rules, rights, and responsibilities of the club and its partners, as well as the distribution of profits and losses. The Delaware Partnership Agreement for Investment Club is designed to facilitate collaboration among individuals interested in pooling their resources and investing collectively. By forming a partnership, club members can combine their expertise, knowledge, and financial contributions to pursue various investment opportunities, such as stocks, bonds, real estate, or mutual funds. This agreement typically covers essential aspects like the club's purpose, duration, capital contributions, decision-making authority, profit sharing, liability limitations, and dispute resolution procedures. It is crucial for the agreement to include specific details related to the club's structure, voting rights, admission and withdrawal of partners, and handling of financial accounts. There are different types of Delaware Partnership Agreement for Investment Clubs, including General Partnerships and Limited Liability Partnerships (Laps). 1. General Partnership: In a general partnership, all partners have equal rights and responsibilities. They actively participate in the management of the club and share profits, losses, and liabilities equally or as specified in the agreement. Each partner has unlimited personal liability for the club's debts or obligations. 2. Limited Liability Partnership (LLP): In an LLP, partners have limited personal liability, protecting their personal assets from the club's debts and other partner's actions. This type of partnership is particularly appealing to members who prefer limited liability but still want to actively participate in decision-making and management. The Delaware Partnership Agreement for Investment Club ensures transparency, cooperation, and protection of the club and its members' interests. It establishes a solid foundation for efficient decision-making, dispute resolution, and the smooth operation of the investment club. In summary, the Delaware Partnership Agreement for Investment Club is a vital legal document that governs the establishment, operation, and management of an investment club in Delaware. Its primary purpose is to outline the rights, obligations, and profit-sharing of the partners and provides a framework for collaboration, decision-making, and dispute resolution. The different types of partnerships include General Partnerships and Limited Liability Partnerships (Laps), each offering unique benefits in terms of liability and involvement in club affairs.

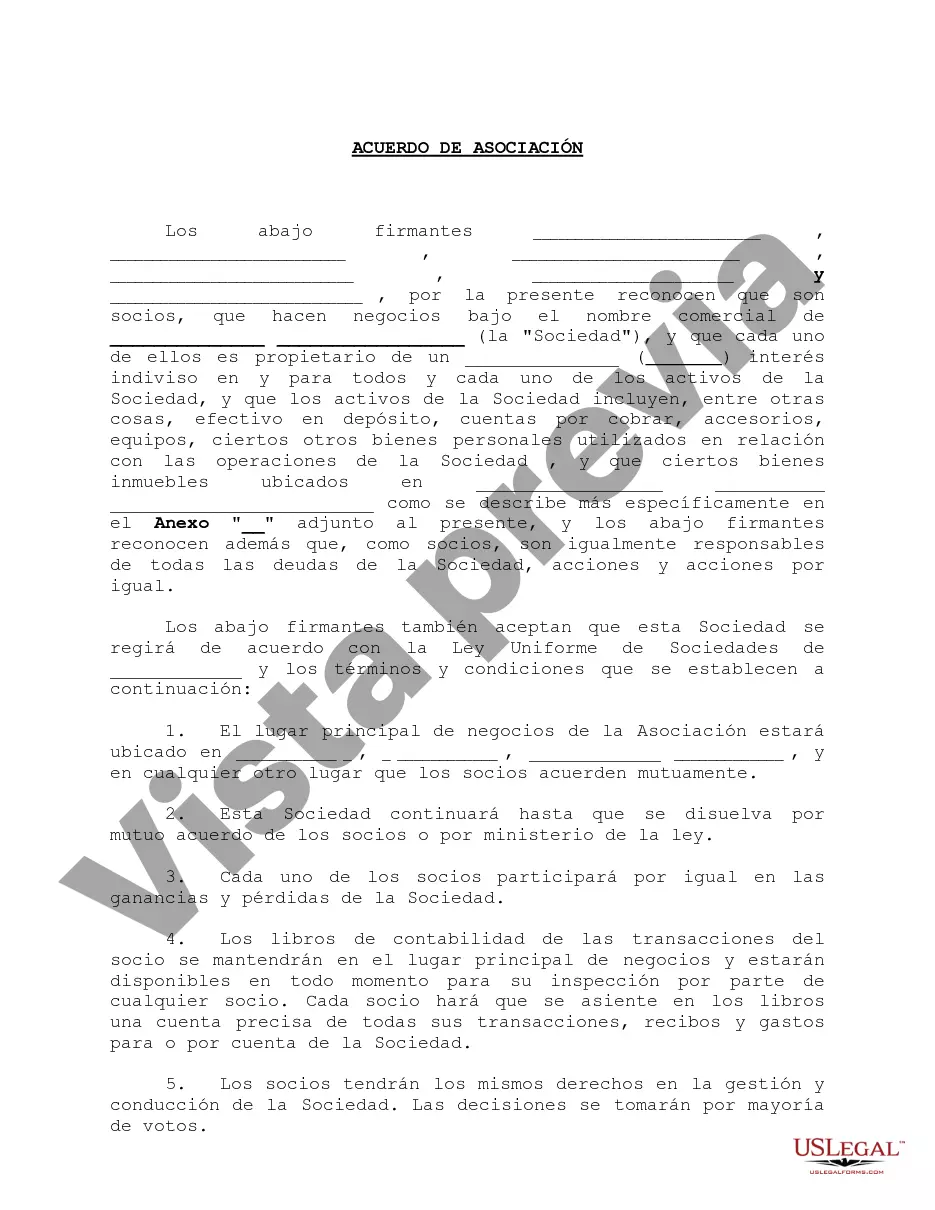

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Acuerdo de Asociación para el Club de Inversión - Partnership Agreement for Investment Club

Description

How to fill out Delaware Acuerdo De Asociación Para El Club De Inversión?

US Legal Forms - one of several biggest libraries of legal types in America - offers a wide array of legal record web templates you are able to obtain or printing. Using the internet site, you will get thousands of types for organization and person purposes, categorized by classes, claims, or keywords and phrases.You can find the most recent variations of types much like the Delaware Partnership Agreement for Investment Club within minutes.

If you already have a monthly subscription, log in and obtain Delaware Partnership Agreement for Investment Club in the US Legal Forms local library. The Download button can look on each and every type you look at. You have accessibility to all in the past delivered electronically types from the My Forms tab of your own account.

If you would like use US Legal Forms the very first time, allow me to share simple instructions to get you started off:

- Be sure you have chosen the correct type for the area/state. Click the Preview button to examine the form`s articles. Look at the type information to ensure that you have selected the appropriate type.

- If the type does not match your demands, utilize the Search field near the top of the monitor to obtain the one who does.

- In case you are pleased with the form, confirm your choice by simply clicking the Get now button. Then, select the rates program you want and provide your references to sign up for the account.

- Approach the purchase. Use your bank card or PayPal account to accomplish the purchase.

- Pick the formatting and obtain the form on the system.

- Make adjustments. Fill up, change and printing and signal the delivered electronically Delaware Partnership Agreement for Investment Club.

Each and every template you included with your account does not have an expiry date and is the one you have forever. So, if you want to obtain or printing an additional backup, just check out the My Forms area and then click about the type you will need.

Obtain access to the Delaware Partnership Agreement for Investment Club with US Legal Forms, probably the most extensive local library of legal record web templates. Use thousands of skilled and express-certain web templates that fulfill your company or person needs and demands.