Delaware Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Letter To Creditor Requesting A Temporary Payment Reduction?

Have you ever been in a location where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding forms you can rely on can be challenging.

US Legal Forms offers a vast array of document templates, including the Delaware Letter to Creditor Requesting a Temporary Payment Reduction, which can be drafted to meet state and federal standards.

Once you find the appropriate template, simply click Buy now.

Select the payment plan you prefer, fill in the necessary information to create your account, and pay for your order using either PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Delaware Letter to Creditor Requesting a Temporary Payment Reduction template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/state.

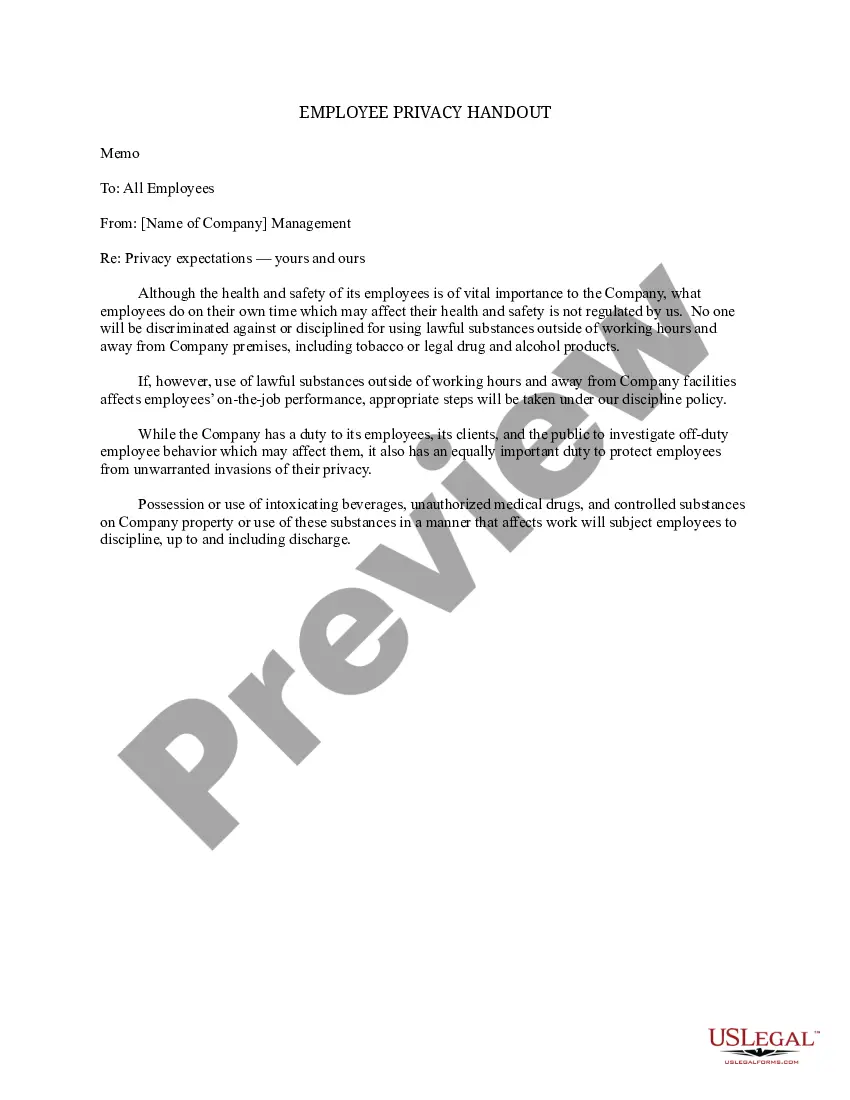

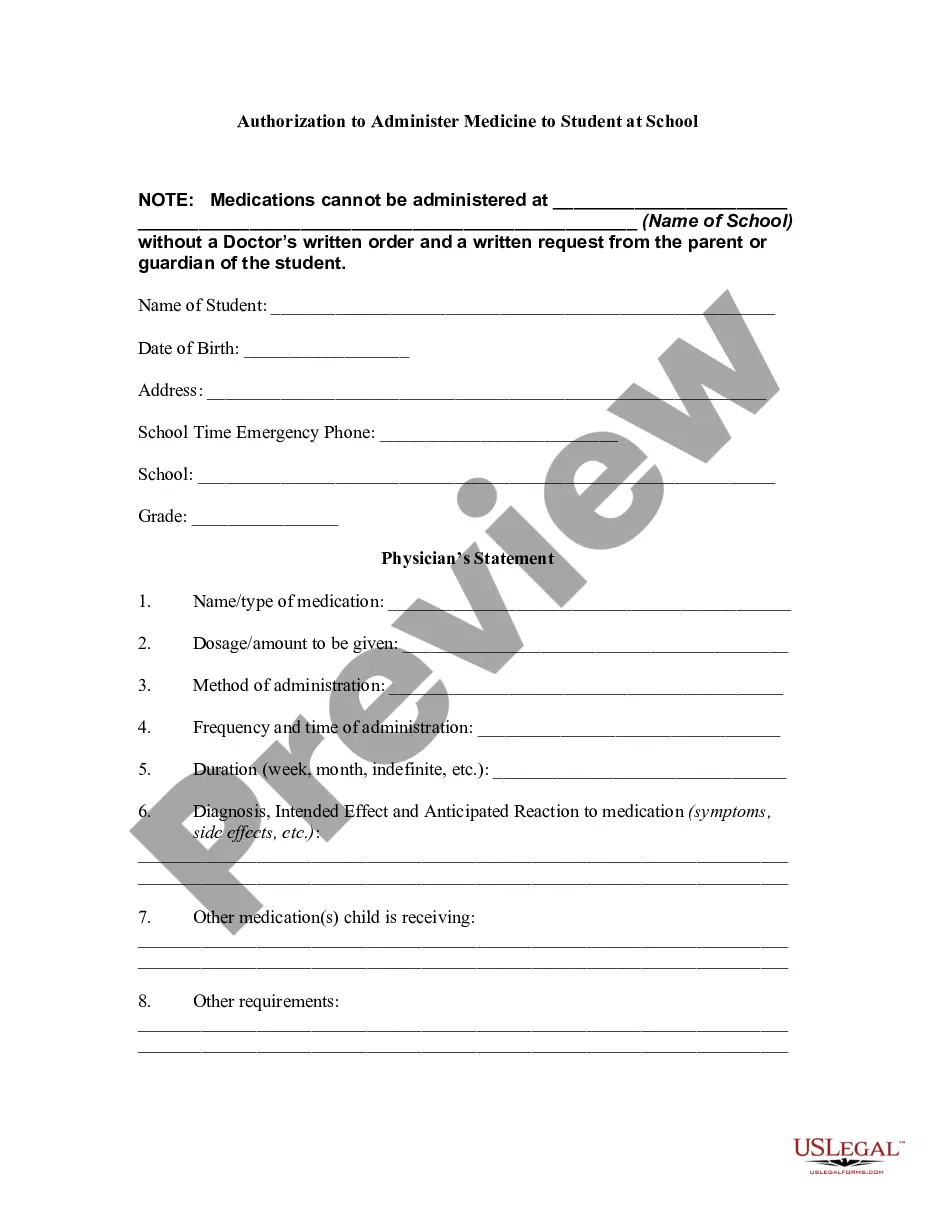

- Utilize the Preview button to review the form.

- Read the description to confirm that you have chosen the right template.

- If the template is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Believe it or not, though, it's possible to negotiate with a collection agent and end up paying less than you owe. Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit.

How to Write a Hardship Letter The Ultimate GuideHardship Examples. There are a variety of situations that may qualify as a hardship.Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.More items...

Some examples of events that a lender may consider to be a financial hardship include:Layoff or reduction in pay.New or worsening disability.Serious injury.Serious illness.Divorce or legal separation.Death.Incarceration.Military deployment or Permanent Change of Station orders.More items...?19-Nov-2021

When writing a debt settlement letter, it's important to be explicit and detailed. Treat the letter as a contract between you and your creditor. Include your personal information and account number for easy identification. You'll need to outline the amount you can pay and what you expect in return.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

While it's best to pay off debt that's in collections rather than settling it, both options are far more beneficial than ignoring the debt completely. You should give yourself credit for reaching the point at which you're ready to face your debt and get rid of it.

Contact the creditor you've selected and ask the requirements for a letter of credit. You'll need to follow the creditor's procedures to get your letter. Provide any documents the creditor requests, such as the agreement you have with the seller and your financial documents.

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

Bank statements showing a reduction of income, essential spending and reduced savings. a report from a financial counselling service. debt repayment agreements. any other evidence you have to explain your circumstances.

What Are Some Options for Debt Settlement?Offer a Lump-Sum Settlement. If you decide to offer a lump sum to pay off the debt for less than you owe, understand that no general rule applies to all collection agencies.Negotiate Improvement to Your Credit Report.Make Payments Over Time.