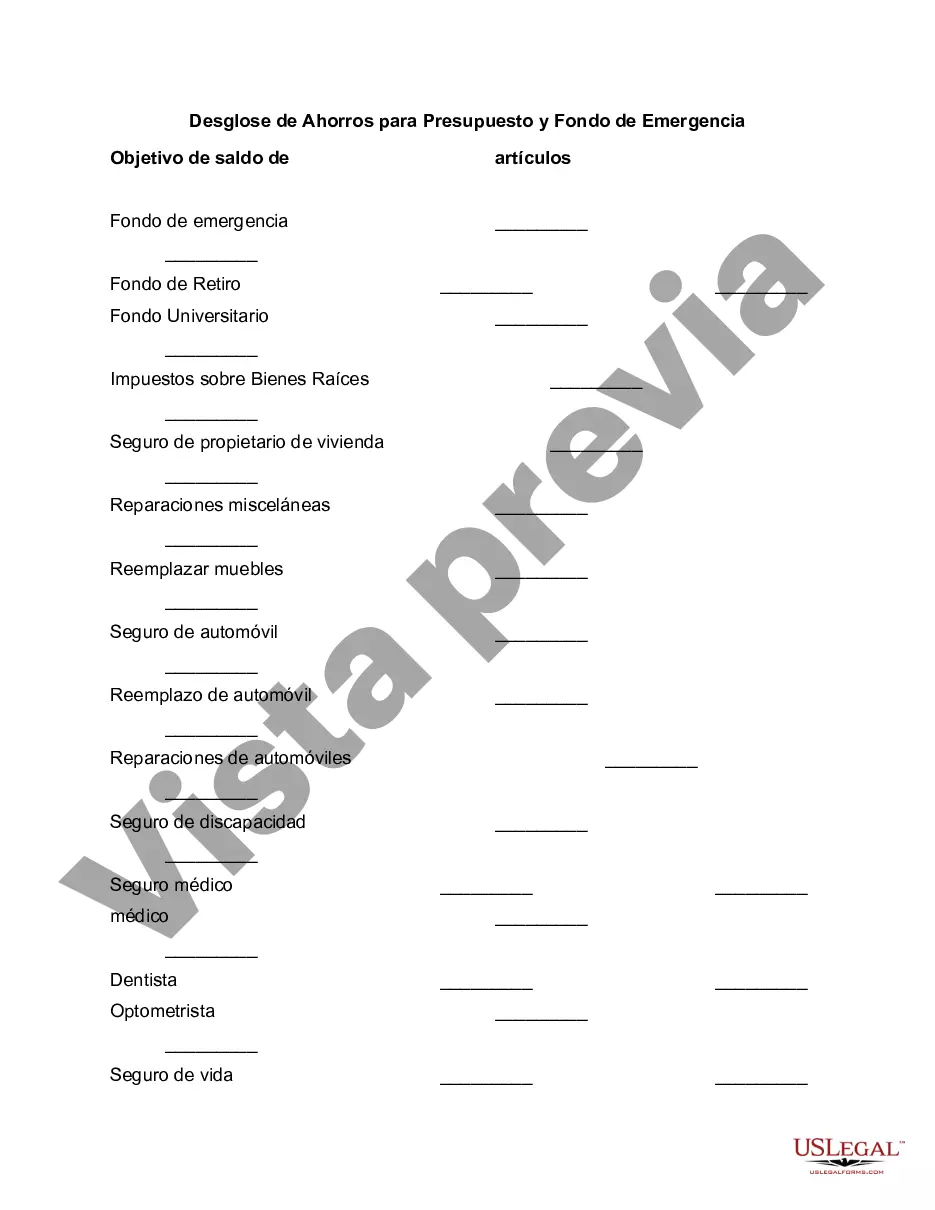

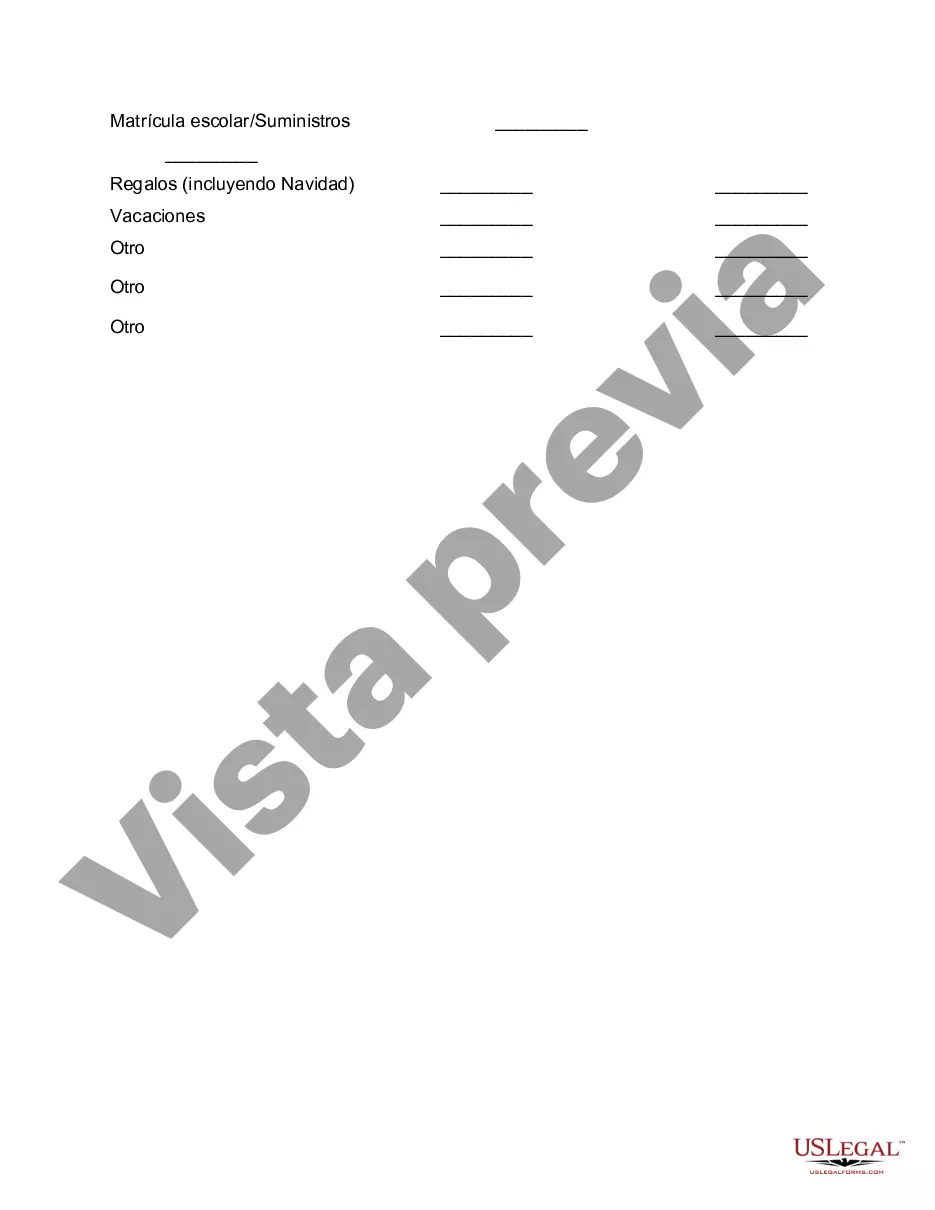

Delaware Breakdown of Savings for Budget and Emergency Fund: When it comes to financial planning, having a breakdown of savings is essential for achieving long-term financial stability. This is particularly important in Delaware, where residents seek to build a robust budget and emergency fund to weather unexpected expenses and protect their financial well-being. The breakdown of savings typically consists of two main components: budget savings and emergency savings. Let's delve into each type and understand their significance: 1. Budget Savings in Delaware: Budget savings refer to funds set aside for planned expenses, such as monthly bills, utilities, groceries, and other routine costs. Allocating a portion of your income to budget savings helps create a buffer that ensures financial stability within your monthly cash flow. It allows you to meet your anticipated expenses comfortably without relying on credit or living paycheck to paycheck. Creating a budget is crucial for determining the exact amount you need to save each month for these planned expenses. It involves tracking your income and expenses, categorizing them, and setting realistic savings goals. The budget savings can be further divided into specific categories, such as housing, transportation, entertainment, and personal expenses, depending on your individual financial needs and goals. 2. Emergency Fund in Delaware: An emergency fund serves as a financial safety net, guarding against unplanned events or unforeseen circumstances that may require immediate funds. Having a well-funded emergency fund is critical for dealing with sudden medical expenses, job loss, home repairs, or any other unexpected financial emergencies that may arise. For Delaware residents, it is recommended to save at least three to six months' worth of essential living expenses for their emergency fund. This should include items like rent or mortgage payments, utilities, transportation costs, food, and insurance. The fund should be easily accessible, preferably in a separate savings account, to ensure immediate access to funds without incurring unnecessary fees or penalties. While the breakdown of savings primarily revolves around budget and emergency funds, some additional types of savings accounts may exist in Delaware based on specific financial goals and circumstances: 1. Retirement Savings: Delaware residents should prioritize long-term financial security by contributing to retirement savings accounts, such as Individual Retirement Accounts (IRAs), 401(k)s, or 403(b)s. These accounts offer tax advantages and should be regularly funded to ensure a comfortable retirement. 2. Education Savings: Families in Delaware can also establish dedicated college savings accounts like 529 plans to save for future educational expenses. These plans offer tax advantages and enable the growth of funds to cover tuition, books, and other educational costs. 3. Short-term Goal Savings: Delawareans may also have specific short-term savings goals, such as saving for a vacation, a down payment on a home, or purchasing a vehicle. Establishing separate savings accounts for these goals can help individuals track their progress and avoid dipping into emergency or budget funds. In conclusion, a proper breakdown of savings in Delaware necessitates a well-structured budget savings plan and an adequate emergency fund. By distributing savings according to individual financial goals, anyone in Delaware can establish a solid financial foundation. It is important to regularly review and adjust this breakdown to accommodate changing circumstances and ensure continued financial security.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Delaware Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

You can spend time on the Internet attempting to find the lawful record template that suits the state and federal requirements you will need. US Legal Forms supplies 1000s of lawful types which are evaluated by professionals. You can easily download or produce the Delaware Breakdown of Savings for Budget and Emergency Fund from the service.

If you already possess a US Legal Forms bank account, you can log in and click on the Obtain button. Following that, you can total, modify, produce, or signal the Delaware Breakdown of Savings for Budget and Emergency Fund. Each lawful record template you purchase is yours permanently. To get yet another copy of any bought kind, proceed to the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms site initially, keep to the easy recommendations listed below:

- Initially, make certain you have chosen the proper record template for that county/city of your choosing. Look at the kind explanation to ensure you have chosen the right kind. If accessible, make use of the Review button to check throughout the record template also.

- In order to get yet another edition from the kind, make use of the Lookup area to find the template that suits you and requirements.

- Upon having discovered the template you desire, click on Buy now to carry on.

- Choose the rates plan you desire, type in your references, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal bank account to cover the lawful kind.

- Choose the format from the record and download it for your system.

- Make modifications for your record if needed. You can total, modify and signal and produce Delaware Breakdown of Savings for Budget and Emergency Fund.

Obtain and produce 1000s of record themes while using US Legal Forms web site, which provides the most important assortment of lawful types. Use skilled and condition-particular themes to handle your small business or individual demands.