A Delaware Promissory Note for a Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Delaware. This type of promissory note is specifically designed for commercial loans that are backed by real property. The Delaware Promissory Note for Commercial Loan Secured by Real Property includes important details such as the loan amount, interest rate, repayment schedule, and the consequences of default. It serves as a binding contract between the lender and the borrower, ensuring that both parties understand their rights and obligations. Different types of Delaware Promissory Notes for Commercial Loan Secured by Real Property may exist, depending on various factors such as the intended use of the loan or the specific terms agreed upon by the parties involved. For example: 1. Fixed-Rate Promissory Note: This type of promissory note sets a fixed interest rate for the entire loan term. Monthly payments are calculated based on this predetermined rate, offering stability to both the lender and the borrower. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate note, this type of promissory note allows the interest rate to fluctuate over time. The interest rate is usually tied to a specific index, such as the prime rate, and may adjust periodically according to market conditions. 3. Balloon Promissory Note: A balloon note involves making regular payments for a certain period, followed by a substantial lump-sum payment commonly referred to as the "balloon payment." This type of promissory note offers lower monthly payments initially but requires the borrower to pay off the remaining loan balance at the end of the specified term. 4. Demand Promissory Note: In this scenario, the lender has the right to request full repayment of the loan amount at any time, often providing a notice period. This type of note is typically used for short-term loans or in situations where the lender wants the flexibility to call the loan due if circumstances change. It is crucial for both lenders and borrowers to carefully review and understand the terms within a Delaware Promissory Note for Commercial Loan Secured by Real Property. Seeking legal advice and conducting thorough due diligence can help protect the interests of all parties involved in the loan agreement.

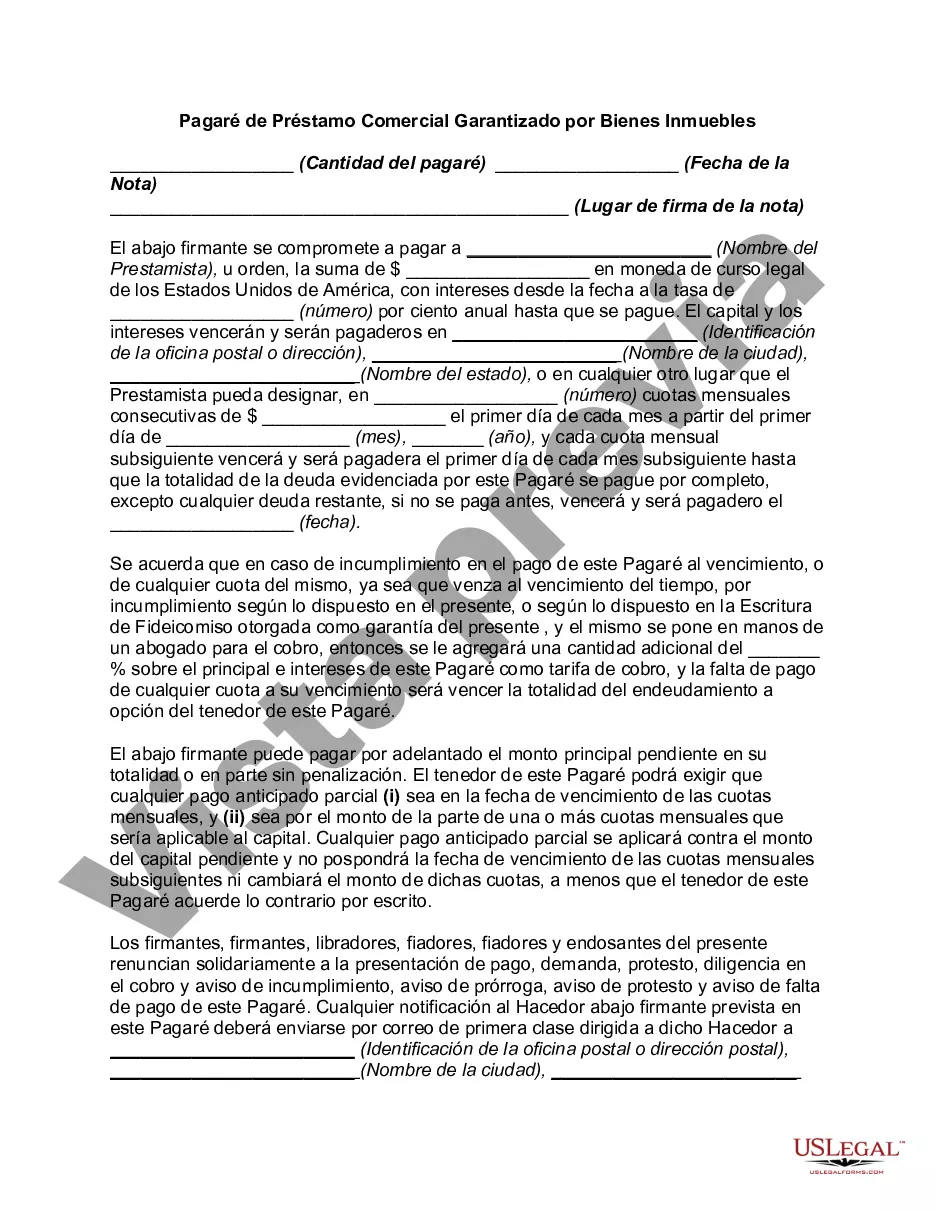

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Delaware Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

US Legal Forms - one of several greatest libraries of authorized kinds in the USA - gives an array of authorized record web templates you may acquire or produce. Using the site, you can get a huge number of kinds for company and individual uses, categorized by classes, suggests, or keywords and phrases.You will discover the most recent variations of kinds just like the Delaware Promissory Note for Commercial Loan Secured by Real Property within minutes.

If you already possess a membership, log in and acquire Delaware Promissory Note for Commercial Loan Secured by Real Property through the US Legal Forms catalogue. The Acquire switch will appear on each form you see. You have access to all in the past downloaded kinds within the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, allow me to share basic directions to obtain began:

- Ensure you have selected the right form for your metropolis/area. Click the Preview switch to analyze the form`s information. Browse the form description to ensure that you have selected the appropriate form.

- In the event the form does not match your specifications, make use of the Search area towards the top of the display to find the the one that does.

- When you are content with the shape, validate your selection by clicking on the Buy now switch. Then, select the costs plan you like and offer your qualifications to register for an accounts.

- Approach the deal. Utilize your bank card or PayPal accounts to accomplish the deal.

- Select the file format and acquire the shape on the system.

- Make adjustments. Load, edit and produce and signal the downloaded Delaware Promissory Note for Commercial Loan Secured by Real Property.

Every web template you included with your bank account does not have an expiry day and is also the one you have eternally. So, if you would like acquire or produce yet another version, just visit the My Forms portion and click on about the form you will need.

Get access to the Delaware Promissory Note for Commercial Loan Secured by Real Property with US Legal Forms, one of the most extensive catalogue of authorized record web templates. Use a huge number of specialist and status-certain web templates that fulfill your small business or individual needs and specifications.