Delaware Petty Cash Form is an essential document used to track and account for small amounts of cash disbursed from an organization's petty cash fund in the state of Delaware. This form is crucial in properly recording and maintaining accurate financial records, ensuring transparency and accountability for the cash transactions. Keywords: Delaware, petty cash form, small amounts, cash disbursed, organization, petty cash fund, financial records, transparency, accountability, cash transactions. Delaware Petty Cash Form serves as a standardized template that captures crucial details such as the date, name of the requester, purpose of the cash withdrawal, amount disbursed, and the recipient's signature. By requiring employees to fill out this form, organizations can establish a systematic and controlled process for dispensing petty cash. Different types of Delaware Petty Cash Forms may exist depending on the specific requirements of different organizations. Some variations can include: 1. Standard Delaware Petty Cash Form: This refers to the basic form utilized by most organizations, incorporating the necessary fields to document cash disbursements accurately. 2. Delaware Petty Cash Reimbursement Form: This type of form is used to reimburse employees or departments for expenses made out of pocket using their own funds. It helps ensure timely reimbursement while maintaining proper records. 3. Delaware Petty Cash Log: While not a form in the traditional sense, a petty cash log is an additional document often maintained in conjunction with the Delaware Petty Cash Form. It serves as a running record of all petty cash transactions, providing a comprehensive overview of cash inflows and outflows. In Delaware, every organization, regardless of size or type, should have a dedicated petty cash fund to manage small expenses efficiently. Using Delaware Petty Cash Forms enables organizations to monitor, control, and account for these expenditures, safeguarding against potential misuse or fraud. Proper use of Delaware Petty Cash Forms ensures that financial records remain accurate, transparent, and compliant with legal and regulatory requirements. By accurately documenting petty cash disbursements, organizations can maintain a clear audit trail and easily reconcile any discrepancies that may occur. To summarize, a Delaware Petty Cash Form is a vital tool for organizations in Delaware to manage and document small cash transactions. It serves to maintain transparency, accountability, and accuracy in financial records. Different variations of this form may exist based on organizational needs, such as reimbursement forms or petty cash logs. Utilizing these forms is crucial in establishing a controlled process for petty cash management and preventing potential financial discrepancies.

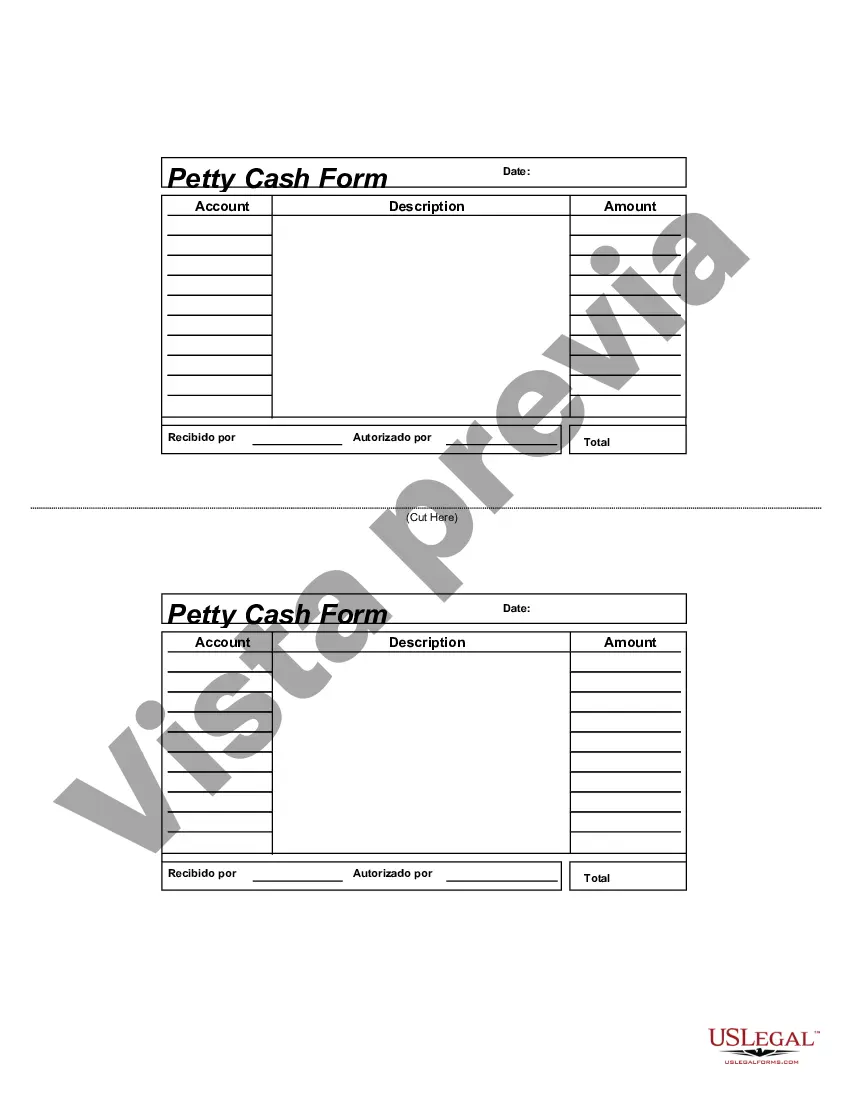

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Formulario de caja chica - Petty Cash Form

Description

How to fill out Delaware Formulario De Caja Chica?

Are you presently within a place in which you require files for either business or specific functions nearly every working day? There are plenty of legal record templates available on the Internet, but discovering versions you can depend on is not simple. US Legal Forms provides 1000s of kind templates, much like the Delaware Petty Cash Form, that happen to be created to meet state and federal specifications.

Should you be currently acquainted with US Legal Forms website and possess your account, just log in. After that, you are able to acquire the Delaware Petty Cash Form format.

Unless you offer an account and want to begin using US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is for that appropriate city/region.

- Utilize the Review option to review the shape.

- Look at the outline to actually have chosen the correct kind.

- When the kind is not what you are searching for, utilize the Lookup area to obtain the kind that meets your needs and specifications.

- Once you find the appropriate kind, click Get now.

- Opt for the prices prepare you desire, complete the necessary info to make your money, and purchase an order with your PayPal or bank card.

- Decide on a hassle-free file formatting and acquire your duplicate.

Discover all of the record templates you might have bought in the My Forms food selection. You can obtain a further duplicate of Delaware Petty Cash Form any time, if necessary. Just select the essential kind to acquire or print out the record format.

Use US Legal Forms, one of the most extensive assortment of legal kinds, to conserve some time and prevent errors. The service provides skillfully created legal record templates which can be used for an array of functions. Produce your account on US Legal Forms and begin generating your way of life easier.