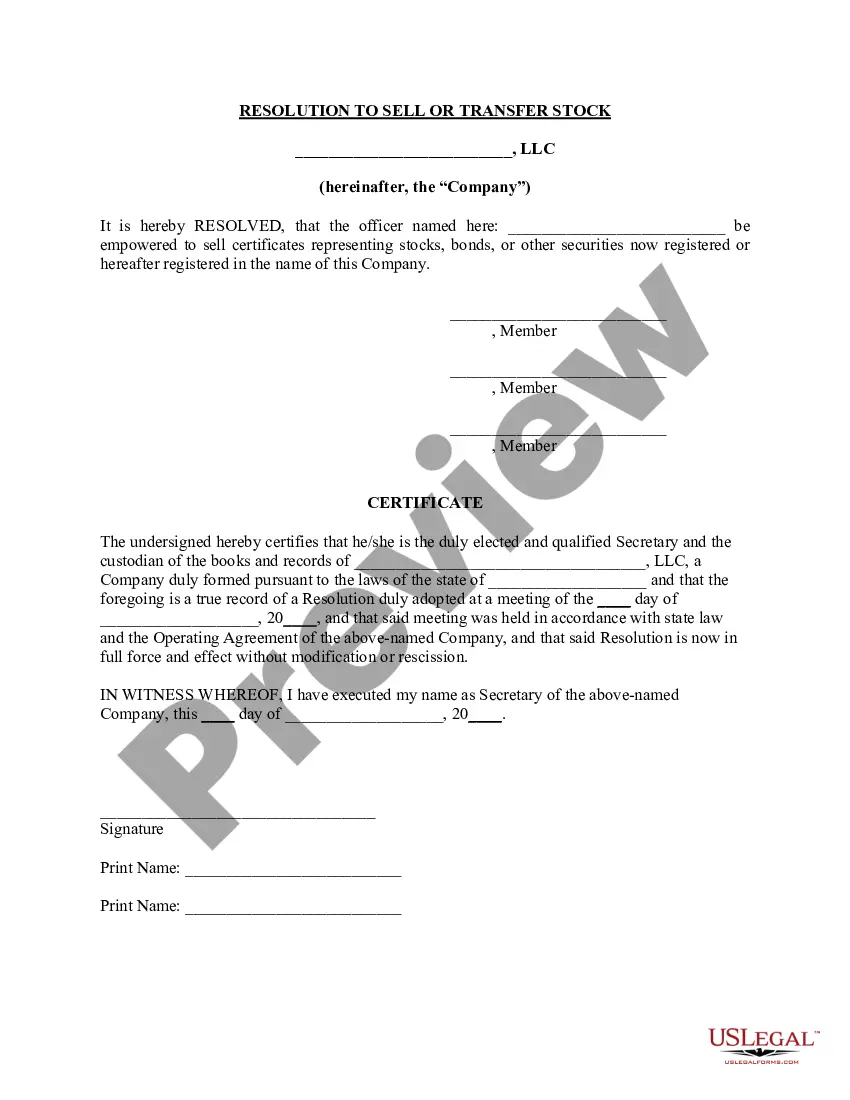

Delaware Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

US Legal Forms - one of many greatest libraries of authorized varieties in America - offers an array of authorized record layouts it is possible to obtain or print out. Making use of the internet site, you can find a huge number of varieties for business and specific purposes, sorted by types, claims, or keywords and phrases.You will discover the newest models of varieties much like the Delaware Resolution of Meeting of LLC Members to Sell or Transfer Stock in seconds.

If you have a registration, log in and obtain Delaware Resolution of Meeting of LLC Members to Sell or Transfer Stock in the US Legal Forms catalogue. The Acquire option will show up on every single kind you perspective. You have access to all earlier downloaded varieties in the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, allow me to share straightforward guidelines to obtain started:

- Ensure you have picked the proper kind for your city/state. Select the Review option to review the form`s information. See the kind description to actually have selected the correct kind.

- When the kind doesn`t suit your needs, make use of the Look for discipline on top of the display screen to obtain the one which does.

- When you are happy with the shape, validate your decision by clicking on the Get now option. Then, opt for the costs strategy you want and give your credentials to register for the accounts.

- Process the deal. Make use of bank card or PayPal accounts to finish the deal.

- Select the format and obtain the shape on the gadget.

- Make changes. Complete, edit and print out and sign the downloaded Delaware Resolution of Meeting of LLC Members to Sell or Transfer Stock.

Each design you included with your money does not have an expiry day which is yours forever. So, if you want to obtain or print out yet another copy, just proceed to the My Forms section and click in the kind you need.

Obtain access to the Delaware Resolution of Meeting of LLC Members to Sell or Transfer Stock with US Legal Forms, by far the most comprehensive catalogue of authorized record layouts. Use a huge number of expert and state-particular layouts that fulfill your business or specific requires and needs.

Form popularity

FAQ

Under Delaware law, sale of the entire LLC must be approved by all of the LLC's members. When transferring full ownership of your LLC, draft and execute a buy-sell agreement with the individual or entity seeking to purchase the business.

You may see it referred to as form J30 or a share transfer form, but it means the same thing. The person selling the shares (often called the 'transferor') should complete their details on the stock transfer form, including their name and address as well as identifying the shares to be transferred, and then sign it.

Shares can usually be transferred to both individuals and entities, such as partnerships and corporations.

Section 203 of the DGCL generally prohibits any owner of 15% or more of a corporation's voting stock from engaging in a business combination with the corporation within three years after the person acquired such ownership, unless, among other options, the board approved the transaction that resulted in the person

You can send your changes by post. Download and fill in the share change forms depending on the changes you're making. Send your completed forms, a copy of your resolution if needed and your statement of capital to the address on the forms.

Gift Hold-Over Relief makes it possible to give away your shares as a gift to another UK resident, tax-free. This relief doesn't apply if you give shares to a company. Gift Hold-Over Relief doesn't exempt any of the chargeable gain, but instead postpones the tax liability.

To add or remove an LLC member, you must amend your Operating Agreement. Although you can amend your Operating Agreement internally, you will also need to alert the appropriate government agencies. Check your state's reporting requirements to see if you need to provide notification when changing LLC members.

Once incorporated, stockholders can transfer ownership of their shares to another party. This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares.

Stockholder Approval Required to: Amend the Certificate of Incorporation. Enter into fundamental corporate transactions (sale of company, merger, sale of substantially all assets of corporation, etc.) Elect Directors (though vacant seats from departed directors can often be filled by Board)

How to Sell Your LLC and Transfer Complete OwnershipReview your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.09-Jul-2020