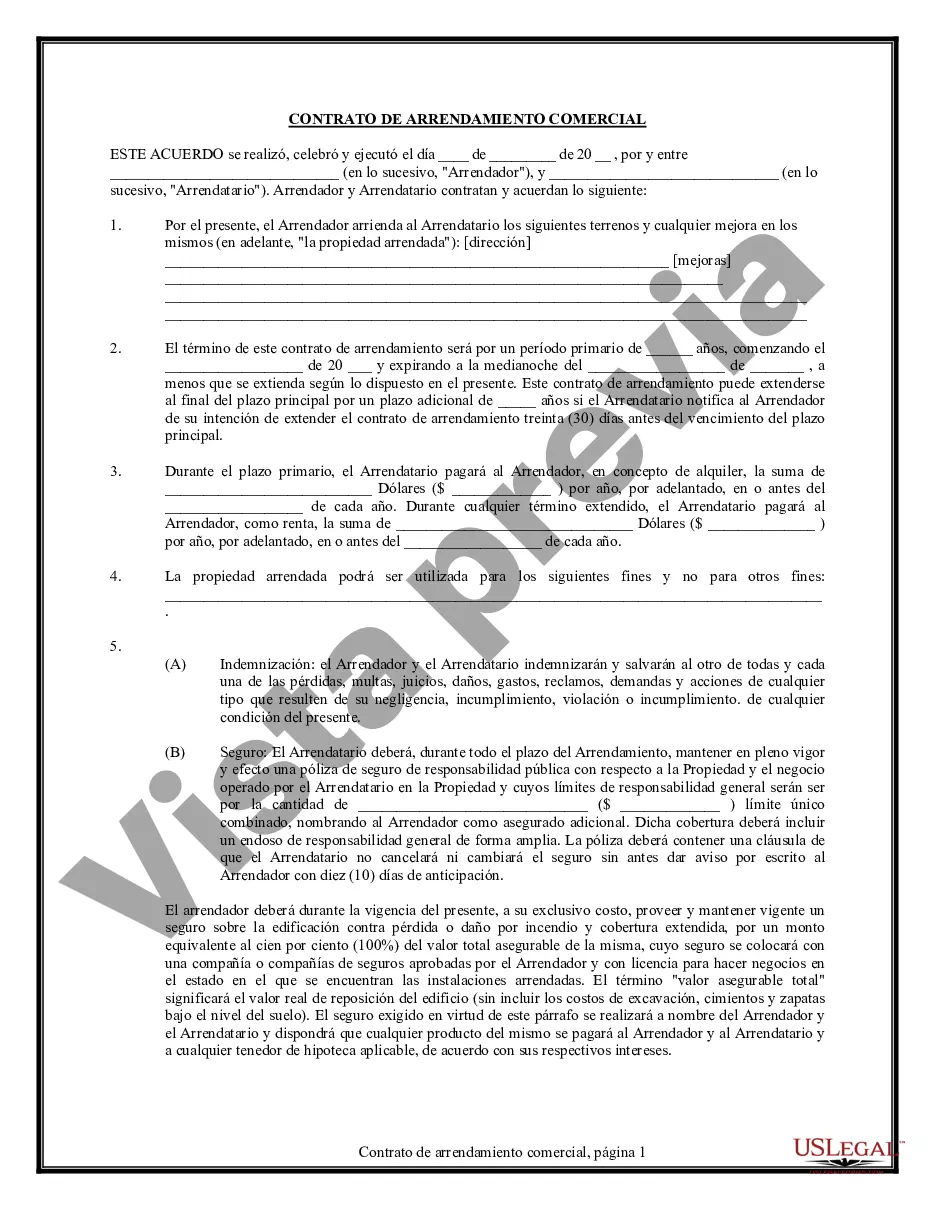

A Delaware Commercial Lease Agreement for Tenant is a legally binding contract that outlines the terms and conditions of renting a commercial property in the state of Delaware. This agreement is designed to protect the rights and responsibilities of both the tenant and the landlord, ensuring a fair and mutually beneficial relationship. In a Delaware Commercial Lease Agreement for Tenant, various crucial aspects are covered, including: 1. Parties involved: The agreement identifies and establishes the relationship between the landlord (property owner) and the tenant (individual or business entity). 2. Property details: The lease agreement describes the commercial property being rented, such as its address, size, and specific areas designated for use by the tenant (e.g., office space, retail space, storage facilities). 3. Lease term: The agreement specifies the duration of the lease, including the start and end dates. Additionally, it may outline options for renewal or termination, along with any associated conditions or penalties. 4. Rent payment: The agreement states the amount of rent to be paid by the tenant, the frequency of payments (e.g., monthly, quarterly), and acceptable payment methods. It may also include provisions for rent increases or adjustments over time. 5. Security deposit: This section explains the amount of the security deposit required, its purpose, how it will be held or utilized, and the conditions for its return at the end of the lease term. 6. Maintenance and repairs: This clause outlines the responsibilities of both the tenant and the landlord concerning property maintenance, repairs, and who is responsible for associated costs. 7. Property use and restrictions: The agreement defines the permitted use of the commercial space. It may include restrictions on activities that could disrupt other tenants or violate local laws, for example, prohibiting noisy manufacturing processes in an area zoned for office use. 8. Utilities and other expenses: This section indicates which party is responsible for paying utility bills, property taxes, insurance costs, and other relevant expenses related to the commercial space. 9. Alterations and improvements: The agreement specifies whether the tenant is permitted to make alterations, renovations, or improvements to the property, and under what conditions. 10. Insurance and liability: This clause outlines the insurance requirements for both parties, including liability insurance, property insurance, and whether the tenant or the landlord is responsible for specific damages or losses. 11. Default and remedies: The agreement includes provisions for defaulting on any terms or conditions, such as non-payment of rent or violation of lease terms, and outlines the remedies available to the non-defaulting party, including eviction procedures. Different types of Delaware Commercial Lease Agreements for Tenant may include: 1. Triple Net Lease: This type of lease places the responsibility for property taxes, insurance, and maintenance costs on the tenant in addition to rent. 2. Gross Lease: In a gross lease, the landlord assumes most of the property expenses, bundling them into the rent, simplifying the tenant's financial obligations. 3. Percentage Lease: Typically used in retail leases, this agreement includes a base rent plus a percentage of the tenant's sales. It is particularly advantageous for the landlord if the tenant experiences a high volume of sales. 4. Modified Gross Lease: This type of lease is a combination of a triple net lease and a gross lease, where some expenses are split between the landlord and the tenant. By utilizing a Delaware Commercial Lease Agreement for Tenant, both parties can establish clear expectations, minimize disputes, and create a transparent and fair rental arrangement for the commercial property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Delaware Contrato de Arrendamiento Comercial para Inquilino - Commercial Lease Agreement for Tenant

Description

How to fill out Delaware Contrato De Arrendamiento Comercial Para Inquilino?

Choosing the best legitimate papers template can be a have difficulties. Obviously, there are a lot of web templates available on the Internet, but how will you discover the legitimate form you want? Take advantage of the US Legal Forms web site. The services offers a large number of web templates, such as the Delaware Commercial Lease Agreement for Tenant, which can be used for company and personal needs. All the forms are inspected by pros and meet up with state and federal demands.

If you are currently authorized, log in for your account and click the Down load button to have the Delaware Commercial Lease Agreement for Tenant. Make use of your account to look from the legitimate forms you may have purchased previously. Proceed to the My Forms tab of your respective account and have yet another version of the papers you want.

If you are a whole new end user of US Legal Forms, allow me to share basic instructions so that you can follow:

- Initially, be sure you have chosen the correct form for the area/state. You are able to check out the form utilizing the Preview button and read the form explanation to ensure this is basically the right one for you.

- In case the form fails to meet up with your requirements, make use of the Seach area to find the right form.

- When you are positive that the form would work, click on the Acquire now button to have the form.

- Select the pricing prepare you need and enter in the necessary information and facts. Make your account and buy the transaction using your PayPal account or Visa or Mastercard.

- Select the file structure and obtain the legitimate papers template for your system.

- Total, modify and printing and indication the received Delaware Commercial Lease Agreement for Tenant.

US Legal Forms is the most significant collection of legitimate forms that you can see different papers web templates. Take advantage of the service to obtain expertly-produced paperwork that follow status demands.