Delaware Voting Trust and Divestiture Agreement

Description

How to fill out Voting Trust And Divestiture Agreement?

US Legal Forms - one of the largest libraries of legal types in America - offers a variety of legal record themes it is possible to acquire or print out. Making use of the web site, you will get 1000s of types for enterprise and specific uses, sorted by categories, says, or search phrases.You will find the latest versions of types such as the Delaware Voting Trust and Divestiture Agreement within minutes.

If you already have a subscription, log in and acquire Delaware Voting Trust and Divestiture Agreement in the US Legal Forms local library. The Download option can look on every type you perspective. You gain access to all earlier downloaded types in the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, listed below are simple recommendations to obtain began:

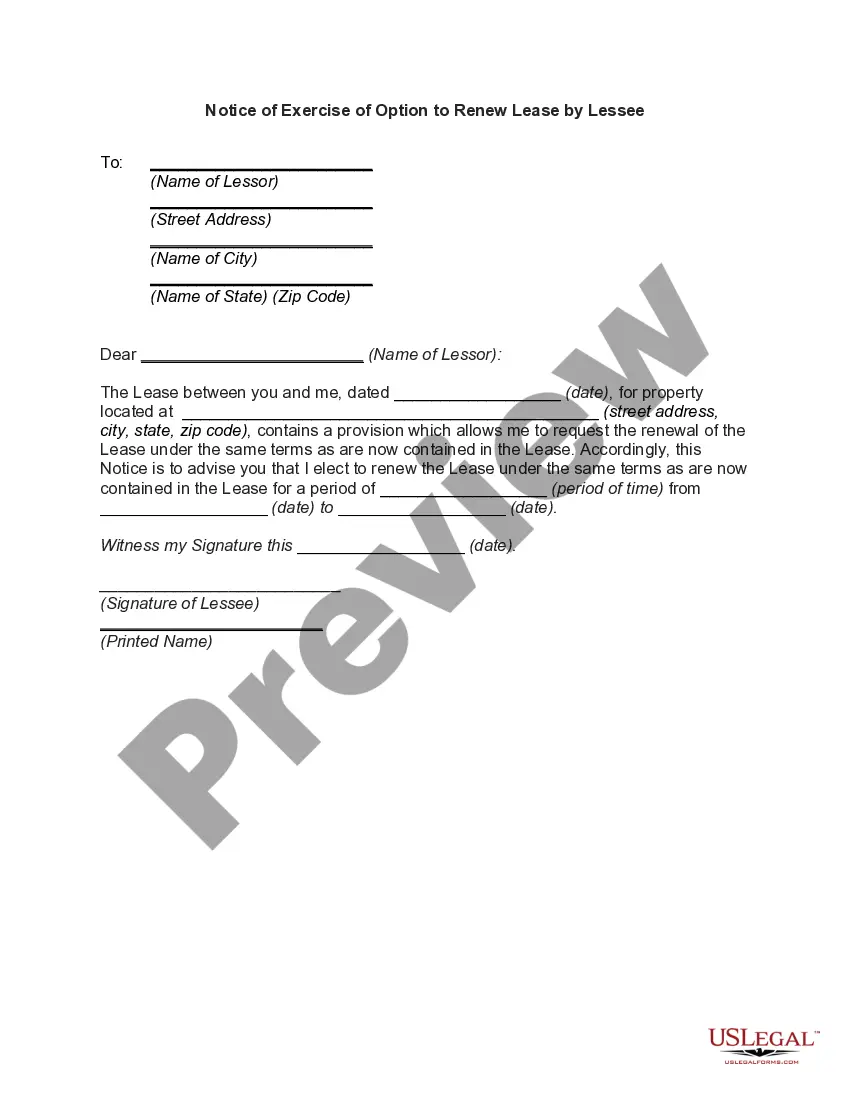

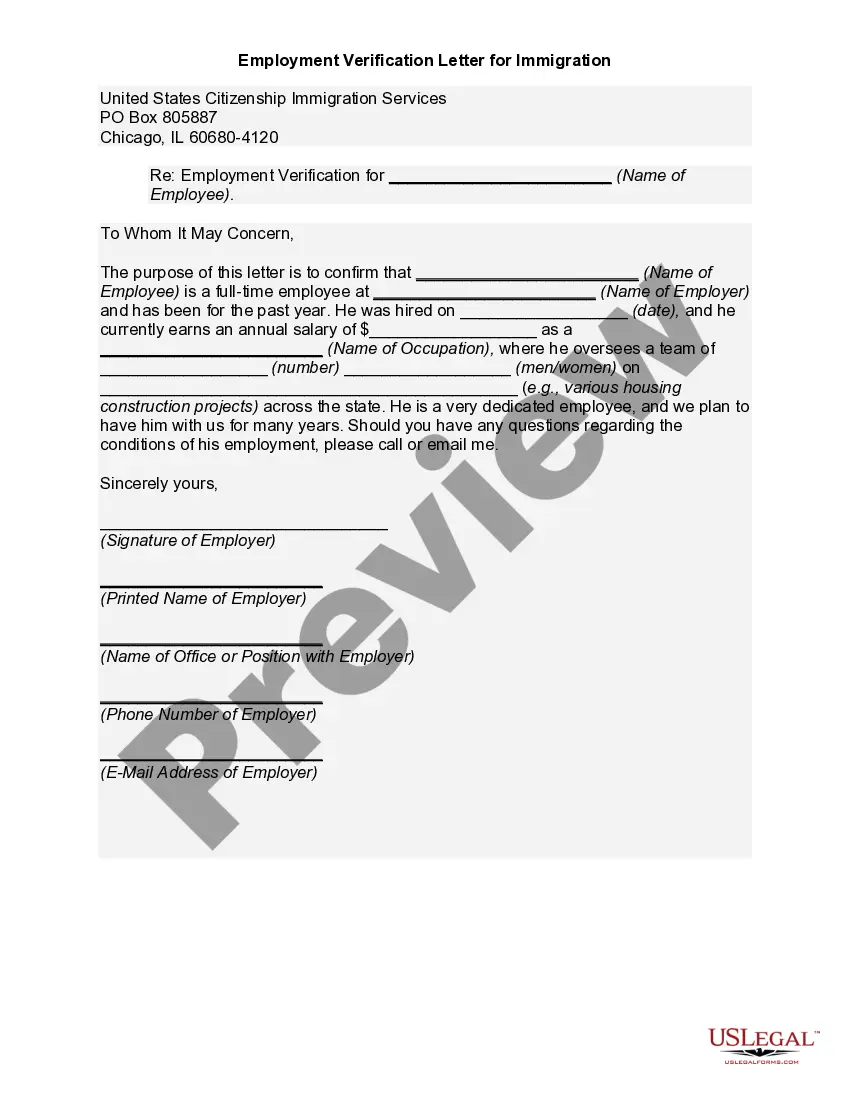

- Be sure you have picked the correct type for the metropolis/county. Click on the Preview option to examine the form`s information. Look at the type explanation to ensure that you have selected the correct type.

- When the type doesn`t satisfy your requirements, make use of the Search area on top of the screen to get the the one that does.

- When you are satisfied with the form, affirm your choice by clicking the Get now option. Then, select the rates plan you want and give your accreditations to register to have an profile.

- Method the transaction. Make use of credit card or PayPal profile to complete the transaction.

- Find the file format and acquire the form in your system.

- Make alterations. Load, edit and print out and sign the downloaded Delaware Voting Trust and Divestiture Agreement.

Every web template you included with your bank account does not have an expiration particular date and is the one you have for a long time. So, in order to acquire or print out an additional backup, just visit the My Forms area and click on in the type you need.

Get access to the Delaware Voting Trust and Divestiture Agreement with US Legal Forms, the most substantial local library of legal record themes. Use 1000s of skilled and condition-distinct themes that meet your organization or specific requires and requirements.

Form popularity

FAQ

Voting trusts are often formed by company directors, but sometimes a group of shareholders will form one to exercise some control over the corporation. It can also be used to resolve conflicts of interest, increase shareholders' voting power, or ward off a hostile takeover.

For a proxy vote, it is a temporary arrangement for a one-time issue; whereas, for a voting trust, it gives the trustees increased power to make decisions on behalf of all shareholders to control the company, which differs from proxy voting in terms of how much power is allocated. Voting Trust Certificate - Overview, How It Works, Terms corporatefinanceinstitute.com ? resources ? equities corporatefinanceinstitute.com ? resources ? equities

For a proxy vote, it is a temporary arrangement for a one-time issue; whereas, for a voting trust, it gives the trustees increased power to make decisions on behalf of all shareholders to control the company, which differs from proxy voting in terms of how much power is allocated.

You can name someone you trust to vote on your behalf. This is known as ?proxy voting.? Proxy voting enables shareholders or members of an organization, such as a corporation or union, to communicate their opinions without being present at the actual vote.

Unless the certificate of incorporation or bylaws of a professional corporation, or a separate contract among all of the shareholders of the professional corporation, provides otherwise for the manner in which such sale or transfer of shares as permitted under this section is to take place, the sale or transfer may be ... 8 Delaware Code § 612 (2022) - Sale or transfer of shares. - Justia Law justia.com ? title-8 ? chapter-6 ? section-612 justia.com ? title-8 ? chapter-6 ? section-612

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting. Voting Trust Agreement: What it Means, How it Works - Investopedia investopedia.com ? terms ? votingtrustagree... investopedia.com ? terms ? votingtrustagree...

A trust formed when individual shareholders transfer both the legal title and voting rights in their shares to a trustee. The trustee then controls a unified voting block - with a stronger voice on matters of corporate governance than the individual shareholders could have on their own. voting trust | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? voting_trust cornell.edu ? wex ? voting_trust

Proxy voting is a form of voting whereby a member of a decision-making body may delegate their voting power to a representative, to enable a vote in absence.